European Journal of Family Business (2020) 10, 6-23

The Value Relevance of Accounting Performance Measures for Quoted French Family Firms: A Study in the Light of the Alignment and Entrenchment Hypotheses

Sami Baslya*, Tayeb Saadib

aUniversity of Paris Nanterre Bureau 108 - Bâtiment E 200 Avenue de la République - 92001 Nanterre - France

bUniversity of Lille Cité scientifique Bâtiment SH3 BP 90 179 - 59653 Villeneuve d’Ascq - France

Received 2019-12-09; accepted 2020-09-10

JEL CLASSIFICATION M10, M41, M48

KEYWORDS

Family firms, Accounting earnings, Value relevance, Agency theory, Alignment hypothesis, Entrenchment hypothesis

CÓDIGOS JEL M10, M41, M48

PALABRAS CLAVE Empresas familiares, Ganancias contables, Relevancia del valor, Teoría de la agencia, Hipótesis de alineación, Hipótesis de afianzamiento

Abstract Family business literature shows that family and nonfamily firms differ with respect to their financial reporting decisions. However, although the literature on financial reporting in family firms has developed over the last ten years, it is mostly oriented towards earnings management and management control issues. Given the specific characteristics of family firms in financing and governance, do their published accounting data have less value relevance for public investors than in the case of non-family firms? How do family firms differ from one another on this issue? While different theoretical perspectives have been used to tackle this problem, two main theses based on agency theory were the most frequently called upon. In fact, the views of interests’ alignment and entrenchment are competing in explaining the differential quality of family and non-family firms accounting numbers. This paper draws on this theoretical lens and contributes to filling this research gap by conducting a comparative analysis of earnings’ value relevance for a sample of quoted French family and non-family firms. First, it examines whether family firms show more or less relevant accounting earnings than non-family firms. Second, it seeks to study the heterogeneity of family firms in terms of earnings figures’ relevance by considering the extent of family control and the involvement of a family CEO as mechanisms leading to alignment or entrenchment. The findings show that family firms exhibit better earnings’ value relevance than non-family firms. In addition, when owning families’ control becomes high, earnings’ value relevance worsens, which suggests a possible entrenchment effect on behalf of controlling families.

La relevancia del valor de las medidas de desempeño contable para las empresas familiares francesas cotizadas: un estudio a la luz de las hipótesis de alineación y afianzamiento

Resumen La literatura sobre empresas familiares muestra que las empresas familiares y no familiares difieren con respecto a sus decisiones de información financiera. Sin embargo, aunque la literatura sobre información financiera en empresas familiares se ha desarrollado en los últimos diez años, está mayoritariamente orientada a temas de gestión de resultados y control de gestión. Dadas las características específicas de las empresas familiares en financiación y gobernanza, ¿sus datos contables publicados tienen menos relevancia de valor para los inversores públicos que en el caso de las empresas no familiares? ¿En qué se diferencian las empresas familiares en este tema? Si bien se han utilizado diferentes perspectivas teóricas para abordar este problema, dos tesis principales basadas en la teoría de la agencia han sido las más utilizadas. Este artículo examina si las empresas familiares muestran ganancias contables más o menos relevantes que las empresas no familiares. En segundo lugar, busca estudiar la heterogeneidad de las empresas familiares en términos de la relevancia de las cifras de ingresos considerando el alcance del control familiar y la participación de un director general de la familia como mecanismos que conducen a la alineación o el atrincheramiento. Los resultados muestran que las empresas familiares exhiben una mayor relevancia de valor de las ganancias que las empresas no familiares. Además, cuando el control de las familias propietarias se vuelve alto, la relevancia del valor de los ingresos empeora, lo que sugiere un posible efecto de atrincheramiento en nombre de las familias controladoras.

https://doi.org/10.24310/ejfbejfb.v10i2.7397

Copyright and Licences: European Journal of Family Business (ISSN 2444-8788 ISSN-e 2444-877X) is an Open Access research e-journal published in Malaga by UMA Editorial.

Except where otherwise noted, contents publish on this research e-journal are licensed under a Creative Commons Atribution-NonCommercial-ShareAlike 4.0 International License (CC BY-NC-SA 4.0)

*Corresponding author

E-mail: sbasly@parisnanterre.fr

1. Introduction

Even if family firms play a significant role in the global economy and are the most common form of firms throughout the world, the issues of their performance measurement and accounting have been somehow neglected. Clearly, some major themes such as succession have a more immediate resonance for academics and practitioners. The scarcity of research in accounting for family firms may be due, as Moores (2009) noted, to the fact that the purpose of accounting “to provide owners with measures of and changes in wealth” takes on a special meaning when ownership is concentrated in the hands of a founding and controlling family (Moores, 2009, p. 169). In their state-of-the-art paper about accounting research in family firms, Prencipe, Bar-Yosef, and Dekker (2014) urge researchers to explore this avenue as “there is still a substantial amount of ground to be covered before the intensity of family firm research in accounting reaches a similar status as in other academic disciplines”. In particular, the issue of accounting figures’ quality, and mainly value relevance, is an interesting topic that deserves a more thorough investigation in the field of family firms. In the accounting literature, an accounting figure is defined as value relevant if it has a predicted association with equity market values (Barth, Beaver, & Landsman, 2001).

The extant empirical literature shows that family and nonfamily firms differ with respect to their financial reporting decisions (Gómez-Mejía, Cruz, & Imperatore, 2014). However, although the literature on financial reporting in family firms has developed over the last ten years, it is mostly oriented towards earnings management and management control issues (Paiva, Lourenço, & Branco, 2016; Ramírez-Orellana, Martínez-Romero, & Mariño-Garrido, 2017). However, the problem of earnings quality and their relevance to users is less frequently analyzed and deserves more attention for many reasons (Pazzaglia, Mengoli, & Sapienza, 2013). In the case of family firms, investors are rarely the main source of financing as their involvement in equity may remain moderate in contrast to non-family firms. Therefore, information disclosed by these firms may have different characteristics, and investors would have different expectations regarding disclosure. Financial information is primarily oriented towards large family shareholders and sometimes to banks that can also access it privately. Given the specific characteristics of family firms in financing and governance, do their published accounting data have less value relevance for public investors than in the case of non-family firms? And how do family firms differ from one another on this issue? These issues are not clear from previous research and the results are inconclusive. For example, drawing on insights from the socioemotional wealth perspective1 and institutional and resource-based theories, Mengoli, Pazzaglia, and Sandri (2020) find that the quality of earnings is better in family firms than nonfamily firms in 12 European countries with different levels of institutional development. However, other studies found the contrary (Ding, Qu, & Zhuang, 2011). While different theoretical perspectives have been used to tackle this problem, two main theses based on agency theory were the most frequently called upon. In fact, the views of interests’ alignment and entrenchment are competing in explaining the differential quality of family and non-family firms accounting numbers. This paper draws on this theoretical lens and contributes to filling this research gap by conducting a comparative analysis of earnings’ value relevance for a sample of quoted French family and non-family firms. First, it examines whether family firms show more or less relevant accounting results than non-family firms. Second, it seeks to study the heterogeneity of family firms in terms of earnings figures’ relevance by considering the extent of family control and the involvement of a family CEO as mechanisms leading to alignment or entrenchment. Through comparative panel regressions between two samples of family and non-family firms, the findings show that family firms exhibit better earnings’ value relevance than non-family firms. In addition, when owning families’ control becomes high (more than 33.33%), earnings’ value relevance worsens, which suggests a possible entrenchment effect on behalf of controlling families. However, the research failed to provide clear evidence about the probable escalation of entrenchment when the CEO is a family member.

The remainder of the paper is organized as follow. The second section describes the theoretical approach used to analyze the value relevance of earning numbers in family firms. The third section describes the research design. Then, the findings, contributions and limitations of the research will be presented in sections four, five and six.

2. Literature Review and Hypotheses Development

2.1. Firm’s status and earnings relevance

Two different hypotheses - one arguing for a positive influence, the second for a negative one - have been commonly used in addressing the relationship between “controlling family” and “accounting” (Miller & Le Breton-Miller, 2006). The most common theoretical lens used to analyze these two hypotheses is agency theory. This is because these two possible scenarios are tightly linked to the ownership structure of family firms and the different types of agency conflicts they may incur. There are two main types of agency problems in public firms. The first type of agency problem arises from the separation of ownership and management (Type I agency problem). Indeed, the separation of managers from shareholders may push managers not to act in the shareholders’ best interest. The second type of agency problem arises from conflicts between controlling and non-controlling shareholders (Type II agency problem). Controlling shareholders may seek private benefits at the expense of non-controlling shareholders.

