|

|

EUROPEAN JOURNAL OF FAMILY BUSINESS |

|

Transition dilemma in a closely held family business: A case of Excel Transporters

Manoj Joshi a, *, Amit K Sinha b, Shailja Dixit c, Balvinder Shukla d

a Professor of Strategy, Entrepreneurship and Innovation, Amity Business School, Amity University, Lucknow Campus, Uttar Pradesh, INDIA

b Associate Professor- Finance Amity Business School, Amity University, Lucknow Campus, Uttar Pradesh, INDIA

c Associate Professor- Marketing Amity Business School, Amity University, Lucknow Campus, Uttar Pradesh, INDIA

d Professor of Entrepreneurship and Leadership Vice Chancellor Amity University Uttar Pradesh, INDIA

Received 26 May 2017; accepted 24 August 2017

Available online 30 june 2018

JEL CLASSIFICATION

D74, D1, J12, G32, G34

KEYWORDS

Family Business; Conflicts; Transition; Succession; Corporate Governance structure; Professionalism

Abstract. The purpose of this case study is to investigate issues that arise at the time of transition of ownership, business and wealth in a multigenerational closely held family business (CHFB). This is particularly relevant if the founder owner-manager has to pass the heir-ship to the offspring and specifically if the incumbent is a women. Through this case, authors have made an attempt to discuss the significance of ownership structure, to plan transition and to mitigate conflicts at the time of generational transition.

The case is based on primary research and secondary information, and has been tested several times post, which the gaps were identified and filled. The results indicate that absence of the corporate governance (ownership) structure leads to conflicts during transfer of power position in a CHFB. This reflects the necessity of professionalizing the family business to avoid breakdown of communication and trust within the family unit. Inadequately prepared heirs, forced entries of siblings in the business with no competence besides the patriarchs’ distribution of ownership and business were of major concern in a CHFB.

CÓDIGOS JEL

D74, D1, J12, G32, G34

PALABRAS CLAVE

Empresas familiares, Conflicto, Transición,Sucesión, Gobierno corporativo, Estructura, Profesionalización

El dilema de la transición en una empresa familiar que sea sociedad anónima cerrada: el caso de Excel Transporters

Resumen. El objetivo de este estudio de caso es investigar los problemas que surgen en el momento de la transición de propiedad, negocios y riqueza en una Empresa Familiar multigeneracional que sea Sociedad Anónima cerrada. Esto es particularmente relevante si el propietario-gerente fundador tiene que pasar el heredero a la descendencia y específicamente si el titular es una mujer. A través de este caso, los autores han intentado discutir la importancia de la estructura de propiedad, planear la transición y mitigar los conflictos en el momento de la transición generacional.

El caso se basa en la investigación primaria y la información secundaria, y se ha probado varias veces después de la publicación, donde se identificaron y completaron las lagunas. Los resultados indican que la ausencia de la estructura de gobierno corporativo (propiedad) genera conflictos durante la transferencia de la posición de poder en una empresa de este tipo. Esto refleja la necesidad de profesionalizar el negocio familiar para evitar el colapso de la comunicación y la confianza dentro de la unidad familiar. Los herederos preparados inadecuadamente, las entradas forzadas de hermanos en el negocio sin competencia además de la distribución de propiedad y negocios de los patriarcas son una gran preocupación en una empresa familiar de este tipo.

Introduction

Family businesses are one of the foundations of the world’s business community. Their creation, growth and longevity are critical to the success of the global economy. In the views of Pearl Initiative & PricewaterhouseCoopers (2012), many of the largest multinational corporations began as family businesses, and around 90% of the world’s businesses can be defined as family businesses, in developed, developing and in emerging markets. Predictions suggest that there will be family turnover in 68% of the world’s Top 500 family businesses employing 21 million and contributing US$6.5 trillion to global GDP (Bain, 2015). Beyond the West, family businesses represent more than half of all large corporations across the Asia Pacific regions (Fernández-Aráoz et al., 2015) and expectations of hand-down to heirs or close relatives stands at 75% of companies in China and Southeast Asia (Koh et al., 2015). In India, 50% of surveyed companies are confident to pass on management to the next generation (PwC Family Business Survey, 2013).

Family business can be defined as a business operation in which a group of relatives and family members have controlling interest or concentration of power in the business. These types of businesses may range from a local retail store to a commercial family firm and even for large corporations operating in multiple locations. In many instances, a family business is passed from one generation to the next, with children often being trained to enter the business at a certain age and then taking over various functions from their parents over time.

To the extent that ownership transition is considered (as opposed to management transition), the literature on succession assumes that transition of ownership to the next generation is the preferred choice. For majority of family owned businesses, transition planning is similar to “elephant in the living room”. Despite understanding the importance of selecting and preparing a successor, the leaders of the CHFB do not give much required attention to process transition planning. The consequence of not focusing on transition despite its obvious importance can be reflective; a leadership void and the resulting discord can significantly undermine the firm’s performance. Indeed, ill planned transition may lead to the biggest value destroying actions.

The objectives of the present exploratory case study are to investigate the issues arising at the time of transition of ownership, business and wealth from one generation to another in a closely held family business (CHFB). This is particularly relevant, if the founder owner-manager has to pass the heir-ship to the offspring and specifically if the incumbent is a female. Through this case authors have made an attempt to discuss the significance of corporate governance structure to plan transition and to mitigate conflicts at the time of generational transition of business in a CHFB. The analytical framework for the present study combines existing literature on family business, transition or succession, corporate governance and women entrepreneurship. In this case, authors have demonstrated issues arising at the time of transition in absence of governance structure and women as possible heirs.

Theoretical Framework

A key theme in the family business research literature is succession planning. Succession planning is pivotal to business sustainability in the long run, but is often fraught with tension within the family, resulting in indefinite postponement of the decision on succession. According to De Massis et al., (2008) family business succession is a complex and often lengthy process that involves “the actions, events and developments that affect the transfer of managerial control” among family members.

Long-term sustainability in a CHFB depends upon cultivation and nurturing of future leader/successor. Transition in a CHFB should focus on two major issues, namely succession planning and leadership development. A sound transition process should possess on two basic ingredients i.e. transparency and flexibility. In a CHFB, transition is basically an intergenerational transfer of ownership, business and wealth. Haberman & Danes (2007), emphasizes on three major issues for smooth and successful transition process, firstly the legal transfer of property, which is concerned with the law, secondly the transfer of decision authority, which is about power structure and the thirdly one is interaction among family business members. Stewart & Danes (2001) advocated that a growing consent about the separation between power structures, which concerns hierarchy and role patterns, and power interaction. This deals with negotiations, influencing strategies and conflict management processes.

According to Guo (2011), differences between founders of family businesses and their successors in values, would affect various innovations and transformation of enterprises. Gilding et al. (2015) states, that because the family identity of the chief executive in family businesses is closely tied to his identity as leader of the firm, chief executives in family businesses often feel a special sense of loss when power is transferred. One aspect that is not well understood and needs investigation is the manner in which successor and incumbent personality congruence affects the succession process (Daspit et al., 2016; Long and Chrisman, 2014).

