1. Introduction

The financial and economic crisis of the last times has challenged businesses the world over. During this period, many firms experienced declining performance; some have survived while others failed, but all of them have had to react to environmental adversity (Mellahi & Wilkinson, 2004; Williams et al., 2017). There is a long-established tradition of turnaround literature in the organizational field (Hambrick & D’Aveni, 1988; Pearce & Robbins, 1993; Robbins & Pearce, 1992; Trahms et al., 2013) and this research question is now gaining importance in the organizational literature (Josefy et al., 2017; Suárez & Utterback, 1995).

This context is especially relevant for investigating the potential differences in behavior between family and non-family businesses (Alonso-Dos-Santos & Llanos-Contreras, 2019; King et al., 2022). If there is something that identifies and personalizes family businesses of those that are not, it is the existence of a kind of complementary to economic wealth: socio-emotional wealth (socioemotional wealth or SEW) (Gómez-Mejía et al., 2007; Gómez-Mejía & Herrero, 2023; Swab et al., 2020). This is mainly due to the existence of a corporate structure in which the separation between family and company is often confused. The emotional level of bonding of family owners with respect to non-family owners differentiates so much that it becomes a hallmark of this type of business with respect to the rest (Laffranchini et al., 2020, 2022). SEW can be understood as the set of non-financial benefits linked especially to the emotional well-being of family business members, and that conditions both their behavior and the company’s decision-making based on different objectives—economic and non-economic (Belling et al., 2022; Gómez-Mejía et al., 2007)— that demonstrate their distinct time orientation, showing that family businesses have a greater long-term orientation (Lumpkin & Brigham, 2011; Lumpkin et al., 2010), and alternative governance systems (a relationship of agency rather than stewardship between the agent and principals).

However, we still know little about how family businesses react to survive long-term through periods of crisis, that is, how family businesses react to declining performance, turnaround strategy (Cater & Schwab, 2008), failure (Revilla et al., 2016) and exit (DeTienne & Chirico, 2013; King et al., 2022; Kotlar et al., 2014). We know that family businesses try to preserve their SEW, avoiding exit by lowering their performance threshold (DeTienne & Chirico, 2013). Casillas et al. (2019) have shown that family businesses are able to take radical retrenchment strategies in the face of declining performance, particularly when their survival is threatened. Nevertheless, while decline, retrenchment and recovery are essentially process concepts, most papers have adopted a cross-sectional perspective, with a few exceptions (Revilla et al., 2016). Recent authors have been keen to adopt a dynamic perspective for turnaround strategy research (Barbero et al., 2017, 2020; King et al., 2022).

We know how underperforming family firms react in order to improve their outcomes, but we still do not fully understand the pacing of their behavior during these processes (Agustí et al., 2021; Laffranchini et al., 2022). We believe that this knowledge can help to understand the impact of the family character on strategic decisions taken by a family business and especially from the perspective of the SEW (Belling et al., 2022; Hernández-Linares et al., 2019; Laffranchini et al., 2020). We therefore propose the following research question: What is the probability of a quick response from family businesses to a decrease in financial performance? A decline has two final consequences: The first has a “sad ending”, that is, the firm does not recover and ultimately ceases its commercial activities and exits (closure); while the second represents the “happy ending”, where the firm is able to restore its financial performance to its former level, prior to decline (recovery). We want to know what is the difference between the two processes (King et al., 2022).

The purpose of this paper is twofold. Firstly, we want to identify the differences between family and non-family businesses in relation to closure speed and recovery speed, and secondly, we seek to understand the role of two contingent factors that may influence the relationship described: firm age and firm size. The consideration of ‘time’ as a variable introduces a factor usually forgotten in the literature, but of great importance when it comes to understanding the success or failure of restructuring strategies. Faced with declining results, it is not only important to make the right decisions, but also the speed with which these decisions are put into action (Barbero et al., 2020). Likewise, the work contributes to the literature on the heterogeneity of family businesses, identifying differences based on size (Schmitt & Raisch, 2013; Sciascia et al., 2012) and age (DeTienne & Chirico, 2013; Moreno-Menéndez & Casillas, 2021) of family businesses in relation to the Effects of speed on the final outcome—success/failure—of restructuring decisions.