On the basis of these two configurations, previous research established two possible scenarios concerning the quality of the accounting earnings reported by family firms relatively to non-family firms (Salvato & Moores, 2010). In the first scenario, the founding or controlling family’s interest in the long-term viability of the firm, its concerns over family and firm reputation, and its enhanced power to better monitor managers are hypothesized as resulting in higher quality accounting, planning, and auditing choices by family firms (Salvato & Moores, 2010). In particular, potential reputational consequences of earnings management lead family principals to engage in less of this practice relative to non-family firms (Martin, Campbell, & Gómez-Mejía, 2016). In the second scenario, attempts to mislead other stakeholders about the actual financial performance of the firm and to conceal the extent of wealth expropriation by founding or controlling families are hypothesized to lower the quality of accounting, planning, and auditing.

A number of studies tried to reconcile the conflicting views linking agency problems to earnings quality, and value relevance in particular. For example, a study performed by Yoe, Tan, Ho, and Chen (2002) on a sample of firms listed on the Singapore stock exchange shows that a non-linear relation exists between managerial ownership and earnings informativeness. Indeed, earnings informativeness increases with managerial ownership at low levels but not at higher levels of managerial ownership where the entrenchment effect sets in (Yoe et al., 2002). In the same vein, Wang (2006) found that beyond a threshold of 33% of family ownership, earnings management tends to increase. In France, Mard and Marsat (2012) found a non-linear relationship between ownership concentration and earnings quality. Similarly, Sánchez-Ballesta and García-Meca (2007) suggest a nonlinear relationship between ownership concentration and quality of financial reporting. In the U.S. context, Cascino, Pugliese, Mussolino, and Sansone (2010) reported that an increase in managerial ownership has a positive effect on the information content of accounting earnings. On the contrary, when the mean and median ownership concentrations are higher (as in Europe, East Asia and Australia), increases in ownership concentration tend to deteriorate the quality of accounting information (Cascino et al., 2010). Finally, Cascino et al. (2010), explain that “extreme levels of ownership concentration (too low or too high) limit the quality of financial reporting”.

Acknowledging the contradictory evidence on this research problem, Salvato and Moores (2010, p. 197) believe that “more research is clearly needed to capture determinants of earnings quality through ownership, governance, and capital market effects”. In particular, the authors push researchers “to further explore under what conditions the interest-alignment effect prevails over the entrenchment hypothesis” (Salvato & Moores, 2010, p. 197).

While the separation of ownership and control characterizes the majority of US and UK firms, listed French firms are mostly controlled by families or individuals. The study of the French context allows us to investigate the topic of earnings quality in a different context from that of the United States (Ben Ali & Summa, 2007). Indeed, France is among the countries of codified law in which the protection of minority interests is moderate (La Porta, Shleifer, & Florencio, 1999). Paradoxically, this specific context may imply two contradictory effects as regards earnings value relevance:

– First, there are weak or moderate agency conflicts between managers and shareholders leading, all things being equal, to better earnings’ value relevance in family firms relatively to non-family firms.

– Then, there are high agency conflicts between controlling and minority shareholders leading, all things being equal, to worse earnings value relevance in family firms relatively to non-family firms.

Consistent with the call of Salvato and Moores (2010), the present research aims at verifying if ownership and governance of public firms (family and non-family) contribute to determining the relative value relevance of their earnings. Thus, as put forward by Wang (2006) and Ali, Chen, and Radhakrishnan (2007), we believe that the question whether family firms’ accounting earnings quality is better or worse in terms of value relevance than that of non-family firms is an empirical question. Accordingly, we propose the following non-directional hypothesis:

H1: Value relevance of earnings is related to the nature of the firm (family firm or non-family firm).

The next section will discuss how the two types of agency problems differ across family firms and explain how the difference in the two types of agency conflicts might be associated with a difference in their earnings value relevance.

2.2 Agency conflicts and earnings relevance and in family firms

2.2.1. Type I agency problem and the alignment hypothesis

Firms whose capital is dispersed may suffer from a lack of control as managers may feel free to act in achieving their own interest to the detriment of the firm’s value maximizing goal (Jensen & Meckling, 1976). This problem may be mitigated by various means like manager’s ownership or ownership concentration in the hands of a single or a few number of shareholders (Beneish, 1997). While the problem of separation of ownership and management is limited in family firms (Fama & Jensen, 1983), many authors argue that family firms may face less severe agency costs as the risk of interest dis-alignment may be insignificant (Ali et al., 2007; Wang, 2006). Close relationships between managers and family characterize family businesses (Prencipe et al., 2014). Weakly motivated by simply financial outcomes, managers attach little importance to the executive job market by seeking instead to demonstrate their loyalty and to gain the trust of the family (Prencipe et al., 2014). As a consequence, in family firms, managers may be weakly tempted not to act in the best interest of shareholders for various motives. For this reason, Quinn, Hiebl, Moores, and Craig (2018) argue that family firms have a reduced need for formal management accounting and control instruments. In any case, the family may exert better monitoring over managers because it has the power, the will and the competence. First, as owning-families tend to hold concentrated and undiversified equity position in their companies, they are likely to have strong incentives to monitor managers’ activities (Ali et al., 2007; Demsetz & Lehn, 1985). Second, owning-families tend to have longer-term investment horizons relative to that of other shareholders (Ali et al., 2007; Tong, 2007). Thus, as explained by Ali et al. (2007), families help mitigate myopic investment decisions taken by managers (James, 1999; Stein, 1989). Third, owning-families provide superior monitoring of managers because they have good knowledge about their firms’ activities (Ali et al., 2007; Anderson & Reeb, 2003). In summary, as stated by Ali et al. (2007, p. 241), “compared to non-family firms, family firms face less severe hidden-action and hidden-information agency problems due to the separation of ownership and management”.

According to this first view, family firms would exhibit better accounting figures than non-family firms (Jara-Bertin & Sepulveda, 2016). In general, high managerial ownership should enhance “financial reporting quality via a reduction of managers’ incentives to report accounting information that deviates from the underlying economic performance of the firm” (Cascino et al., 2010). Regarding blockholders’s ownership, research conveys evidence about the favorable impact on accounting quality and earnings management, in particular (Smith, 1976). For instance, Sánchez-Ballesta and García-Meca (2007) found that the presence of inside shareholders moderates earnings management as long as they hold a limited equity stake. In family firms, direct monitoring exerted by owning-families would have a double impact on the quality of accounting. First, it could constitute a basis for management compensation instead of observable earnings-based performance measures (Ali et al., 2007) because owning-families directly monitor managers’ actions. Therefore, family firms’ accounting earnings are less likely to be manipulated as management compensation is less likely to be based on accounting earnings (Ali et al., 2007; Fields, Lys, & Vincent, 2001; Healy & Palepu, 2001). Second, as explained by Ali et al. (2007), direct monitoring by the owning-families and their better knowledge of the firms’ activities are additional motives explaining why managers’ opportunistic behavior is less likely to influence earnings of family firms. That being said, in many cases, the founder or family members holding large amount of stocks are also managers. The above arguments suggest that because of less severe Type I agency problems, earnings of family firms are likely to be of higher quality than those of non-family firms.

As noted by Salvato and Moores (2010), the alignment hypothesis is usually supported in studies carried out in contexts where the mean and median ownership concentration is lower (such as the United States and the United Kingdom). For instance, results reported by Wan (2006) for Standard & Poor’s 500 companies and by Warfield, Wild, and Wild (1995) for 1,618 firms document lower abnormal accruals, greater accounting earnings informativeness, and lower persistence of transitory components. Similarly, Jung and Kwon (2002) and Cascino et al. (2010) found support for the alignment hypothesis in the context of Korean and Italian family firms. Overall, the results evidenced that the convergence of interest of the owner–manager structure improves the informativeness of accounting earnings.