Current knowledge available on the process of succession and sources of resistance is based mainly on family businesses founded and managed by male and that when the successor is also a male. But the core issue is, to what extent we can transfer that knowledge and power of family-owned businesses founded and managed by male to a woman successor! The process of transition in family business especially in case of woman entrepreneur as heir or successor is critical (Hishrish & Brush, 1984; Ratte, 1999). Handler (1994), Harveston, et al. (1997), focus on the process of succession in case of a man. According to Schröder et al. (2011), growing up in a family business may well foster girls interest on entrepreneurial activities in general, however, as their parents’ businesses represent more male-dominated types of industry (e.g., carpenter, electrician) these girls may seek fulfillment of their entrepreneurial career intentions by starting their own business in less male-dominated trades. Gender roles refer to the common roles of activity found in business (leader, successor, owner, etc.) in terms of societal expectations about what men can and should do, and what women can and should do. (Dumas, 1998; Dumas et al., 1995; Galiano & Vinturella, 1995; Harveston et al., 1997; Mehrotra et al. 2011; Sharma & Irving, 2005; Vera & Dean, 2005). Mozhdeh et al., (2017) has researched on preparation level of heirs and the relationship between family and business members that have a positive impact on the performance of family business.

Stavrou et al., (2005) states that, gender plays a pivotal role in the succession preparation stage. It interacts with others factors, such as birth order, nationality, and industry context. The stereotypical attributes of gender associated with women, such as nurturing and family-orientated tendencies, can compromise a daughter’s ability to assume the leadership position in a family business. The potential for gender bias was based in part on family acceptance, culture, role-tradition, and the family’s expectations of sons as the natural heirs.

Transition in a CHFB is always a challenging job especially when business is in distress and has inexperienced successor. Though family business succession is understood to influence long-term performance, many family businesses do not have clear plans or systematic processes for its implementation (Fang et al., 2015).

Transition in CHFB leads to several conflicts related to transfer of ownership, wealth and business. Major conflicts faced by most of the CHFBs are:

- Who will operate the business? Family member or external management?

- Who will control business, ownership and wealth?

- Active Vs. Inactive successor

- Expectation Vs. Reality

- Non-alignment of business future

The identity of enterprise and the identity of the leader complement each other. Zhao et al. (2015), stated that the identity of the second generation of enterprise is beneficial for successors to take over management rights and control power. The higher the legitimacy of the first generation, the higher the legitimacy will be of the second generation. Joshi, et al., (2017), mention on leadership that clearly demonstrates its pro-activeness, involvement through constant innovative skills and a capacity to take risks. Blumentritt et al., (2013) emphasize that leadership succession involves family members, which encompasses the transfer of responsibility for the ongoing management of the firm from members of senior to the junior generations. Yoo et al., (2014) have acknowledged family business successors are identified with their family system.

Decker et al., (2017) have found that succession involves certain unique contextual factors (i.e. individual, organizational, family), which includes various stakeholders who must be considered. Thus, identification of competent successor has always been an area of major concern in succession planning. Chrisman et al., (2009) suggested that succession planning also involves ability of the family firm to identify the number of successors, detailing the criteria and designating the successor. Helin and Jabri (2015) recapped that due to the sensitive intertwining of family and business, as well as individual desires and mutual interests, succession becomes a complicated issue.

Succession planning is a matter of concern for the business of all sizes. According to Buang et al., (2013) family businesses in SMEs also encounters internal conflict between family members in particular on succession issues, which is one of the critical factors affecting succession process effectiveness.

Governance is widely recognized as a key determinant in the success and failure of all organizational activity. Family involvement introduces a unique dimension to governance, which we define broadly as the mechanisms used to ensure that the actions of organizational stakeholders are consistent with the goals of the dominant coalition (Aguilera & Jackson, 2003; Chua, et al. 1999; Sirmon & Hitt, 2003). Although governance has long been recognized as an important topic in family business research (Gersick, 2015; Morck & Steier, 2005), its various dimensions remain understudied (Berrone et al. 2012). McMullen and Warnick, (2015) argue that the governance challenge undergone by family firms in preparing for leadership transitions is to provide a family and firm environment where potential successors’ need for self-fulfillment and self-determination. This was one aspect in respect to the commitment of future generations that McMullen and Warnick, (2015) did not consider as a difference between ownership succession and management succession. This separation is even more important for business families because of the size of their resource endowments.

Family businesses are sensitive to the necessity of a well-defined and sound governance structure for long-term sustainability of business as well as family.

In this academic endeavor authors have made an attempt to excavate and demonstrate, transition issues in a CHFB and how transition may lead to conflicts within a family as well as in business. With the help of this case, an attempt has been made to depict challenges faced by a founder during transition of business to next generation especially when successor are inexperienced and is a female. At the end of the case, authors have proposed a way out to mitigate transition issues in the form of corporate governance and professionalism in a CHFB.

Case Study

Background

This case is a reflection of conflicts and challenges that arises during transition of business from one generation to another in a CHFB started by Pullampilel Kochupillai Achutham Pillai. Born in a lower middle class farmer family of Kerala (India) and started his professional career as an auto mechanic, but eventually became an entrepreneur through his latent entrepreneurial orientation and skills, which he realized gradually. Though he failed initially, but with his strong will power and passion he fought back and came up with a new venture. After operating his business successfully for years, he had some medical issues and the trouble aggravated with his venture. His legal successors were two daughters, who were studying at the time of crisis and had no business insight. The issues related to transition and succession of his business began henceforth.

Table 1: Case Time Line of Excel Transporters

Year

Major Event of Family/Business

Demonstrations in case

1979

Pillai Migrated from Kerala to Allahabad Uttar Pradesh

“...to give wings to his dream, he left his native place Kerala and reached at holy city of Allahabad in state of Uttar Pradesh...”

1987

Establishment of 1st venture

“…in 1987, Pillai gave wings to his dream of owning a venture. He started a chassis body manufacturing unit at Allahabad…”

1989

Entry of Sibling into business and conflict begins

“…after getting an initial growth in 2 years, Pillai called his younger brother Naraynan from Kerala to help in his business...”

1990

Marriage of Pillai with Shubhralaxmi. Founding pillar of family support system. An essential ingredient for family business.

“...meanwhile, in 1990 Pillai got married to Shubhralaxmi, a girl from small business family from Allahabad, with highly rich value system…”

1991

Birth of Elder Daughter Pallavi, beginning of 2nd generation in family.

“...in the year 1991, it was the time which brought happiness for Pillai and Shubhralaxmi, as they were blessed with Pallavi, the elder daugter…”

1993

Birth of younger daughter Divya, one more ‘Women’ successor in family.

“...It was in the year 1993, Shubhralaxmi was pregnant again and blessed with Divya, the younger daughter...”

1994

Failure in 1st venture and winding up of business and back to automobile & transportation industry to work.

“...and finally in the year 1994, his venture suffered huge losses in 2 consecutive financial years, Pillai decided to wind up his first venture and returned to his previous place of work…”

1997

Establishment of Excel Transporter, rebirth of entrepreneur

“...his entrepreneurial orientation and experience at Commercial Auto Sales as convey in-charge led to setting up a transportation firm in 1997, by the name of Excel Transporters…”

2012

Health deterioration of founder Pillai begins

“…by the year 2012, the founder-owner Pillai started facing some serious health issues...”

2013

Unplanned entry of Divya in family business, entry of 2nd generation in family business

“...it was unplanned entry for Divya, the younger daughter in her father’s business in 2013..”