The next pages of the paper are structured as follows. In the following section (section 2), the theoretical background is presented, followed by section 3, that includes the hypotheses development. Section 4 describes the empirical methodology, detailing the sample selection, measures of the variables used in the empirical research, and the statistical techniques used. The main results are presented in section 5, followed by a discussion and conclusion in the final section of the paper (section 6).

2. Background

2.1. Decline and turnaround strategy

The business environment has undergone radical changes in recent decades in terms of technological and social upheaval, market globalization and so on. Those changes have generated opportunities for some companies, but proved a dramatic challenge to the survival of many firms all around the world. As a result, the study of firm decline is gaining significance. Firm decline is a process that occurs when the performance of an organization deteriorates or when its resources become eroded over a period of time (Hambrick & D’Aveni, 1988; Weitzel & Jonsson, 1989). Previous literature differentiates between the internal and external causes of a firm’s decline (Argenti, 1976; Cameron et al., 1988). In a period of decling performance, a business will usually take decisions to reverse the situation, developing so-called turnaround strategies (Pearce & Robbins, 1993; Robbins & Pearce, 1992) to recover performance, which involve taking a number of actions in response to a situation of decline.

The prior literature identifies two main phases in a turnaround strategy (Pearce & Robbins, 1993, 1994a, 1994b): (1) the retrenchment phase; and (2) the recovery phase. The first stage involves the adoption of measures oriented to the control of cash-flow by reducing operational expenditure and divestment processes (Hambrick & Schecter, 1983; Robbins & Pearce, 1992), in tandem with decisions to replace members of the corporate governance bodies (CEO, board of directors, TMT). The recovery phase requires a reorientation of the firm to enable a new phase of improved long-term performance. During this stage the firm adjusts its area of operations to align itself better to the environment. The actions carried out during this stage are strategic in nature (Trahms et al., 2013) because the company’s aim is to reposition itself in order to grow and recover profitability (Barker & Duhaime, 1997; Schmitt & Raisch, 2013).

However, some authors argue that both of these measures —retrenchment and recovery— are not always necessary (Barker & Mone, 1994), or that they can be implemented simultaneously (Schmitt & Raisch, 2013). Within this area of research, a new stream is investigating the role of “time” in the turnaround strategy, given that (a) it is a process in itself, and (b) timing is important because the point at which the turnaround develops, and its pacing will affect the final outcome (Arogyaswamy et al., 1995; Hambrick, 1985; Slatter, 1984). For example, Arogyaswamy et al. (1995) posit that timing and speed are important during retrenchment —the initial stage of a turnaround— and will affect the firm’s survival.

2.2. Family firms and turnaround strategy

Turnaround strategy is of particular interest in the case of family business (Gimeno et al., 1997; Hernández-Linares & Arias-Abelaira, 2022; Revilla et al., 2016), where decision-making processes are influenced by SEW (Gómez-Mejía et al., 2007; Laffranchini et al., 2020; Swab et al., 2020). Berrone et al. (2012) define SEW as the stock of affect-related value that a family derives from its controlling position in a company, in accordance with Gómez-Mejía et al. (2007) who define SEW as the non-financial aspects of the firm that meet the family’s affective needs, including family-business overlap, identity, the capacity to exercise family influence, perpetuation of the family dynasty, etc. (p. 106). The SEW perspective assumes that family businesses view the avoidance of potential loss as a priority, accepting a lower performance threshold than non-family businesses, and argues that these companies are able to survive at lower performance levels than non-family companies (DeTienne & Chirico, 2013; Gimeno et al., 1997).

Family businesses interpret declining performance in a different way to non-family businesses (Belling et al., 2022; Laffranchini et al., 2020). Firstly, family involvement on boards and the potential role of a family member as CEO is based on a stewarding relationship that exists between directors and shareholders, rather than an agency relationship (Gómez-Mejía et al., 2001). The stewardship role of family directors involves the responsibility to assure the long-term continuity of the firm, above any higher short-term performance (Lumpkin & Brigham, 2011). This role, however, has a contradictory effect on how family businesses react to declining performance. On one hand, this may be down to the family directors’ misperception of their own decisions, where they assume that the causes of declining outcomes are mainly external (Shepherd & Haynie, 2011), and there is a reluctance to take difficult decisions that may damage the internal and external social capital of the family business (Miller et al., 2008). On the other hand, family involvement allows family-run companies to take quicker and more intensive decisions to cut expenditure and implement other retrenchment measures over a short period of time (Kammerlander, 2016; Zellweger et al., 2012). This is due to the highly centralized structure of family-managed businesses, compared to the more formalized management structure of non-family companies that are in evidence (Nordqvist & Melin, 2010), particularly when survival is threatened (Casillas et al., 2019).