2.2.2. Type II agency problem and the entrenchment hypothesis

Research in management and governance documented the existence of an entrenchment effect by managers who possess a significant stake in the firm (Fama & Jensen, 1983; Morck, Shleifer, & Vishny, 1988). While a moderate management ownership in the firm could ensure interest-alignment, a high ownership could entail risk of entrenchment (Alexandre & Paquerot, 2000). For example, McConnel and Servaes (1990) found that beyond a threshold of 38% of equity held by owner-managers, a firm’s value starts decreasing. Generally, entrenched managers are willing to increase their power in the firm and over stakeholders and would pursue their own goals, which may deviate from the value-maximizing objective (Charreaux, 1991). Entrenchment could be observed in family firms when the families have a concentrated equity holding in their firms and their voting rights exercised exceed their cash flow rights and their domination of the board of directors’ membership. This allows owning-families to enjoy substantial control of firms (Ali et al., 2007). Entrenched families could seek private benefits at the expense of other non-controlling shareholders by, for instance, freezing out minority shareholders (Gilson & Gordon, 2003), engaging in related-party transactions (Anderson & Reeb, 2003), and through managerial entrenchment (Shleifer & Vishny, 1989). Type II agency problems may lead a differential effect on accounting earnings quality between family and non-family firms (Ali et al., 2007). As stated by Ding et al. (2011, p. 623), “in contrast to the owners of non-family firms, the owners of family firms have more incentives to seek private benefits of control at the expense of minority shareholders and provide lower-quality earnings for self-interested purposes”. More precisely, type II agency problems could likely lead to a greater manipulation of earnings by family firms for opportunistic reasons by, for example, hiding the adverse effect of a related party transaction and/or facilitating family members’ entrenchment behavior in management positions (Ali et al., 2007). In a socio-emotional wealth perspective, Gómez-Mejía et al. (2014) argue that, when contemplating earnings management and voluntary disclosure as a gamble, family owners would use SEW protection as the main reference point and may engage in earnings management and voluntary disclosure to protect their SEW regardless of financial gains. For Gómez-Mejía et al. (2014), when control is prioritized, in considering earnings management as a gamble, family owners would value more the potential benefits of manipulating earnings in terms of ensuring family control at the expense of the potential reputational costs if the manipulation is discovered. In this vein, Ding et al. (2011) found empirical evidence which showed that listed Chinese family firms are characterized by less informative accounting earnings, and that family firms use less conservative accounting practices than their non-family counterparts.

With some exceptions, “the entrenchment hypothesis is usually supported by studies conducted in national contexts where ownership concentration is higher or legal systems weaker, such as the European Union (EU), France, Korea, China, and East Asia” (Salvato & Moores, 2010). According to Ball and Shivakumar (2005), private company financial reporting is of lower quality than that of public firms because of a different market demand notwithstanding regulation. Beuselinck and Manigart (2007) found, after controlling for factors like company size and age, that unquoted EU firms in which private equity (PE) investors have a high equity stake produce lower quality accounting information than companies in which PE investors have a low equity stake.

Our study will check if the value relevance of earnings in family firms is contingent on the extent of family control. More precisely, is the alignment effect verified when family control is low-to-moderate? And is there any entrenchment effect when family control becomes higher? With these questions in mind, we formulate the following hypothesis:

H2: Value relevance of earnings is better for moderately controlled family firms than for highly controlled family firms.

We believe that the probable entrenchment influence on earnings’ value relevance could be better evidenced when the agency conflicts type I are controlled for. Thus, in the case of “perfect” interest alignment between shareholders and managers i.e. when the CEO is a family member2, any difference in value relevance between moderately controlled family firms and highly controlled family firms would be due to a probable entrenchment on the behalf of the owning-family. Implicitly, we assume that in the case of high family control, the family CEO may constitute an additional medium for the expropriation of minority shareholders. Therefore, we suggest that:

H3: Value relevance of earnings is better for family-CEO moderately controlled family firms than for family-CEO highly controlled family firms.

If any entrenchment effect is detected for highly controlled family firms, is it linked to the CEO type? Expressed differently, when family control is high and owning-families risk to be entrenched, could the presence of an external manager mitigate this entrenchment and its impact on earnings value relevance? Assuming that this logic could be corroborated, we formulate the final hypothesis is:

H4: Value relevance of earnings is better for non-family-CEO highly controlled family firms than for family-CEO highly controlled family firms.

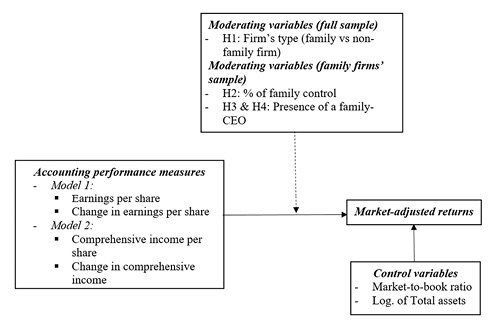

Figure 1 summarizes our four hypotheses.

3. Research Design

3.1. Accounting earnings measures

Attributes of earnings that are usually considered as proxies for high quality of earnings are accrual quality, persistence, predictability, smoothness, value relevance, timeliness, and conservatism (Subramanyam & Wild, 2008). As stated before, our study focuses on value relevance of earnings in terms of informativeness. Several studies have analyzed the quality of accounting data in accordance with accounting standards adopted: local or international standards (Barth, Landsman, & Lang, 2008; Bartov, Goldberg, & Kim, 2005; Hung & Subramanyam, 2007; Lenormand & Touchais, 2009; Van Tendeloo & Vanstraelen, 2005). In this research, the net income obtained through local French accounting standards is a first measure of earnings. However, in recent years, the use of fair value at the expense of historical cost replaced the performance measurement issue at the center of the debate. Indeed, in a clean surplus accounting, the period income, called comprehensive income, includes all revenues and expenses, as well as all gains and losses related to operations or not, recurrent or temporary. In addition to the value of the net income derived from the classical net income account, it includes unrealized profits and/or losses obtained particularly from revaluation at fair value of certain firm’s assets and liabilities. In brief, the comprehensive income has three major characteristics: volatility, non-recurrence and non-controllability (Barth, Landsman, & Wahlen, 1995; Biddle & Choi, 2006; Hirst & Hopkins, 1998; Koonce, Mcanally, & Mercer, 2005; Ohlson, 2001) firms.

3.2. Value relevance measurement

Quantitative research in financial accounting has focused on decision usefulness and information content of accounting data concerning market valuation. These analyses are mainly based on association studies that aim at measuring empirically the intensity of relationships between accounting and market variables thereby checking if the firm’s value based on accounting data is consistent with that reflected in the financial market through stock market data. Market variables are often presented as the benchmark that can be used to assess how well particular accounting data reflect information used by investors (Barth et al., 2001). In particular, these studies aim at verifying the informational utility in terms of value relevance of accounting data in investment through its correlation with information used by investors in valuing shares. In this regard, Francis and Schipper (1999) argue that the value relevance of accounting data is measured through their ability to capture or summarize information affecting stock prices, regardless of their source.

To measure the value relevance of accounting data through association studies, research tried to identify their relative and/or incremental informational content (Biddle, Seow, & Siegel, 1995; Holthausen & Watts, 2001). The intensity of the relationship between accounting earnings and stock returns is captured firstly by the adjusted coefficient of determination of the regression model (R²), which measures the explanatory power of independent variables over dependent variables (Barth et al., 2001; Collins & Kothari, 1989; Veith & Werner, 2014). Specifically, it expresses the ability of accounting data to learn about the information conveyed to the financial market and included in the stock price. The value relevance is also measured through earnings response coefficients indicating the decisional usefulness of the information content of earnings accounting for investors. Both an adjusted R² close to one and positive and statistically significant earnings response coefficients are needed in order to evidence a positive correlation between accounting data and market variables (stock prices or stock returns). When these two conditions are met, the redundant informational content of accounting information is value relevant.

Like Dhaliwal, Subramanyan, and Trezevant (1999), Francis and Schipper (1999) and Veith and Werner (2014), the present research is based on the association studies’ methodology that perfectly suits the goal of this research. Indeed, this method is appropriate for revealing the accounting earnings that have the most value relevant information content for investment in family and non-family firms. In accordance with Dhaliwal et al. (1999), Francis and Schipper (1999) and Veith and Werner (2014), we will compare the different regressions in pairs through the adjusted R² of the regression model3 and/or earnings response coefficients.

3.3. Regression model

The value relevance of the comprehensive income and net income is analyzed in the context of family and non-family firms over the period 2009-2012, especially after the entry into force of the mandatory revised IAS 1 in 2009. Descriptive statistics are calculated for our sample data for the four financial years (Cf. Table 1). However, our econometric study is limited to the 2010-2012 period since our regressions are based on the empirical version of the Ohlson model (1995) which connects the stock returns to the accounting income and its variation4.