2015

Best Transporter Award, success of 2nd generation women entrepreneur

“…the firm achieved ‘the best transporters’ award in the year 2015, by one of the most popular global brands in automobile industry i.e. Tata Motors Ltd…”

2016

Entry of elder daughter in business and issues related to transition begins….

“...in the year 2016 the elder sister, Pallavi returned to Lucknow to live with her parents. Seeing business growing and prospering, she also developed curiosity in business…”

The Journey

This journey started in the state of Kerala (Southern India). It was summer of 1979, in hot and humid weather of Kerala in the month of June, when the land of Kerala was expecting rains, an 18-year-old Pillai was thinking about his future endeavor. Right from the childhood, he exhibited signs of leadership and was an enterprising child with a positive mindset. Though he belonged to a lower middle class farmer family but he had dreams for achieving high goals and being a successful person. To give wings to his dream, he left his native place Kerala and reached at the holy city of Allahabad situated in state of Uttar Pradesh (a northern central state of India) for better prospects.

He started his professional journey as an auto mechanic at a garage of Tata Motor’s dealer Commercial Auto Sales at Allahabad. There, he barely earned Rs. 5 for the entire day’s work. Pillai was a man on his mission right from the beginning of his professional career, somewhere at the back of his mind there was an entrepreneur planning to achieve his goals. His focus was on learning and getting exposure to business skill and to enhance his social network. With the passage of time, driven by his capability, commitment and responsibility; very soon he won the trust of the owner. In due course of time he got a superior role in the organization and started shunting chassis of that dealer as a driver. His experience and acquaintance on different routes steered him to become as convey in-charge.

B.M. Gupta (Owner of Commercial Auto Sales) was impressed by Pillai’s commitment towards work and his trustworthiness, and eventually he sent him to Tata Motors Ltd., Jamshedpur plant, one of the leading manufacturers of commercial vehicle in India for training in a Tipper operation. This was the turning point in Pillai’s professional life. His interest, inquisitiveness and capability helped him in learning even the smallest nuances of automobile industry. This training gave him dual exposure, one in terms of technical aspects of automobile industry and on the other hand on the aspects of building networks.

With the help of training at Tata and hands on experience with Commercial Auto Sales, over the time, he developed an insight on the dynamics of automobile industry. His strength of being a social person, zeal towards the industry and rich experience in automobile and transportation industry gave him a right mixture of what was required to be an entrepreneur.

Establishment of the 1st Venture

Pillai is one of those individuals who woke up early in the morning with an idea and finding a journey within, rather than finding excuses for not doing it.

During his professional journey of 8 years, from an auto mechanic to ‘Convey In charge’ with Commercial Auto Sales at Allahabad, Pillai had dreamt with an idea to become an entrepreneur. It is here, where Pillai demonstrated the basic instinct of being an entrepreneur, with risk taking propensity blended with an entrepreneurial mind-set for creating a venture of his own. In 1987, Pillai gave wings to his dream, owning a venture. He started a chassis body-manufacturing unit at Allahabad. After witnessing initial growth in 2 years Pillai called his younger brother Narayanan from Kerala to help in his business. It seems, here he erred rather than having an outside professional as an associate in business; he offered an opportunity to his inexperienced but qualified younger brother to join his business.

Involvement of Sibling: Conflicts Begins and Ended with Failure

To accelerate the growth of his budding business Pillai involved his inexperienced younger brother Narayanan into his venture in 1989. But there were no defined governance processes and no written guidelines regarding roles and responsibility for new entrants. Narayanan was a commerce graduate and pursuing graduation in Law (LLB), therefore Pillai expected that he might help him in managing the business. But Narayanan was a youth with a lot of personal ambitions along with a greed for success. Initially, entry of Narayanan gave a positive outcome and the business started growing. However, growth in every closely held family business leads to greed for money and power, which eventually results into a conflict. After a period of 5 years family feud grew many folds. His younger brother started malpractices, which resulted in a huge loss followed by confrontation between Pillai and his brother. The conflict became monstrous. And finally in the year 1994, when his venture suffered huge losses in two consecutive financial years, Pillai decided to wind up his first venture and returned to his previous place of work.

Rebirth of an Entrepreneur

Pillai claimed, ‘an entrepreneur always learns from his mistakes and must never lose hope.’ Though he left his business but his passion and hunger was steering to do something new and big. Later on, he decided to move to Lucknow (capital of a Northern state, Uttar Pradesh, India), in search of new business opportunity. Being the state capital, Lucknow had distributors for all leading manufacturers of commercial vehicle, with limited number of transporters involved in transportation of chassis. His entrepreneurial orientation and experience at Commercial Auto Sales as convey-in-charge led in setting up a transportation firm in 1997, by the name of Excel Transporters.

Excel Transporters: Business and Family Structure

Excel Transporters, was established as a small firm where all the activities were managed and controlled by Pillai himself. His core business became as chassis transportation on pan India basis. Initially he had to face stiff competition in the market but with added experience and understanding of dynamics of automobile and transport industry, he could make his presence felt in the market. It was his dedication and passion to turn his entrepreneurial dream into a reality. His social network and communication skills helped him in developing the required business networks. Due to his excellent inter personal relations; he developed a strong relationship with Tata Motors. His network at Tata Motors helped him to fetch a contract with Tata Motors Ltd, i.e. to transport chassis throughout India. This was the turning point in the business, which changed the entire business dynamics. The growth story of Excel Transporters began with obtaining this contract from Tata Motors. However, this opportunity came with several challenges too and it was not an easy journey as competition crept in simultaneously.

Meanwhile, in 1990 Pillai got married to Shubhralaxmi a girl from a small business family from Allahabad, with good values. Shubhralaxmi, who came from a strong family value system, was of great help and with a strong moral support for Pillai. Though, Shubhralaxmi wan not actively involved in the business but she was a great support in decision-making. Being a commerce graduate, sometimes she helped him in managing finances.

In the year 1991, it was the time, which brought happiness for Pillai and Shubhralaxmi as they were blessed with their elder daughter, Pallavi. It was in the year 1993, Shubhralaxmi was again blessed with a younger daughter, Divya. Hence, Pillai had two women successors in the family. It was time for the business and kids to move on. At a later stage, the elder daughter Pallavi moved to south India for higher education, while her younger daughter Divya decided to stay closer to parents and hence, went to Allahabad to pursue her graduation.