3. Hypotheses Development

3.1. Closure speed and family business

One of the main differences between family and non-family businesses is the priority of long-term survival over short-term performance (King et al., 2022; Revilla et al., 2016). Family firms demonstrate a long-term orientation (Lumpkin & Brigham, 2011; Lumpkin et al., 2010) in their desire to develop and nurture a legacy to pass on to subsequent generations (Zellweger & Astrachan, 2008; DeTienne & Chirico, 2013). Exit is the last option for a family business, even in a period of poor performance. Threshold theory suggests that exit strategy depends on a certain level for the economic and organizational threshold of performance; “the level of performance below which the dominant organizational constituents will act to dissolve the organization” (Gimeno et al., 1997, p. 750). DeTienne and Chirico (2013) argue that a higher level of SEW drives down the performance threshold in family businesses.

Family businesses tend not to leave a business in difficult economic times (decline), not only because it is necessarily a “good business”, but because there is a controlling family that is willing to make personal sacrifices (Haynes et al., 1999). This argument supports one of the dimensions of the SEW model, specifically the one that refers to the family identification of its members with the Company, to the point that it is sometimes difficult to separate the identity of both (Laffranchini et al., 2020; Micelotta & Raynard, 2011).

Chirico et al. (2018) identify a series of factors in family businesses that help to understand the strengthening of family commitment and that in the case of family businesses with low profitability supposes a drag to carry out change. From this it can be deduced that factors such as emotional property, the sense of responsibility, investment in capital, the time since the founder created the business, and individualism / collectivism will not prevent a business closure (since they do not facilitate the taking of decisions to reverse the situation) and will only delay it. This argument has also recently been reinforced by Revilla et al. (2016), who identify a lower ratio of failure among family businesses due to the higher level of SEW and financial costs for family members when they are involved in the firm’s management or serve on the board of directors. These results are consistent with previous research that demonstrates a higher resilience among family businesses (Acquaah et al., 2011; Brewton et al., 2010; Schulze & Bövers, 2022). From the process perspective, family businesses try to avoid failure, not only by taking retrenchment decisions but also by taking measures such as delaying dividend distribution or lowering family members’ wages in order to ensure survival.

Other researchers state that generally in the case of family businesses with a business portfolio and when it is time to part with it (sell or liquidate), they prefer to “turn it off” (leave them on stand-by, without selling the assets and prepared for a possible activation later) to be sold to a third party in spite of the succulent income that this sale could generate that could be destined to other destinations. They claim that from the perspective of SEW, family businesses do not prioritize profit maximization. Therefore, the “off” instead of the sale of satellite companies in a situation of deterioration in performance may be conditioned by identity issues that impact them on greater emotional benefits. Therefore, these measures could be interpreted as a slowdown of a possible final closure of some lines of the family business. We argue that family businesses delay potential failure and closure for as long as possible. We therefore expect that, at times of declining performance, family businesses take longer to close than non-family firms, and we propose the following hypothesis:

Hypothesis 1. The probability that family businesses in decline close earlier is lower than in the case of non-family businesses.

Family businesses do not constitute a homogeneous population. Several characteristics influence how family firms behave in relation to strategic decisions, such as firm age and firm size. Firm age is associated with the generational level, and the existing literature offers contradictory views. On one hand several authors argue that SEW decreases as the family business ages. For example, Ensley and Pearson (2005) state that greater dispersion between family members, typical of multi-generational firms, would further dilute “the strong central beliefs and ties of a more closely knit social group” (p. 269). Corbetta and Salvato (2012) refer to “generational drift”; the gradual evaporation of the family owners’ emotional attachment to the business across generations (DeTienne & Chirico, 2013). These ideas, together with the increased professionalization of multi-generational companies (Gersick et al., 1997), would increase the dilution of SEW across generations (Gómez-Mejía et al., 2007), reducing the socio-emotional barriers to pursuing potential exit strategies when older companies are faced with declining performance (DeTienne & Chirico, 2013; Doughty & Hill, 2000).