To do this, regressions5 are estimated through analysis of panel econometrics applied to data of our two sub-samples: family firms versus non-family firms. Panel regressions’ estimates are more reliable in providing information on the value relevance of accounting data as the models simultaneously integrate the temporal dimension and the individual dimension. Indeed, in the presence of specific effects (individual and/or temporal), ordinary least squares regression, applied to models ignoring these specific effects (pooled models), may produce biased estimators. In this case, it is important to consider other estimation methods, such as the within estimator if the effects are assumed to be fixed or the generalized least squares, if the effects are assumed random. The choice between these two methods (fixed or generalized least squares) can be made according to the Hausman test. In this study, the test reveals the rejection of the null hypothesis of the existence of random effects in our profitability-based models as the p-value (0%) is below the 10% confidence level. Therefore, the fixed-effects models are preferable to random effects models.

This research will assess the two following models:

Model 1:

Model 2:

Where,

Rit = market-adjusted return, is defined as the stock return of the share (i) for fiscal year (t) minus the average return for year (t) for firms composing the CAC-All tradable index;

EPSit is the earnings per share for the share (i) at the end of the fiscal year (t);

∆EPSit is the change in net income per share for the share (i) at the end of the fiscal year (t);

CIit is the comprehensive income per share for the share (i) at the end of the fiscal year (t);

∆CIit is the change in comprehensive income per share for the share (i) at the end of the fiscal year (t);

Pi, t-1 is the stock price of firm (i) at the beginning of the period (t);

MBR is the market-to-book ratio for the share (i) at the end of the fiscal year (t);

Lg TA is the logarithm of total assets.

Deflating independent variables by the share price at the beginning of the period improves the specification of regressions and minimizes the impact of residuals’ heteroscedasticity (Christie, 1987; Kothari, 1992). Similarly, estimation results are not affected by any scale effect econometric bias (Brown, Lo, & Lys, 1999). Finally, control variables used in our models are: market-to-book ratio (MBR) and the logarithm of total assets (Lg TA). In accordance with Collins and Kothari (1989) and Smith and Watts (1992), the market-to-book ratio (ratio of the market value of equity to book value) allows controlling for firms’ growth opportunities. The logarithm of total assets is useful to control the firm’s size effect. Year-effects are also controlled for.

3.4. Sample data

The research is based on a longitudinal data set (2009 – 2012) obtained from a sample of 349 firms quoted on the Paris stock market and composing the CAC-All tradable index.

While there is a continuous debate about the definition of a family firm, the involvement in ownership seems to be a major defining criterion alongside involvement in management and family influence on firm’s culture (Chua, Chrisman, & Sharma, 1999). However, holding an absolute majority of equity or even a blocking minority is not a necessary condition to define family firms. Even with a small equity stake, a family could exert a strong influence on strategic decision-making and family business culture. In order to identify quoted family firms, many authors choose a minimum of 10% or 20% of total votes (or sometimes equity) which needs to be controlled by the owning-family. While family ownership and family control are both used in previous literature in studying earnings informativeness (see for e.g. Francis, Schipper, & Vincent, 2005), the present research focuses only on the ultimate control of firms since many family groups use different control enhancing mechanisms to maintain control over their groups. As such, the mere use of direct firm ownership could be a non-relevant indicator of family’s involvement in these firms.

With this in mind, in this research, a company is a family firm (FF) if:

– The controlling shareholder (holding a relative majority of the voting rights or, if data is missing, of equity) is a family or an individual6.

– The firm has at least one manager (operational manager, CEO, member of the management or supervisory boards) belonging to the controlling family or the family of the controlling individual (outside of that same individual). Otherwise, the firm is classified as a family-owned firm (FOF).

It should also be noted that if the controlling shareholder is an individual who is also executive (CEO) but no involvement of his family members is detected, the firm is labelled a founder-managed firm (FMF). Besides, if the controlling individual has no involvement in management, the firm is classified as an individual-owned firm (IOF). In all other cases, the firm is considered as a non-family (NFF).

We collected information on percentages of voting rights and equity holdings of our sample firm’s shareholders. Data was obtained through Thomson Reuters Database, Bloomberg and Diane Database (Bureau Van Dijck) and firms’ public reports. The classification yielded 139 family firms (FF), 130 non-family firms (NFF), 5 family-owned firms, 42 founder-managed firms and 4 individual-owned firms. Even if founder-managed and individual-owned firms could be considered as potential family firms as they may be managed or governed in a near or a more distant future by members of the founder’s or owner’s family, in their present state, they are not considered family firms as their strategic and financial behavior could be particular. Consequently, only FF and NFF were kept for the analysis. Following the suppression of individuals with missing data, the final sample is comprised of 133 FF and 119 NFF.

We also needed to distinguish between largely controlled and moderately controlled family firms. Under French law, a two-thirds majority is required to influence decisions at extraordinary shareholders’ general meetings. However, for current affairs, the approval of shareholders detaining at least 50.01% of equity is needed. Finally, shareholders holding one third of equity can block these decisions. In this research, as we will explain in detail below, the last two thresholds (50.01% and 33.33%) were successively retained to determine if a family firm is largely controlled or moderately controlled7. Thus, a family firm is considered as largely controlled if a shareholder family holds more than a third (or 50.01% for the second threshold) of voting rights under the condition that no other shareholder holds a third of the capital. This criterion permits us to identify 89 highly controlled and 44 moderately controlled family-firms (respectively, 55 highly controlled and 78 moderately controlled when the second threshold is chosen). Finally, our family firm’s sample is comprised of 92 family-CEO and 41 non-family-CEO firms (Cf. Table 1).

Table 1. Screening procedure

|

Firms composing the index: 349 |

Firms with missing market data: 29 |

Research Sample |

||||

|

Firms with available data: 320 |

Family firms: 139 |

Family firms with complete data: 133 |

33% threshold |

50% threshold |

Family-CEO family firms: 92 |

|

|

Highly-controlled family-firms: 89 |

Highly-controlled family-firms: 55 |

|||||

|

Moderately-controlled family-firms: 44 |

Moderately-controlled family-firms: 78 |

Non-family-CEO family firms: 41 |

||||

|

Non-family firms: 130 |

Non-family firms with complete date: 119 |

|||||

|

Family-owned firms: 5 |

||||||

|

Founder-managed firms: 42 |

||||||

|

Individual-owned firms: 4 |

||||||

4. Results and Discussion

4.1. Descriptive statistics

Table 2 presents descriptive statistics for the comprehensive income per share, earnings per share, other comprehensive income (OCI) per share and stock returns per share for the period 2009-2012. For all the firms in our sample, the earning per share is lower, on average, than the comprehensive income per share (0.022 against 0.043). This difference is mainly explained by the revaluation at fair value of OCI whose average value equals to 0.018€.

On average, net earnings per share and comprehensive income per share are higher for family firms than non-family firms (0.058€ versus -0.019€ for net income and 0.062€ versus 0.023€ for comprehensive income). Compared to non-family firms, the best performance of family firms can be explained among others by better management performance8. This finding is confirmed through stock market returns as we can confirm a higher market profitability in family firms than in non-family firms (0.216€ against 0.154€).

4.2. Information content of net income and comprehensive income in family and non-family firms

The estimation results presented in Table 3 are used to compare the degree of value relevance of information content of net income and comprehensive income on the basis of the whole sample. This value relevance is assessed using the adjusted coefficients of determination (adjusted R2) and the regression coefficients. Although Model 1 confirms a significant influence of EPSn on the dependent variable, Model 2 does not show any significant influence of CIPSn on stock returns. This means that the intensity of association between stock returns and comprehensive income (in level and variation) is weaker than that linking the same stock return to net earnings (in level and variation). Thus, compared to net income, the comprehensive income seems to be the performance accounting measure with the less value relevant information content for investors9. Moreover, under the assumption that stock returns accurately reflect the value creation on an efficient financial market, the results in Table 3 also indicate that only the net income provides useful information to investors.