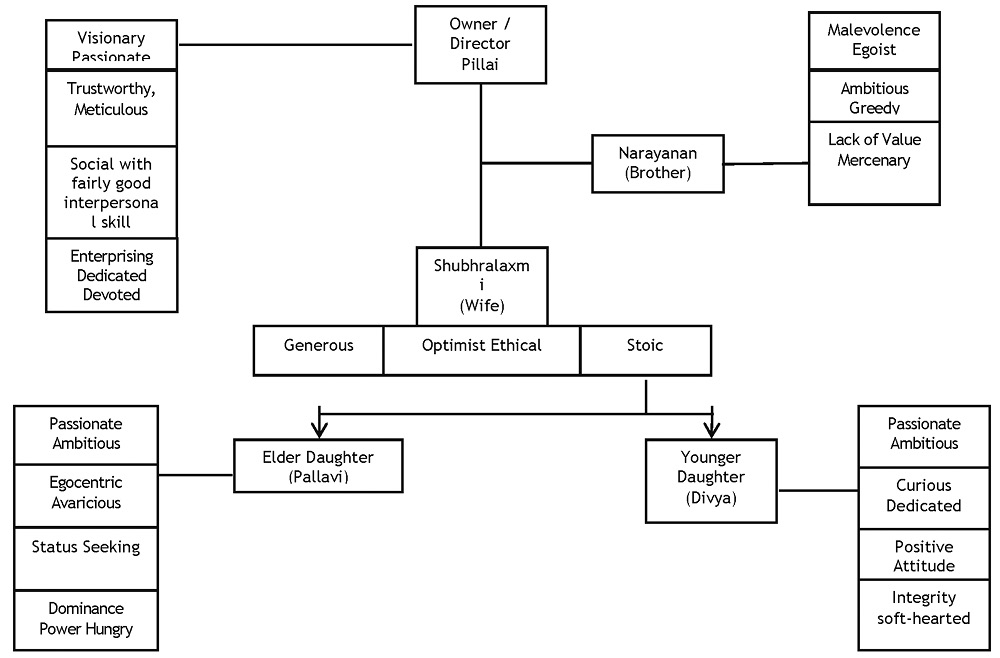

Figure 1 Family Structure and their characteristics

Excel Transporters: Organization Structure

Organization structure at Excel Transporters is based on a sole proprietorship firm. Pillai hired employees, but as a sole proprietorship firms are in their character, it followed a benevolent dictatorship. The entire decision-making was centralized in the hands of founder-owner Pillai. As an owner and considered the brain and mind behind the organization, he was not answerable to anyone. The firm lacked a defined governance structure. There was no distinguishing line between the power structure (which concerned hierarchy and authority and role pattern in organization) and strategic decisions.

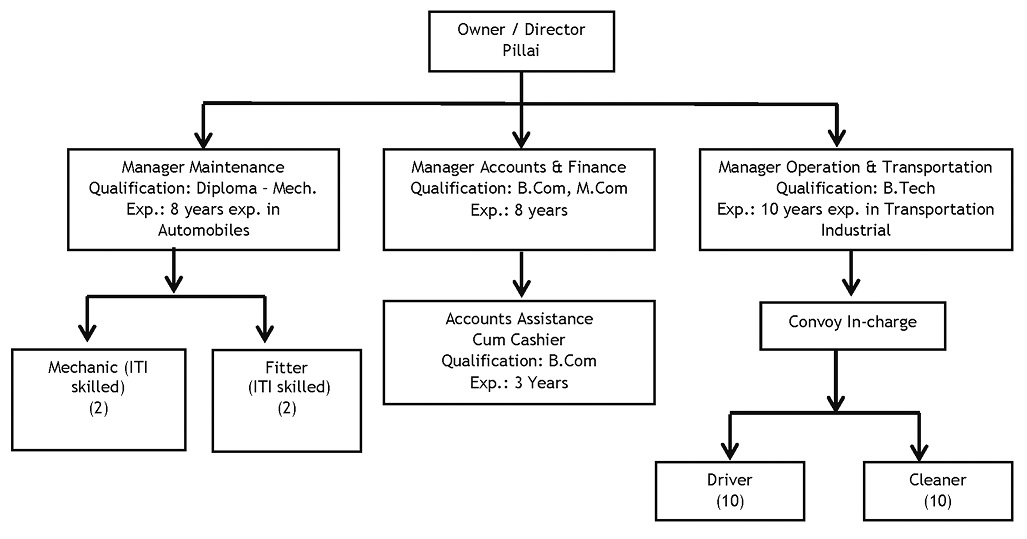

Figure 2 Organization Structure

The Trouble in the Empire: Bumpy Ride Begins

By the year 2012, the founder-owner Pillai started facing some serious health issues. His wife started insisting him in considering a break from business while reducing work stress. Due to his ill health, Excel Transporter started suffering continued losses and was hardly able to make out variable operating cost. The firm went under a substantial financial distress condition.

This was the time when the firm required an individual who could take a lead in bringing the required sustainability to the firm. The day operations were not being handled well and the employee confidence was dwindling. The employees had no clear instructions and proper directions. The environment in the firm was in total chaos. As Pillai’s thoughts wandered, he found himself thinking about the future of the business, which he had so successfully built. His daughters had never been active in the business before and he felt rather uncomfortable with their ability to lead it forward. During his entire entrepreneurial and professional journey, he had never seen a women entrepreneur in the transport business. It is true that in India, the transport industry is a male dominated one and engages interaction with low and semi-skilled staff. Apart from this, he had occasional disagreements with daughters about the business and new developments. His concern, about future of this business revived with his deteriorating health. He was concerned about the transfer of his control, ownership, wealth, and business stake. The elder daughter was pursuing graduation in a city situated in Southern part of India and the younger daughter was at Allahabad, a city in the Northern state of India, pursing graduation.

His wife Shuibhralaxmi was the backbone of the family and a great support to the family system. She had rescued him during his tough times, when the venture was undergoing a rough patch. Being a homemaker, she took care of her family, efficiently. Though she was never involved actively in the business but provided interim solutions to frequent business problems. Watching her ailing husband and the collapse of family business, she decided to take the reins in her own hands. This is where she decided as to who would lead the family business. She initiated a dialogue with her two daughters on the future of the family business. Contrary to what she had expected, both of them expressed their desire to manage the family business. However, the mother saw a spark in her younger daughter, Divya and decided to shift her to Lucknow (Capital city of a northern State in India) for higher education, as the city offered good quality education. Being in the 1st year of a bachelor’s course in commerce, it was an unplanned entry for Divya, in her father’s business from the year, 2013. Divya being an amateur and a newcomer in the business did not think much on the pros and cons in joining the family transportation business.

Table 2 Income Statements of Excel Transporters

2010-11

2011-12

2012-13

Sales

913,8720

5483250

2193300

EBITDA

% of Sales

142,1690

15.6%

416750

7.6%

92118

4.2%

Profit From Recurring Operations

% of Sales

1297820

14.2%

338850

7.1%

38480

1.8%

Operating Profit

% of Sales

1296660

13.9%

372860

6.8%

(23425)

Net Finance Cost

(132450)

(148460)

(153520)

Income Tax

(320960)

(62832)

-----

Net Profit from Operation

811450

161568

(176945)

% of Sales

8.9%

2.95%

(8.06%) Loss

Note: All figures are in Indian Rupees (INR)

Second Generation: Women Entrepreneur

With no experience in the business, she was reluctantly compelled to be the decision maker. She started learning the pros and cons of operating a business. Her passion, logical thinking and entrepreneurial drive, followed by eagerness to learn developed a mystic change in her personality. In addition her ambition, passion and dedication towards work made her youngest (Partner) of transportation firm in the entire north India. Within one year of her joining the firm, the hard work of this budding entrepreneur helped her in reaching the next stage of business. The business resumed generating profits. The firm achieved the best transporter award in the year 2015, by one of the most popular global brands in automobile industry i.e. Tata Motors Ltd. With their added experience, social networking, fresh inputs and enthusiasm they got the contract from Ashoka Leyland (yet another large vehicle manufacturer) for chassis transportation across India. They started spreading their wings into southern India also.