Table 2. Descriptive statistics of selected financial and accounting variables

|

Accounting and financial variables |

N |

Mean |

Standard Deviation |

Minimum |

Maximum |

|

1- Total sample Comprehensive income per share Earnings per share Other comprehensive income (OCI) Stock returns Adjusted stock returns 2- Subsample of family firms Comprehensive income per share Earnings per share Other comprehensive income (OCI) Stock returns Adjusted stock returns 3- Subsample of non-family firms Comprehensive income per share Earnings per share Other comprehensive income (OCI) Stock returns Adjusted stock returns |

846 994 846 1008 1008 443 527 443 532 532 403 467 403 476 476 |

0.043 0.022 0.018 0.187 1.58e-08 0.062*** 0.058*** 0.005 0.216*** 0.029*** 0.023*** -0.019*** 0.034 0.154*** -0.033*** |

0.203 0.494 0.424 0.492 0.436 0.201 0.244*** 0.042*** 0.512*** 0.476*** 0.205 0.670*** 0.614*** 0.459*** 0.384*** |

-1.834 -13.542 -0.361 -0.768 -1.021 -1.500 -2.442 -0.332 -0.612 -0.878 -1.834 -13.542 -0.361 -0.768 -1.021 |

1.142 2.211 12.251 4.720 4.836 1.142 2.211 0.310 4.720 4.836 0.680 0.641 12.251 2.574 2.053 |

The results presented in Table 4 allow for comparing the degree of value relevance of the information content for net income and comprehensive income for family and non-family firms. As the estimates of Model 2 are non-significant, only model 1 allows us to compare the two sub-samples and find a relative superiority of earnings value relevance in terms of informational value for family firms in comparison to non-family firms (R2 is 24.35% and the regression coefficient is significant at the 1% threshold for the subsample of family firms only). This finding corroborates the supposed alignment thesis which advocates for better quality of earnings’ figures for family firms.

In order to check if an alternative way of defining family firms has an impact on these findings, we adopted the second minimum threshold of 10% of voting rights held by one or multiple families as a defining criterion of family firms. This choice led to the same results as those obtained by using the first definition.

An additional result is provided in table 4 where the higher value relevance of net income compared to comprehensive income among family firms is again evidenced (as it was the case for the full sample).

Table 3. Information content of net income and comprehensive income for the whole sample

|

Model 1 |

Model 2 |

||

|

Net Income |

Comprehensive Income |

||

|

M1 (N = 705) |

M2 (N = 594) |

||

|

R2/F |

0.1883 / 27*** |

R2/F |

0.2943 / 37.76*** |

|

EPSn |

0.590*** (4.70) |

CIPSn |

0.21 (1.13) |

|

VAR. EPSn |

-0.046 (-1.56) |

VAR. CIPSn |

0.058 (0.62) |

|

LN ASSETS |

-0.154 (-1.2) |

LN ASSETS |

0.005* (0.04) |

|

MBR |

0.160*** (9.45) |

MBR |

0.229*** (11.88) |

Note: ***, ** and* indicate significance at the level of 1, 5 and 10%, respectively. The standard deviation are shown in brackets. N: number of observations. F: Fisher test. R²: the adjusted coefficient of determination.

Variable definitions: EPSn is earnings per share, scaled by the share price at the beginning of the period. VAR. EPSn is the change in earnings per share, scaled by the share price at the beginning of the period. CIPSn is the comprehensive income per share, scaled by the share price at the beginning of the period. VAR. CIPSn is the change in comprehensive income per share, scaled by the share price at the beginning of the period. LN ASSETS is the logarithm of total assets at the end of the fiscal year (t). MBR is the market-to-book ratio at the end of the fiscal year (t).

Table 4. Information content of net income and comprehensive income in family and non-family firms

|

Model 1 |

||

|

Net Income |

||

|

Non-family firms |

Family firms |

|

|

N = 330 |

N = 375 |

|

|

R2/F |

0.0804 / 5.12*** |

(0.2435) / 20.04*** |

|

EPSn |

0.248 (1.42) |

0.820*** (3.36) |

|

VAR. EPSn |

-0.042 (-1.61) |

-0.076 (-0.60) |

|

LN ASSETS |

-0.023 (-0.14) |

-0.26 (-1.36) |

|

MBR |

0.149*** (3.79) |

0.165*** (8.17) |

|

Model 2 |

||

|

Comprehensive Income |

||

|

Non-family firms |

Family firms |

|

|

N = 282 |

N = 312 |

|

|

R2/F |

(0.0787)/ 4.08*** |

(0.3996) / 31.36*** |

|

CIPSn |

0.037 (0.14) |

0.307 (1.19) |

|

VAR. CIPSn |

0.057 (0.45) |

0.056 (0.41) |

|

LN ASSETS |

-0.591 (-0.28) |

0.243 (0.12) |

|

MBR |

0.170*** (3.75) |

0.241*** (10.82) |

Note: ***, ** and* indicate significance at the level of 1, 5 and 10%, respectively. The standard deviations are shown in brackets. N: number of observations. F: Fisher test. R²: the adjusted coefficient of determination.

Variable definitions: EPSn is earnings per share, scaled by the share price at the beginning of the period. VAR. EPSn is the change in earnings per share, scaled by the share price at the beginning of the period. CIPSn is the comprehensive income per share, scaled by the share price at the beginning of the period. VAR. CIPSn is the change in comprehensive income per share, scaled by the share price at the beginning of the period. LN ASSETS is the logarithm of total assets at the end of the fiscal year (t). MBR is the market-to-book ratio at the end of the fiscal year (t).

4.3. Effect of ownership concentration on earnings value relevance

To check if the alignment hypothesis is persistent for all our sample’s firms, we conducted our regressions again by distinguishing highly-controlled and moderately-controlled family firms and comparing their earnings. Table 5 shows in Model 1 that moderately-controlled family firms exhibit better earnings’ value relevance than highly-controlled family firms, thus corroborating our hypothesis H2 according to which value relevance of earnings is better for moderately controlled family firms than for highly controlled family firms.

Table 5. Ownership and relevance of earnings in family and non-family firms

|

Net Income |

||||

|

Threshold of 50% |

Threshold of 33% |

|||

|

Moderate family ownership |

High family ownership |

Moderate family ownership |

High family ownership |

|

|

N = 220 |

N = 155 |

N = 124 |

N = 251 |

|

|

R2/F |

(0.2821) / 14.33*** |

(0.1062) / 3.45*** |

(0.3797) / 12.56*** |

(0.0912) /4.55*** |

|

EPSn |

0.817** (2.37) |

0.719** (2.21) |

0.814* (1.89) |

0.740*** (2.43) |

|

VAR. EPSn |

-0.030 (-0.16) |

-0.072 (-0.46) |

-0.043 (-0.17) |

-0.057 (-0.39) |

|

LN ASSETS |

-0.215 (-0.71) |

-0.313 (-1.47) |

-0.88* (-1.80) |

-0.096 (-0.49) |

|

MBR |

0.175*** (7.16) |

0.092** (1.91) |

0.174*** (6.75) |

0.142*** (2.92) |

|

Comprehensive Income |

||||

|

Threshold of 50% |

Threshold of 33% |

|||

|

Moderate family ownership |

High family ownership |

Moderate family ownership |

High family ownership |

|

|

N = 179 |

N = 133 |

N = 102 |

N = 210 |

|

|

R2/F |

(0.4445)/ 21.40*** |

(0.1682)/ 4.43*** |

(0.5865)/ 21.27*** |

(0.1132)/ 4.43*** |

|

CIPSn |

0.270 (0.68) |

0.224 (0.70) |

-0.091 (-0.18) |

0.417 (1.28) |

|

VAR. CIPSn |

0.155 (0.63) |

0.015 (0.10) |

0.430 (1.24) |

-0.040 (-0.27) |

|

LN ASSETS |

0.193 (0.57) |

-0.129 (-0.60) |

0.015 (0.03) |

0.041 (0.19) |

|

MBR |

0.239*** (8.95) |

0.259*** (3.44) |

0.240*** (8.95) |

0.260*** (3.76) |

Note: ***, ** and* indicate significance at the level of 1, 5 and 10%, respectively. The standard deviations are shown in brackets. N: number of observations. F: Fisher test. R²: the adjusted coefficient of determination.

Variable definitions: EPSn is earnings per share, scaled by the share price at the beginning of the period. VAR. EPSn is the change in earnings per share, scaled by the share price at the beginning of the period. CIPSn is the comprehensive income per share, scaled by the share price at the beginning of the period. VAR. CIPSn is the change in comprehensive income per share, scaled by the share price at the beginning of the period. LN ASSETS is the logarithm of total assets at the end of the fiscal year (t). MBR is the market-to-book ratio at the end of the fiscal year (t).

4.4. Effect of the separation of management and control on earnings value relevance

In order to assess a possible impact on value relevance of the separation of management and control in family firms, we conducted four more regressions based on the family firms subsample. For the two models, we distinguished four types of family firms: family-CEO managed/highly controlled family firm, non-family-CEO managed/highly controlled family firm, family-CEO managed/moderately controlled family firm, Non-Family-CEO managed/moderately controlled family firm. As shown in table 6, when the CEO is a family member, net income is more value relevant when family ownership is moderate than in the case of high family ownership. These findings are exactly the same when the 50.01% threshold is retained to distinguish highly-controlled and moderately-controlled family firms. In sum, our results confirm that value relevance of earnings is higher for family-CEO moderately-controlled family firms than for family-CEO highly-controlled family firms (H3). The finding further corroborates the entrenchment effect that may originate from the high concentration of ownership in the hands of the family.

In order to further emphasize the entrenchment effect in the case of high family ownership, assuming that this problem may be sharper when the CEO is a family member, we compared the value relevance of earnings for non-family-CEO highly-controlled family firms with that of family-CEO highly-controlled family firms. When retaining the control threshold of 33%, this comparison shows better income value relevance when the CEO is a family member. The finding is the same when the retained threshold is 50%. Accordingly, hypothesis 4 is not supported. This finding is observed again when looking at the comparison between family-CEO and non-family-CEO managed moderately controlled family firms. Through the two thresholds (33% and 50%), it is found that earning value relevance is better when the CEO is a family member.

Finally, our results show that size doesn’t seem to be related to market returns neither for family nor for non-family firms. In addition, the market-to-book ratio is quasi-systematically linked to market returns for family and non-family firms.

4.5. Findings discussion

To summarize, our findings first show that, compared to net income, the comprehensive income seems to be the performance accounting measure with the less value relevant information content for investors. Therefore, contrarily to the findings of Kanagaretnam, Mathieu, and Shehata (2009) and Biddle and Choi (2006), we show that the comprehensive income and its OCI component (other comprehensive income) do not convey additional information implying more value relevance to investors than the only information conveyed by the net income. However, this finding is consistent with the research of Dhaliwal et al. (1999) and O’Hanlon and Pope (1999).

With the application of the IFRS, investors would benefit from better accounting and financial data to satisfy their information needs and to help them making investment decisions. Although the IASB does not neglect the other firm’s stakeholders (creditors, employees, etc.), investors are considered as the primary users of financial information. As a result, the IASB has given particular attention to the “value relevance” of accounting data. Unexpectedly, this goal does not seem to be corroborated by the results of our research concerning the comprehensive income.

Second, our findings corroborate the supposed alignment thesis which advocates for better quality of earnings’ figures for family firms. Thus, we could say that in our sample of French quoted firms, there is evidence that firm ownership has an impact on the value relevance of earnings to investors as family firms seem to convey more relevant earnings to investors. Independently of ownership degree, French listed family firms convey to investors more value relevant accounting earnings than non-family firms. This result is in line with the findings of Cascino et al. (2010) who found that accounting quality is systematically related to the firm status (family and nonfamily firms) and that, overall, earnings of family firms are of greater quality comparatively to their nonfamily counterparts. This finding is consistent with our first hypothesis and could be interpreted in light of less agency conflicts leading to better accounting figures. The so-called stewardship theory (Davis, Schoorman, & Donaldson, 1997) could also prove useful in understanding such results. This theory criticizes the logic of opportunism by suspecting its adequacy to analyzing the family firm. Stewardship theory considers that organizational actors’ motivation is primarily founded on Maslow’s pyramid higher needs (growth, achievement, etc.) contrarily to the agency theory where monetary “rewards”, even though necessary to reduce information asymmetries and opportunistic behavior, are the main motivations. Consequently, because the executives’ identity is tied with the organization, they would be more capable of acting as stewards of firms’ resources rather than in an opportunistic way and should exhibit a strong commitment to organizational values. Pursuing a set of non-economic goals such as a firm’s reputation and protection of a firm’s long term sustainability, managers in family firms would be enticed to enhance the quality of accounting figures.

|

Table 6. CEO family membership and relevance of net income in family firms Net Income |

||||||||

|

Moderate family ownership (<50%) |

High family ownership (>50%) |

Moderate family ownership (<33%) |

High family ownership (>33%) |

|||||

|

Family CEO |

Non-family CEO |

Family CEO |

Non-family CEO |

Family CEO |

Non-family CEO |

Family CEO |

Non-family CEO |

|

|

N = 150 |

N = 70 |

N = 108 |

N = 47 |

N = 94 |

N = 30 |

N = 164 |

N = 87 |

|

|

R2/F |

0.3937 / 16.05*** |

0.000 / 0.41 |

0.2114 / 5.10*** |

0.2450 / 2.81** |

0.4521 / 12.85*** |

0.1549/ 1.20 |

0.1841/ 6.40*** |

0.03/ 0.90 |

|

EPSn |

1.68*** (3.36) |

0.227 (0.45) |

0.840** (1.96) |

0.784* (1.88) |

2.232*** (3.13) |

-0.241 (-0.40) |

0.804** (2.17) |

0.529 (0.99) |

|

VAR. EPSn |

-0.150 (-0.63) |

0.086 (0.26) |

0.477* (1.76) |

-0.297 (-1.60) |

-0.264 (-0.91) |

0.518 (1.08) |

0.327 (1.41) |

-0.155 (-0.69) |

|

LN ASSETS |

-0.339 (-0.91) |

-0.027 (-0.05) |

-0.290** (-1.28) |

-0.568 (-0.97) |

-0.671 (-1.21) |

-1.205 (-1.37) |

-0.095 (-0.45) |

0.019 (0.04) |

|

MBR |

0.188*** (7.57) |

0.073 (0.52) |

0.065 (1.29) |

0.345** (2.39) |

0.190*** (6.85) |

0.043 (0.35) |

0.124*** (2.57) |

0.253* (1.71) |

Note: ***, ** and* indicate significance at the level of 1, 5 and 10%, respectively. The standard deviations are shown in brackets. N: number of observations. F: Fisher test. R²: the adjusted coefficient of determination.

Variable definitions: EPSn is earnings per share, scaled by the share price at the beginning of the period. VAR. EPSn is the change in earnings per share, scaled by the share price at the beginning of the period. CIPSn is the comprehensive income per share, scaled by the share price at the beginning of the period. VAR. CIPSn is the change in comprehensive income per share, scaled by the share price at the beginning of the period. LN ASSETS is the logarithm of total assets at the end of the fiscal year (t). MBR is the market-to-book ratio at the end of the fiscal year (t).

|

Table 7. CEO family membership and relevance of comprehensive income in family firms Comprehensive Income |

||||||||

|

Moderate family ownership (<50%) |

High family ownership (>50%) |

Moderate family ownership (<33%) |

High family ownership (>33%) |

|||||

|

Family CEO |

Non-family CEO |

Family CEO |

Non-family CEO |

Family CEO |

Non-family CEO |

Family CEO |

Non-family CEO |

|

|

N = 117 |

N = 62 |

N = 92 |

N = 41 |

N = 74 |

N = 28 |

N = 135 |

N = 75 |

|

|

R2/F |

0.6014 / 25.21*** |

0.000 / 0.32 |

0.2213 / 4.26*** |

0.2464 / 2.28* |

0.6324/ 17.91*** |

0.1281/ 1.02 |

0.2443/ 6.81*** |

0.0157 / 0.62 |

|

CIPSn |

0.473 (0.65) |

0.304 (0.58) |

-0.012 (-0.03) |

0.611 (1.33) |

0.683 (0.56) |

-0.102 (-0.19) |

0.221 (0.59) |

0.436 (0.72) |

|

VAR. CIPSn |

0.335 (0.88) |

0.019 (0.05) |

0.535*** (2.10) |

-0.234 (-1.18) |

0.317 (0.62) |

0.410 (0.90) |

0.383 (1.65) |

-0.133 (-0.53) |

|

LN ASSETS |

0.422 (0.95) |

0.032 (0.06) |

-0.242 (-1.06) |

-0.582 (-0.79) |

0.283 (0.46) |

-0.869 (-0.97) |

-0.030 (-0.14) |

0.025 (0.05) |

|

MBR |

0.247*** (9.68) |

0.026 (0.16) |

0.195** (2.33) |

0.358** (2.17) |

0.245*** (8.22) |

0.020 (0.16) |

0.252*** (4.00) |

0.263 (1.44) |

Note: ***, ** and* indicate significance at the level of 1, 5 and 10%, respectively. The standard deviations are shown in brackets. N: number of observations. F: Fisher test. R²: the adjusted coefficient of determination.