Even though women entrepreneurship and the formation of women business networks are steadily rising, Divya underwent a number of challenges and obstacles that a women entrepreneur would have undergone. One major challenge that many women entrepreneurs undergo is the traditional gender-roles society for women. This is where Divya was looked upon if she could deliver results in a male dominated business? Entrepreneurship is still considered as a male-dominated field and it may be difficult to surpass these conventional views. Other than dealing with the dominant stereotype, women entrepreneurs face several obstacles related to their businesses. Here too, Divya was considered as a novice entrepreneur who would fall flat in the longer run yet her courage and determination failed the contemporaries.

Second Generation Conflict: Rivalry among Sisters

In-between Divya, took up an MBA in Entrepreneurship from renowned Private University in Lucknow, for advancing her skills and knowledge. Meanwhile in the year 2016 her elder sister Pallavi returned to Lucknow to live with her parents. Observing that the business is growing and prospering, she too developed propensity and curiosity towards the family business. The elder sister also got her admission in the same business school to pursue an MBA where Divya was already studying. Pallavi by this time started having ambitions of owning and controlling the family business. A kind of sibling rivalry developed between the two sisters.

Divya completed her MBA and took charge of the family business. After a year, the elder sister Pallavi post completing her MBA started active participation in the family business. Contrastingly amongst the two sisters, Pallavi was more educated but less exposed to father’s business. On the other hand Divya was not only educated, but she also had the advantage of an initial exposure to the family business, This she had been handling for quite some time along with her father.

Meanwhile, the elder daughter Pallavi got married to one of her batch mate. With this marriage Pallavi tried to take an upper hand in the business and started dominating Divya. She thought of having an advantage in the family business as her husband (could make an entry), who would be beneficial for this male oriented business. With this, the third stakeholder also emerged in the family business. This kind of situation typically occurs within closely held family businesses where the organization structure is founder/owner centric and all authorities toward decision-making lies with owner. Moreover, there was no governance structure at Excel Transporters to define the degree of control, delegation of authority, responsibility and transition in the absence of the founder-owner.

Transition Issues: The Imbroglio

Pillai’s health has started deteriorating and so were a plethora of unanswered queries. Currently, the family must be hedged against all odds, a primary reason to start his venture. At the same time the business cannot be ignored. There are transition dilemmas for the founder. Pillai has two daughters and one day one of them would be the successor as he had claimed. However, the biggest challenge he fore sees is passing the baton to the identified heir. Any one or both daughters could be as an heir? Or is there a choice outside the family? The second one is remote as not until now any one has been identified neither based on organizational competencies or proximity to family and loyalty.

Therefore, who would take over, if amongst the two daughters? Will there be a partition/division in ownership? What will happen when one or both move forward in life post their respective marriage? What would be the involvement of their respective spouses, if they decide to engage in the family business? Several unanswered questions have started striking Pillai. It is definitely not an easy one. This is where the toughest part of family business is, when the successors are women. The Indian society confines the roles and capability of women in general. Accepting a woman running a family transport business was never going to be easy when the successor is not certain and clear, then transition of business, wealth and ownership from one generation to other become highly complicated in a VUCA (volatile, uncertain, complex, ambiguous) world.

Currently, the firm is in deep imbroglio with the following challenges, unattended, unresolved and forthcoming.

i. Who will take up ownership of the firm? Elder or the younger daughter?

ii. What shall be the basis of transfer of ownership and Control?

iii. If business is to be divided then, how?

iv. Internal resistance by employees in respect of change, particularly acceptance of women successor by senior employee.

v. Managing conflicts and particularly on transition.

vi. Is it the right time to start putting the corporate governance structure in place?

Conclusion

It is imperative for family businesses to adopt a proper and effective succession planning in order to ensure that they can continue to sustain and survive in the global competitive era. Family with loving and caring ingredients will not only put individual family members in a favorable position, but also to the business they own and manage. As a result, the next generation will be able to follow the footsteps of their forefather to expand their business and bring the family firm to the next step of success. A social structure of gender lens could advance our understanding of family business succession.

Results indicate that absence of corporate governance (ownership) structure leads to conflicts in the transfer of power position in CHFB. This research reflects the necessity of professionalizing the family business to avoid breakdown of communication and trust within the family unit, inadequately prepared heirs, forced entries of sibling in the business with no competence besides the patriarchs’ distribution of ownership and business.

Implications

Several studies suggest that, all across the world majority of family businesses failed, during transition from one generation to another. This case discusses the importance of corporate governance structure in a family business to handle conflicts and transition management in a CHFB. The findings shall help family businesses to understand in a better way, the importance of preparation level of heirs, governance structure and the relationship between family and business members.

References

Abidi, S, & Joshi, M. (2015). The VUCA Company, Jaico publishing house

Aguilera, R.V. & Jackson, G. (2003). The cross-national diversity of corporate governance: Dimensions and determinants. Academy of Management Review, 28, 447–465.

Bain, D. (2015). The top 500 family businesses in the world. Retrieved from https://familybusiness.ey-vx.com/pdfs/182- 187.pdf

Barnes, L. B., & Hershon, S. A. (1976), Transferring power in family business. Harvard Business Review, July-August, 105-114 http://www.iiis.org/CDs2011/CD2011SCI/SCI_2011/PapersPdf/SA110RC.pdf accessed on May 26, 2017

Berrone, P., Cruz, C., & Gomez-Mejıa, L.R. (2012). Socioemotional wealth in family firms: Theoretical dimensions, assessment approaches and agenda for future research. Family Business Review, 25, 258–279.

Brush, C. (1992), Research on women business owners: Past trends, and new perspectives and future directions. Entrepreneurship Theory and Practice, 16(4), 5-30

Blumentritt, T., Mathews, T., and Marchisio, M. (2013). “Game Theory and Family Business Succession”. Family Business Review. 26(1), 51-67.

Buang, N. A., Ganefri, and Sidek, S. (2013), “Family business succession of SMEs and post-transition business performance”, Asian Social Science, 9(12):79-92.

Chrisman, J. J., Chua, J. H., Sharma, P., and Yoder, T. R. (2009), “Guiding family businesses through the succession process”. The CPA Journal. 79(6), 48-51.

Chua, J.H., Chrisman, J.J., & Sharma, P. (1999). Defining the family business by behavior. Entrepreneurship Theory and Practice. 23(4), 19–39.

Churchill, N. C., & Hatten, K. J. (1987), Non-market based transfers of wealth and power: A research framework for family businesses. American Journal of Small Business. 11(3),51-64.

Daspit, J. J., D. T. Holt, J. J. Chrisman, and R. G. Long. (2016). “Examining Family Firms Succession from a Social Exchange Perspective: A Multiphase, Multistakeholder Review”. Family Business Review, 29(1), 44-64.

Decker, C., Heinrichs, K., Jaskiewicz, P. and Rau, S.B. (2017), “What do we know about succession in family businesses? Mapping current knowledge and unexplored territory”, in Kellermanns, F.W. and Hoy, F. (Eds), The Routledge Companion to Family Business, Routledge, New York, NY, pp. 15-44.

De Massis, A., Chua, J.H., & Chrisman, J.J. (2008). Factors preventing intra-family succession. Family Business Review. 21(2), 183–199.

Donnelly, R.G. (1964), The Family Business. Harvard Business Review, Vol. 42, pp. 93-105.