Variable definitions: EPSn is earnings per share, scaled by the share price at the beginning of the period. VAR. EPSn is the change in earnings per share, scaled by the share price at the beginning of the period. CIPSn is the comprehensive income per share, scaled by the share price at the beginning of the period. VAR. CIPSn is the change in comprehensive income per share, scaled by the share price at the beginning of the period. LN ASSETS is the logarithm of total assets at the end of the fiscal year (t). MBR is the market-to-book ratio at the end of the fiscal year (t).

Third, it was found that moderately-controlled family firms exhibit better earnings’ value relevance than highly-controlled family firms, thus corroborating our hypothesis H2. This finding is consistent with previous literature that evidenced the alignment hypothesis in the specific context of low or moderate family ownership (Cascino et al., 2010; Jung & Kwon, 2002; Wan, 2006; Warfield et al., 1995). Therefore, the convergence of interest between the owning-family and the manager may increase the informativeness of earnings expressed in our case in terms of value relevance. Conversely, this finding evidences an entrenchment effect under the condition of high family control. Our findings show that the value relevance of net income is always poorer for highly-controlled family firms relatively to moderately-controlled family firms (considering the two retained thresholds of high control). This finding is consistent with that of Fan and Wong (2002) who showed that concentrated ownership reduces earnings informativeness. First, investors may have less confidence in earnings reported by these firms and prepared under the instigation of controlling owners as they may be motivated by self-interest (Fan & Wong, 2002). Second, “ownership concentration prevents leakage of proprietary information about the firms’ possible rent-seeking activities” (Francis et al., 2005). This loss of earnings’ informativeness is exacerbated when cash flow rights are separated from voting rights (Francis et al., 2005). A last finding confirms that value relevance of earnings is higher for family-CEO moderately-controlled family firms than for family-CEO highly-controlled family firms (H3). The finding further corroborates the entrenchment effect that may originate from the high concentration of ownership in the hands of the family. In light of the teachings of the SEW framework, our results may imply that the more the owning-family’s control increases, the more the family owners would give priority to ‘Family Control and Influence’ dimension of SEW over the ‘Family Identity’ dimension (Gómez-Mejía et al., 2014) thereby leading to different outcomes as for the relevance of accounting earnings.

Finally, when comparing the value relevance of earnings for non-family-CEO highly-controlled family firms with that of family-CEO highly-controlled family firms, this comparison shows better income value relevance when the CEO is a family member. Accordingly, hypothesis 4 is not supported. This is an unexpected finding, as previous research showed diverse impacts of the CEO (mainly family or non-family) on earnings figures. However, our finding is consistent with that of Yang (2010) who showed that in the context of insider ownership, non-family CEOs exhibit a greater tendency to manage earnings than do family CEOs. Some contextual variables could explain this divergence of results. For example, Pazzaglia et al. (2013) have shown that acquired family firms benefit with respect to their earnings quality from having a nonfamily CEO while nonacquired family firms benefit from having a family CEO.

5. Contributions and Implications

The publication of value relevant accounting data allows investors to properly assess the value of the firm and its future development prospects. Resting on the classical debate between the alignment and the entrenchment effects in agency theory, our research aimed at verifying if ownership, control and governance (namely family CEO presence) of family firms have an influence on their earnings’ value relevance for investors.

This research contributes to the literature by showing that more value relevant earning figures are associated with moderate family control whereas high family control is associated with less value relevant earnings. Furthermore, theoretical and empirical research interested in the study of value relevance and informational usefulness of accounting indicators for investment in the context of family and non-family businesses are almost exclusively Anglo-Saxon. Thus, this research contributes to the debate between the advocates of alignment and entrenchment hypotheses by showing that, in the French context, alignment is evidenced in the case of family ownership. This result is in line with the findings of Cascino et al. (2010) who found that accounting quality is systematically related to the firm status (family and nonfamily firms) and that, overall, earnings of family firms are of greater quality comparatively to their nonfamily counterparts. Another contribution of our research is that it does not rely only on ownership concentration as an operationalization of family firms but on a definition that aims at “capturing the essence of the family influence on accounting practices” (Salvato & Moores, 2010). The screening procedure adopted allowed for contrasting earnings’ value relevance of family firms (excluding individually-owned or founder-managed firms) with those of non-family firms. Even if the adopted definition of family firms relied on the voting rights variable, a high control degree was not a defining criterion of family firms because families in these firms could hold variable equity and voting rights stakes. Thus, combining voting rights holding with involvement in governance/management allowed us to single out family firms.

Our research has practical implications. First, independently of performance differences, and all other things being equal, investors are invited to invest in family firms as they could have more confidence in the earnings reported by these firms in comparison to non-family firms. Especially when control held by family shareholders is moderate, the risk that they try to expropriate minority shareholders and conceal “bad” information about performance is weak. Second, our findings have shown that, compared to the net income, the comprehensive income seems to be the performance accounting measure with the less value relevant information content for investors. When a public firm publishes these two earning figures, investors could more confidently base their investment decisions on the net income. So, the criticisms addressed to the comprehensive income such as its volatility, non-recurrence and non-controllability seem to be justified as this performance measure seems to be less value relevant to investors’ decisions, at least in the French context.

6. Limitations and Future Research

Our research suffers from some limitations and offers a number of future research prospects. First, our results cannot be easily generalized to other countries because they pertain to the particular context of French listed firms. Another major limitation pertains to the fact of focusing on the informational characteristics of accounting data only in terms of value relevance. According to Holthausen and Watts (2001), association studies restrict the role of the financial statements to the production of financial information useful for firm valuation. Yet, one of the essential functions of accounting and any reporting in general is a stewardship function necessary to ensure the accountability of managers. This function is neglected by the value relevance stream of research to the detriment of the value relevance of accounting data. Future research could seek to employ more accurate and comprehensive indicators of accounting data value relevance. Another avenue for future research may imply the use of other metrics based on earnings management (discretionary accruals, earnings smoothness, etc.) in order to assess the relative impact of the alignment and the entrenchment hypotheses on earning figures for family firms and non-family firms. In addition, our research does not account for the influence of financial statements’ demand on value relevance, and this has to be done in future research.

Our results could be extended to private firms. For example, Beuselinck and Manigart (2007) found that EU unquoted companies in which private equity investors have a high equity stake produce lower quality accounting information than companies in which private equity investors have a low equity stake. Finally, other contextual variables could be considered in future research. For example, the type of shares could have an explanatory power, as some authors such as Lobanova Lobanova, Barua, Mishra, and Prakash (2019) show that the earnings are less informative in dual-class firms compared to single-class firms.

References

Alexandre, H. & Paquerot, M. (2000). Efficacité des structures de contrôle et enracinement des dirigeants. Revue Finance Contrôle Stratégie, 3(2), 5-29.