Dumas, C. (1998). Women’s pathways to participation and leadership in the family-owned firm. Family Business Review. 11, 219-228.

Dumas, C., Dupuis, J., Richer, F., & St-Cyr, L. (1995). Factors that influence the next generation’s decision to take over the family farm. Family Business Review. 8, 99-120.

Fang, H.C., Randolph, R.V.D.G., Memili, E. and Chrisman, J.J. (2015), “Does size matter? The moderating effects of firm size on the employment of nonfamily managers in privately held family SMEs”, Entrepreneurship Theory and Practice. 40(5), 1017-1039

Fernández-Aráoz, C., Iqbal, S., & Ritter, J. (2015). Why family firms in East Asia struggle with succession. Harvard Business Review. Retrieved from https://hbr.org/2015/03/ why-family-firms-in-east-asia-struggle-with-succession. Access on 3rd July 2017.

Folker, C. A. (1999), Female vs. male family business owners: Exploring the differences through a trust/ distrust framework. USASBE Proceedings. Available:www.sbaer.uca.edu/docs/proceedingsIII. Accessed on 5th Sept., 2017

Galiano, A., & Vinturella, J. (1995). Implications of gender bias in the family business. Family Business Review, 8, 177-188

Gatamah, K. (2008), Corporate Governance in the African Context. Centre for International Private Enterprise, Washington DC.

Gersick, K.E. (2015). Essay on practice: Advising family enterprise in the fourth decade. Entrepreneurship Theory and Practice, 39, 1433–1450.

Gilding, M., Gregory, S., & Cosson, B. (2015). Motives and outcomes in family business succession planning. Entrepreneurship Theory and Practice, 39, 299-312.

Gompers, P.A., Ishii, J.L. and Metrick, A. (2003), Corporate Governance and Equity Prices. The Quarterly Journal of Economics. 118, 107-156. http://dx.doi.org/10.1162/00335530360535162

Gulzar, M.A. and Wang, Z.J (2010), Corporate Governance and Non-Listed Family Owned Businesses: An Evidence from Pakistan. International Journal of Innovation, Management and Technology. 1, 127-128.

Guo, C. (2011) Inherit from Father or Develop New Machines—The Value Deviation of Second Generation Successor and the Transformation of Family Business. Journal of Sun Yat-Sen University (Social Science Edition), 5, 653-770.

Haberman, Heather & Danes Sharon M. (2007), Father-Daughter and Father-Son Family Business Management Transfer Comparison: Family FIRO Model Application, Family Business Review, 20(2), 163-184

Handler, W. C. (1990), Succession in family firms: A mutual role adjustment between entrepreneur and next-generation family members. Entrepreneurship Theory and Practice, 15(1), 37

Handler, W. C. (1994), Succession in family business: A review of the research. Family Business Review, 7(2), 133-157.

Harveston, P. D., Davis, P. S., & Lyden, J. A. (1997), Succession planning in family business: The impact of owner gender. Family Business Review. 10(4), 373- 396.

Helgesen, S. (1990), The female advantage: Women’s ways of leadership. New York: Doubleday

Helin, J., and Jabri, M. (2015), “Family business succession in dialogue: The case of differing backgrounds and views”, International Small Business Journal. 34(4), 1-19.

Hishrish, R. D., & Brush, C. (1984), The woman entrepreneur: Management skills and business problems. Journal of Small Business Management. 22(1) 30-37.

Holland, P. G., & Oliver, J. E. (1992), An empirical examination of the stages of development of family business. Journal of Business & Entrepreneurship. 4(3), 27-38.

Hugron, P., & Dumas, C. (1993), Modélisation du processus de succession des entreprises familiales québécoises. (Cahier de Reherche No. GREF-93-07). Montreal: École des Hautes Études Commerciales.

Koh, A., Ling, C., Kong, E., & Ejercito, J. (2015). Riding on Asia’s economic transformation: Growth strategies of Asian business families. Singapore: Singapore Management University

Lee-Gosselin, H., & Grisé, J. (1990), Are women owner-managers challenging our definition of entrepreneurship? An in-depth study, Journal of Business Ethics. 9( 4-5), 423-433.

Longenecker, J. G., & Schoen, J. E. (1978), Management succession in the family business. In C. E. Aronoff, J. H. Astrachan, & J. L. Ward (Eds.), Family business sourcebook II (pp. 87-92). Marietta, GA: Business Owner Resources.

Long, R. G., and J. C. Chrisman. (2014). “Management Succession in Family Business.” In The Sage Handbook of Family Business (pp. 371-387). Eds. L. Melin, M. Nordqvist, and P. Sharma. London, UK: Sage Publications.

Louise, C., Lorrain, J., & Hugron, P. (2002). Succession in Women-Owned Family Businesses: A Case Study. Family business review, 15(1), 17-30.

Joshi, M., Dixit, S., & Sinha, A. (2017). “Comfort & shelter for all: a case of an entrepreneurial firm”, Journal of Entrepreneurship in Emerging Economies. 9(3), 333-347

McMullen, J.S. & Warnick, B.J. (2015). To nurture or groom? The parent-founder succession dilemma. Entrepreneurship Theory and Practice, 39, 1379–1412.

Mehrotra, V., Morck, R., Shim, J., & Wiwattanakantang, Y. (2011). Must love kill the family firm? Some exploratory evidence. Entrepreneurship: Theory and Practice, 35, 1121-1148.

Morck, R. & Steier, L. (2005). The global history of corporate governance: An introduction. In R. Morck (Ed.), The history of corporate governance around the world: Family business groups to professional managers (pp. 1–64). Chicago: Chicago University Press & National Bureau of Economic Research.

Mozhdeh Mokhber, Tan Gi Gi, Siti Zaleha Abdul Rasid, Amin Vakilbashi, Noraiza Mohd Zamil, Yee Woon Seng, (2017) “Succession planning and family business performance in SMEs”, Journal of Management Development. 36(3), 330-347, https://doi.org/10.1108/JMD-12-2015-0171

PwC Family Business Survey. (2013). Family firm: The India perspective. Retrieved from https://www.pwc.in/ assets/pdfs/family-business-survey/family-business-survey-2013.pdf

Ratte, S. (1999), Les femmes entrepreneures au Québec: Qu’en est-il? Fédération Canadienne de l’entreprise indépendante (Ed.). Montréal in MICST (2000), L’entrepreneuriat féminin: Une force un atout: Portrait statistique des femmes entrepreneurs, Ministère de l’industrie et du commerce, Québec (Ed.).

Sarbah Alfred and Xiao Wen (2015), Good Corporate Governance Structures: A Must for Family Businesses, Open Journal of Business and Management. 3, 40-57

Schröder, E., Schmitt-Rodermund, E., & Arnaud, N. (2011). Career choice intentions of adolescents with a family business background. Family Business Review, 24, 305-321.

Sharma, P., & Irving, P. G. (2005). Four bases of family business successor commitment: Antecedents and consequences. Entrepreneurship: Theory and Practice, 29, 13-33

Sirmon, D.G. & Hitt, M.A. (2003). Managing resources: Linking unique resources, management and wealth creation in family firms. Entrepreneurship Theory and Practice, 27, 339–358.

Stewart, C. C., & Danes, S. M. (2001). The relationship between inclusion and control in resort family businesses: A developmental approach to conflict. Journal of Family and Economic Issues. 22, 293–320.