Ali, A., Chen, T.-Y., & Radhakrishnan, S. (2007). Corporate disclosures by family firms. Journal of Accounting and Economics, 44(1–2), 238–286. https://doi.org/10.1016/j.jacceco.2007.01.006

Anderson, R. C. & Reeb, D. M. (2003). Founding-family ownership and firm performance: Evidence from the S&P 500. The Journal of Finance, 58(3), 1301–1328. https://doi.org/10.1111/1540-6261.00567

Ball, R. & Shivakumar, L. (2005). Earnings quality in UK private firms: Comparative loss recognition timeliness. Journal of Accounting and Economics, 39(1), 83–128. https://doi.org/10.1016/j.jacceco.2004.04.001

Barth, M. E., Beaver, W. H., & Landsman, W. R. (2001). The relevance of the value relevance literature for financial accounting standard setting: Another view. Journal of Accounting and Economics, 31(1–3), 77–104. https://doi.org/10.1016/S0165-4101(01)00019-2

Barth, M. E., Landsman, W. R., & Lang, M. H. (2008). International accounting standards and accounting quality. Journal of Accounting Research, 46(3), 467–498. https://doi.org/10.1111/j.1475-679X.2008.00287.x

Barth, M. E., Landsman, W. R., & Wahlen, J. M. (1995). Fair value accounting: Effects on banks’ earnings volatility, regulatory capital, and value of contractual cash flows. Journal of Banking and Finance, 19(3–4), 577–605. https://doi.org/10.1016/0378-4266(94)00141-O

Bartov, E., Goldberg, S. R., & Kim, M. (2005). Comparative value relevance among German, U.S., and international accounting standards: A German stock market perspective. Journal of Accounting, Auditing and Finance, 20(2), 95–119. https://doi.org/10.1177/0148558X0502000201

Ben Ali, C. & Summa, M. G. (2007). Disclosure quality and ownership structure: Evidence from the French stock market. British Accounting Association Annual Conference Proceedings, 1-36

Beneish, M. D. (1997). Detecting GAAP violation: Implications for assessing earnings management among firms with extreme financial performance. Journal of Accounting and Public Policy, 16(3), 271–309. https://doi.org/10.1016/S0278-4254(97)00023-9

Beuselinck, C. & Manigart, S. (2007). Financial reporting quality in private equity backed companies: The impact of ownership concentration. Small Business Economics, 29(3), 261–274. https://doi.org/10.1007/s11187-006-9022-1

Bhatt, R. R. & Bhattacharya, S. (2017). Family firms, board structure and firm performance: Evidence from top Indian firms. International Journal of Law and Management, 59(5), 699-717. https://doi.org/10.1108/IJLMA-02-2016-0013

Biddle, G. C. & Choi, J. (2006). Is comprehensive income useful? Journal of Contemporary Accounting and Economics, 2(1), 1–30. https://doi.org/10.1016/S1815-5669(10)70015-1

Biddle, G. C., Seow, G. S., & Siegel, A. F. (1995). Relative versus incremental information content. Contemporary Accounting Research, 12(1), 1–23. https://doi.org/10.1111/j.1911-3846.1995.tb00478.x

Brown, S., Lo, K., & Lys, T. (1999). Use of R2 in accounting research: Measuring changes in value relevance over the last four decades. Journal of Accounting and Economics, 28(2), 83–115. https://doi.org/10.1016/S0165-4101(99)00023-3

Cascino, S., Pugliese, A., Mussolino, D., & Sansone, C. (2010). The influence of family ownership on the quality of accounting information. Family Business Review, 23(3), 246-265. https://doi.org/10.1177/0894486510374302

Charreaux, G. (1991). Structure de propriété, relation d’agence et performance financière. Revue Économique, 42(3), 521–552. https://doi.org/10.3406/reco.1991.409292

Christie, A. A. (1987). On cross-sectional analysis in accounting research. Journal of Accounting and Economics, 9(3), 231–258. https://doi.org/10.1016/0165-4101(87)90007-3

Chua, J. H., Chrisman, J. J., & Sharma, P. (1999). Defining the family business by behavior. Entrepreneurship Theory and Practice, 23(4), 19–39. https://doi.org/10.1177/104225879902300402

Collins, D. W. & Kothari, S. P. (1989). An analysis of intertemporal and cross-sectional determinants of earnings response coefficients. Journal of Accounting and Economics, 11(2-3), 143-181. https://doi.org/10.1016/0165-4101(89)90004-9

Davis, J. H., Schoorman, F. D., & Donaldson, L. (1997). Toward a stewardship theory of management. Academy of Management Review, 22(1), 20–47. https://doi.org/10.5465/amr.1997.9707180258

Demsetz, H. & Lehn, K. (1985). The structure of corporate ownership: Causes and consequences. Journal of Political Economy, 93(6), 1155–1177. https://doi.org/10.1086/261354

Dhaliwal, D., Subramanyam, K. R., & Trezevant, R. (1999). Is comprehensive income superior to net income as a measure of firm performance? Journal of Accounting and Economics, 26(1–3), 43–67. https://doi.org/10.1016/S0165-4101(98)00033-0

Ding, S., Qu, B., & Zhuang, Z. (2011). Accounting properties of Chinese family firms. Journal of Accounting, Auditing and Finance, 26(4), 623–640. https://doi.org/10.1177/0148558X11409147

Fama, E. F. & Jensen, M. C. (1983). Separation of ownership and control. The Journal of Law and Economics, 26(2), 301–325. https://doi.org/10.1086/467037

Fan, J. P. H. & Wong, T. (2002). Corporate ownership structure and the informativeness of accounting earnings in East Asia. Journal of Accounting and Economics, 33(3), 401–425. https://doi.org/10.1016/S0165-4101(02)00047-2

Fields, T. D., Lys, T. Z., & Vincent, L. (2001). Empirical research on accounting choice. Journal of Accounting and Economics, 31(1–3), 255–307. https://doi.org/10.1016/S0165-4101(01)00028-3

Francis, J. & Schipper, K. (1999). Have financial statements lost their relevance? Journal of Accounting Research, 37(2), 319-352. https://doi.org/10.2307/2491412

Francis, J., Schipper, K., & Vincent, L. (2005). Earnings and dividend informativeness when cash flow rights are separated from voting rights. Journal of Accounting and Economics, 39(2), 329–360. https://doi.org/10.1016/j.jacceco.2005.01.001

Gómez-Mejía, L. R., Haynes, K. T., Núñez-Nickel, M., Jacobson, K. J. L., & Moyano-Fuentes, J. (2007). Socioemotional wealth and business risks in family-controlled firms: Evidence from Spanish olive oil mills. Administrative Science Quarterly, 52(1), 106–137. https://doi.org/10.2189/asqu.52.1.106

Gómez-Mejía, L., Cruz, C., & Imperatore, C. (2014). Financial reporting and the protection of socioemotional wealth in family-controlled firms. European Accounting Review, 23(3), 387–402. https://doi.org/10.1080/09638180.2014.944420

Gilson, R. J. & Gordon, J. N. (2003). Controlling controlling shareholders. University of Pennsylvania Law Review, 152(2), 785-843. https://doi.org/10.2307/3313035

Hausman, J. A. (1978). Specification tests in Econometrics. Econometrica, 46(6), 1251-1271. https://doi.org/10.2307/1913827

Healy, P. M. & Palepu, K. G. (2001). Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics, 31(1–3), 405–440. https://doi.org/10.1016/S0165-4101(01)00018-0

Hirst, D. E. & Hopkins, P. E. (1998). Comprehensive income reporting and analysts’ valuation judgments. Journal of Accounting Research, 36, 47-75. https://doi.org/10.2307/2491306

Holthausen, R. W. & Watts, R. L. (2001). The relevance of the value-relevance literature for financial accounting standard setting. Journal of Accounting and Economics, 31(1–3), 3–75. https://doi.org/10.1016/S0165-4101(01)00029-5

Hung, M. & Subramanyam, K. R. (2007). Financial statement effects of adopting international accounting standards: The case of Germany. Review of Accounting Studies, 12(4), 623–657. https://doi.org/10.1007/s11142-007-9049-9

James, H. S. (1999). Owner as manager, extended horizons and the family firm. International Journal of the Economics of Business, 6(1), 41–55. https://doi.org/10.1080/13571519984304

Jara-Bertin, M. & Sepulveda, J. P. (2016). Earnings management and performance in family-controlled firms. Academia Revista Latinoamericana de Administración, 29(1), 44–64. https://doi.org/10.1108/ARLA-08-2015-0229

Jensen, M. C. & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Jung, K. & Kwon, S. Y. (2002). Ownership structure and earnings informativeness: Evidence from Korea. International Journal of Accounting, 37(3), 301-325. https://doi.org/10.1016/S0020-7063(02)00173-5

Kanagaretnam, K., Mathieu, R., & Shehata, M. (2009). Usefulness of comprehensive income reporting in Canada. Journal of Accounting and Public Policy, 28(4), 349–365. https://doi.org/10.1016/j.jaccpubpol.2009.06.004

Koonce, L., McAnally, M. L., & Mercer, M. (2005). How do investors judge the risk of financial items? The Accounting Review, 80(1), 221–241. https://doi.org/10.2308/accr.2005.80.1.221

Kothari, S. P. (1992). Price-earnings regressions in the presence of prices leading earnings. Earnings level versus change specifications and alternative deflators. Journal of Accounting and Economics, 15(2-3), 173-202. https://doi.org/10.1016/0165-4101(92)90017-V