Stavrou, E.T., Kleanthous, T. and Anastasiou, T. (2005), “Leadership personality and firm culture during hereditary transitions in family firms: model development and empirical investigation”, Journal of Small Business Management. 43(2),187-206.

The Pearl Initiative & PricewaterhouseCoopers, (2012), Family Matters Governance Practices in GCC Family Firms. http://www.pwc.com/en_M1/m1/publications/documents/pipwc-report.pdf

Vera, C. F., & Dean, M. A. (2005). An examination of the challenges daughters face in family business succession. Family Business Review, 18, 321-345.

Ward, J.L. (2001), The Role of Owners, Directors and Managers in Family Business Governance. Research Note 10/05/2001

Yoo, S. S., Schenkel, M. T., and Kim, J. (2014), “Examining the impact of inherited succession identity on family firm performance”, Journal of Small Business Management, 52(2), 246-265.

Zhao, J., Zhang, S. and Zhu, L. (2015) The Influence of the Inheritor’s Legitimacy on the Strategic Change of Family Business. China Industrial Economics, 8, 130-142.

Teaching Notes

Synopsis

Excel Transporter is a typical family owned and a family controlled business initiated by Pullampilel Kochupillai Achuthan Pillai (Founder-Owner, here by referred as Pillai). He was an entrepreneur driven by a passion to start a venture. This case reflects the entrepreneurial journey and the family business established by Pillai. Pillai had adventured from his native state of Kerala (a southern most state in India) to Allahabad (A city in Northern India) in the year 1979. Thereof, he started his career as a motor mechanic in a garage with a leading Motor manufacturer, Tata Motors. Obtaining experiential learning was the main motive and his intrinsic desire. Soon he shifted to the Lucknow (the capital city of Uttar Pradesh, a state in Northern India) and persuaded his brother to join him for a similar work exposure. As the business expanded so did the challenges of VUCA (volatility, uncertainty, complexity, ambiguity) in the family and the family business, Excel Transporter. The firm started reflecting weaknesses that were deep rooted in the business. There were no fixed responsibilities. The firm began its downfall with the financial mechanism also crippling speedily. The emotions came in between the business and the family while as an outcome of both, wealth started eroding.

Though initially he failed, but with a strong will power and passion Pillai fought back and resumed the business. However, after running his business successfully for few initial years, he had some medical issues and wasn’t able to continue. Pillai has two daughters and it is understood that one day, one of them would be the successor. However, the biggest challenge of having heir is both are females. Who would take over? There is a debate over females taking the baton and are considered to be incompetent and emotionally unfit to take over the family reigns, as understood in the local culture! Will there be a partition/division in ownership? What will happen when one or both decide to move out in personal life with their spouses post marriage? Will there be an involvement by their respective spouses? Several unanswered questions started striking in Pillai’s mind.

This is where the toughest part of family business is, when successors are women. Indian society confines the roles and capabilities of women in general. Accepting a woman running a family transport business was never going to be easy when the successor is not certain and clear. The transition of business, wealth and ownership from one generation to other becomes highly complicated and complex.

With no clear guidelines and absence of corporate governance structure the siblings are in a conflict like situation. Had Pillai planned transition or had incorporated corporate governance, Excel Transporter would have been a much more successful closely held family business (CHFB).

Methodology for teaching

I. Distribute the case at least five (5) days in advance

II. Assign the students / Scholars to write a synopsis (300-400 words) after reading the main case

III. First Class 60 minutes:

1. 10 minutes discussion on the synopsis

2. 30 minutes on the main case and identifying issues

3. 20 minutes on opinions on various issues

IV. Second class 60 minutes:

4. 20 minutes discussion on questions 5a…d

5. 30 minutes discussions on theory, and implications as connected with main theme on “transition management in a family business”

6. 10 minutes learning from the case.

Teaching Objectives:

1. To understand what a closely held family business means (CHFB).

2. To examine what is transition management in CHFB

3. To demonstrate issues and conflicts arising at the time of transition in CHFB

4. To address the complexities in transition in case of women successors.

5. To examine the significance of planning and corporate governance in a CHFB its benefits in handling conflicts during succession and transition cycle in a CHFB.

6. To demonstrate the relevance of professionalizing a CHFB.

Learning Outcome

1. To understand conflicts arising out of transition in CHFB?

2. Complexities of transition in case of women successors.

3. Significance of corporate governance and professionalization in a CHFB.

Identification of intended course(s):

Entrepreneurship, Family Business, Conflict Management, Strategy

Discussion Questions in class:

1. What do you understand by closely held Family Business (CHFB) and how it’s different from non-family business?

2. What is transition planning; elaborate the significance of transition planning in CHFB?

3. What were the issues concerning transition and conflict in the case?

4. What are the challenges faced by women successor; and how women successor different from male successor?

5. Discuss the significance of corporate governance in mitigation of conflicts during transition in CHFB.

6. After analyzing case, discuss the current scenario, transition dilemmas and the way out.

Discussion Questions

1. What do you understand by closely held Family Business (CHFB) and how it’s different from non-family business?

Family businesses are one of the foundations of the world’s business community. Their creation, growth and longevity are critical to the success of the global economy. Donnelly (1964), however, defines a family business as a company that: “has been closely identified with at least two generations of a family, and when this link has had a mutual influence on company policy and on the interests and objectives of the family. Such a relationship is indicated when one or more of the following conditions exist:

a) Family relationship is a factor, among others, in determining management succession;

b) Wives or sons of present or former chief executives are on the board of directors;

c) The important institutional values of the firm are identified with a family, either in formal company publications or in the informal traditions of the organization;

d) The actions of a family member reflect on the reputation of the enterprise, regardless of his formal connection to the management;

e) The relatives involved feel obligated to hold the company stock for more than purely financial reasons, especially when losses are involved;

f) The position of the family member in the firm influences his standing in the family;

g) A family member must come to terms with his relationship to the enterprise in determining his own career.”

Donnelly’s (1964), definition covers two interacting dimensions of the family business, i.e. the family and the business. The understanding here is that to function properly, a business family may benefit from effective family governance, while the business may benefit from corporate governance.

2. What is transition planning? Elaborate the significance of transition planning in CHFB.

In a closely held family businesses transition is basically an intergenerational transfer of wealth, business and ownership. Haberman & Danes (2007), emphasizes on three major issues for smooth and successful transition process, first the legal transfer of property, which is concerned to the law, second transfer of decision authority, which is about power structure and the third one is interaction among family business members. Stewart & Danes (2001), advocated that a growing consent about the separation between power structures, which concerns hierarchy and role patterns, and power interaction. This deals with negotiations, influence strategies, and conflict management processes.

Louise, et al. (2002), succession is a dynamic process during which the roles and duties of the two main groups of individuals involved, i.e., the predecessor and the successor, evolve interdependently and overlap, with the ultimate goal being to transfer both the management and ownership of the business to the next generation. The existing models are based on the principle that the process begins well before the successor is brought into the business and ends when the predecessor retires. As shown in Figure 1, the phases in those models (Barnes & Hershon, 1976; Longenecker & Schoen, 1978; Churchill & Hatten, 1987; Handler, 1990; Holland & Oliver, 1992; Hugron & Dumas, 1993) can be summarized as follows: the initiation phase, the integration phase, the joint management phase, and the retirement phase.

3. What were the issues concerning transition and conflict

Transition in a CHFB is always a challenging job especially when business is in distress and have inexperienced female successor. Transition in CHFB leads to several conflicts related to transfer of ownership, wealth and business. Major conflicts faced by most of the CHFBs are:

- Who will run business? Family member or outside management?

In absence of founder owner-manager who will run or manage business whether a family member or an outside professional, is the first conflict that arises during transition from one generation to next. Founder needs to decide whether to select a successor from within family or outside family. Several family members may each aspire to take the reins, and talented as well as experienced non-family executive may also interested in leading the business.

- Who will control wealth, ownership and business?

In case of more than one successor, it may cause conflict within family as well as in business that owner and manager will be one person or multiple. Control of wealth is a matter of law in respect of transfer of property to legal heir; control of ownership is again a legal affair, which comes with control of business in case of CHFB, focusing on decision authority and power structure.

- Active Vs. Inactive successor

In transition identification of active and inactive successor is a big challenge, sometime it has been observed one successor is involved in family business with predecessor, hence being an active member becomes a natural choice for transfer of control, but when inactive successor claims his/her rights then conflict arises.

- Expectation Vs. Reality

Although setting expectation, philosophy and values is central to many family business issues and doing so is essential when it comes to succession planning, but in the case of a successor unable to cope up with expectations, philosophy and values set by predecessor, it may lead to conflict.

- Non-alignment of business future

This conflict is an outcome of generational gap in terms of thought process and vision between predecessor and successor.

These could be a real time VUCA challenge (Abidi & Joshi, 2017), where failure is not an option, but failure to learn from failures, certainly would be a failure. There must be early resolutions in the family business.

4. What are the challenges faced by women successor; and how women successor are different from male successor?

Hishrish, & Brush, (1984), Helgesen (1990) and Brush (1992) have illustrated that women are different from men in their business dealings in many ways. For example, women owners perceive their managerial skills, to be as good communicators followed by appropriate interpersonal relationships with teamwork. Brush’s (1992) & Folker (1999) have found, contrary to their male counterparts; women see their business operations and the business as a cooperative network of relationships rather than just a profit center. Such an attitude would explain why they are more open to sharing, less distrustful, more conciliatory, less directive, more attentive, and less competitive in their business dealings. Lee-Gosselin & Grisé (1990), states as women give more weightage on human and social values, their value system moderately describes their so-called “feminine” style of management.

For woman entrepreneur the nature of business is also a very crucial factor. In this particular case where women successors have to manage a transporter business, they have different challenges and conflicts. Transportation field is considered to be a male dominated business and not fit for women. There are many problems that women may undergo in such situations:-

- People around them consider that the “little girl” (in their eyes a girl never grows up in business) doesn’t know much and that she cannot substitute a male (in a rather male driven chauvinistic society)

- The disliking of elderly and older employees, ego problem of gender, etc.

- Decision-making is viewed from emotional perspective and that’s what girls are primarily woven around.

- Women entrepreneurs cannot be a lead marketer. It is one of the core problems, as males and even women with adequate experience fail to make a dent in this area.

- Family Conflicts: Women undergo role conflicts both as a homemaker and as a member in the business, incase of engagement with the family business. They spend long hours in business and as a result, they find it difficult to meet the demands of their family members and society as well.

5. Discuss the significance of corporate governance in mitigating conflicts during transition in CHFB.

The nature of ownership structure in family firm differs in several important ways from the widely held companies. According to Ward (2001), the main differences are: family business owners are less in numbers and identifiable; apart from business they have lifelong, interpersonal relationship and apply a long-term view of their actions. Secondly, besides purely economic goals, ownership has non-economic meanings. Thirdly, the ownership position cannot be easily left, both financially and emotionally.

Thus, Gompers et al. (2003), have defined corporate governance (CG), as a combination of relationships among all stakeholders, which comprises of a company’s management, its board and its shareholders to improve organizational efficiency and market competitiveness. Principally, corporate governance is about protecting the concerns of a company’s stakeholders, and ensuring that all their interests are balanced. Therefore, in case of family businesses, to offer a better transparency to the principal stakeholders, corporate governance should be accomplished through main elements of CG, such as board supervision, auditing process and financial disclosure as well as institutional and societal arrangements.

The family aspect is what differentiates family businesses from their counterpart non-family businesses. As a consequence, the family plays a crucial role in the governance of these businesses. When the family is still at its initial founder(s) stage, very few family governance issues may be apparent as most decisions are taken by the founder(s) and the family voice will be still unified. Over time, as the family goes through the next stages of its lifecycle, newer generations and more members join the family business. This implies different ideas and opinions on how the business should be run and how its strategies are set. It becomes mandatory, then a clear family governance structure that will bring discipline among family members, preventing potential conflicts and ensuring continuity of the family’s business.

Sarbah and Xiao (2015) have defined that a well-functioning family governance structure should mainly focus on:

i. Communicating the family values, mission, and long term vision to all family members.

ii. Keeping family members (especially those who are not involved in the business) informed about major business accomplishments, challenges, and strategic directions.

iii. Communicating the rules and decisions that might affect family members’ employment, dividends, and other benefits they usually get from the business.

iv. Establishing formal communication channels that allow family members to share their ideas, aspirations and issues.

v. Allowing the family to come together and make any necessary decisions.

Developing such a governance structure will help build trust among family members (especially between those inside and outside of the business), and thus unify the family thereby increasing the viability of the family business.

As the family business grows, the relationship amongst the owners, managers and employees becomes more complex. To manage such complexities, it is required to have a good corporate governance system in place. Gulzar and Wang (2010) have stated that increasing growth and globalization shall bring many challenges for family businesses. Most of these challenges can be tackled by adopting sound corporate governance structures. Gatamah (2008) emphasizes upon the corporate governance, which creates a solid organizational structure that clarifies roles, reporting lines and delegation of responsibility. It also draws the line between ownership and management and separates policy direction from the day-to-day operations of the company.

A good governance structure helps in resolving conflicts within the family, thereby permitting the family members to concentrate on other crucial issues concerned with the business. This would invariably lead to a transparent decision-making system and procedures ensuring fairness, which is desired to mitigate conflicts and thereby nurturing the goodwill of the family firm.

6. After analyzing case, discuss the current scenario, transition dilemmas and the way out.

There are transition dilemmas for the founder. Pillai, who has two daughters and that one-day one of them, would be a successor. However, the biggest challenge being, both likely to be heirs as females. In a male driven chauvinistic society will the females get an edge to lead, as choices are limited? Who would take over? Will there be a partition/division in ownership? What when one or both get married and moves out? What would be the involvement of their respective spouses? Several unanswered questions have started striking in his mind. This is where the toughest part of family business is, when the successors are women. Indian society confines the roles and capability of women in general. Accepting a woman running a family transport business was never going to be easy when the successor is not certain and clear, then transition of business, wealth and ownership from one generation to other become highly complicated and complex.

Pillai may define the degree of control and stake of both daughters through a legal written document either in the form will or through well-defined corporate governance structure with clear stake holding and well defined role and responsibility, degree of control. This may be late but the quickest way out. In this way, Pillai may mitigate the anticipated conflict marginally as well as can hedge the risk of splitting of his established family business.

- Who will run business? Family member or outside management?