On the other hand, different research argues that older firms value their accumulated legacy (Burton & Beckman, 2007; Miller & Le Breton-Miller, 2005), which has developed over time. In older, multi-generational family firms, family leaders perceive themselves as a bridge or link between generations. As in a relay race, their mission is to pass on an improved legacy from their predecessor to their successors. History and culture become an intangible asset of the family firm that may strengthen as the firm ages (Price et al., 2000). Similarly, as firm age rises, social capital and intangible resources also tend to be more developed than in younger firms. For example, long-established family firms benefit from a higher family reputation and social image (Deephouse & Jaskiewicz, 2013; Miller et al., 2008).

Social capital also needs time to develop in family businesses (Arregle et al., 2007). We argue that older, multi-generational family businesses have a greater incentive not to close than younger, non-family enterprises. Despite arguments to the contrary, entrepreneurial non-family businesses have developed fewer internal and external links with stakeholders (partners, employees, customers, owners, and so on) and have not yet generated a robust culture and legacy. Conversely, older family businesses have not only established social capital, reputation, and other intangible assets that make it worthwhile avoiding a potential exit, but have also engendered specifically family-related motivations that endure over time, maintaining the legacy that will be passed on to the next generation, preserving SEW (Arregle et al., 2007; Gómez-Mejía et al., 2007; Miller et al., 2008). For this reason we propose the following hypothesis:

Hypothesis 1a. The age of the company will have a negative effect on the probability of early closing of the company (time between decline and exit).

Different arguments can accelerate or delay the potential closure of family businesses experiencing a decline in performance. Firm size is highly correlated to the availability of resources and capabilities. Smaller businesses suffer from a lack of resources, which can have dramatic consequences for both family and non-family businesses when performance is declining (Mellahi & Wilkinson, 2004; Thornhill & Amit, 2003), due to their “liability of smallness” (Aldrich & Auster, 1986; Stinchcombe, 1965) —their limited access to resources such as specific knowledge, human capital, networks, customer relationships, and financing (DeTienne, 2010). The lack of resources experienced by small firms tends to be higher among family SMEs. Prior research underlines this lack of resources in family firms (Sciascia et al., 2012), mainly in relation to financial and managerial resources (Graves & Shan, 2014), assuming that family firms have less access to the best human and managerial capabilities (Barbero et al., 2012) and that there is an unwillingness to accept non-family expertise.

Prior research has also demonstrated that smaller firms show less ability to implement changes (Schmitt & Raisch, 2013). Consequently, they are less able to develop turnaround strategies that make it possible to reverse negative performance and avoid failure and exit. We argue that the greater availability of resources and capabilities enjoyed by larger family businesses provides a buffer, enabling them to undertake retrenchment and recovery measures in an attempt to reverse declining performance, extending the time until failure (lower closure speed), when the firm finally ends with closure. If, despite the measures taken, the company fails to reverse the situation, it will be subject to bankruptcy and closure. Often some large companies postpone the closure of the company (from the declining performance) through the reduction of activity; other companies try to generate cash through the sale of the acquired assets while other entities try to get out of lines with reduced profit margin and liquidating profitable pore strategic units (Miller & Friesen, 1984). For this reason, we propose the following hypothesis:

Hypothesis 1b. The size of the company will have a negative effect on the probability of early closing of the company (time between decline and exit).

3.2. Recovery speed and family business

Our previous hypotheses refer to a “sad ending” for declining firms; we hypothesize about the timing of a firm’s closure from a situation of declining performance. However, not all businesses in decline are destined for closure or bankruptcy. Thanks to turnaround strategies, many firms are able to reverse the fall in their outcomes, to survive and regain a positive financial performance. For that reason, we now hypothesize about the recovery speed, rather than the closure speed, in other words, the “happy ending” scenario.

In this case, we propose five main reasons for a family business’ ability to recover sooner than a non-family business. Firstly, SEW implies that the declining performance stage has more severe consequences for the family controlling the business than for non-family shareholders, directors or managers in non-family companies. As stated above, declining performance erodes the firm’s reputation (Deephouse & Jaskiewicz, 2013) and has a negative impact on its social connections with external agents (partners, customers, suppliers, etc.) and internal stakeholders (shareholders, employees, etc.). In family-controlled companies (Miller et al., 2008), the negative consequence of poor performance is transferred to the family, also damaging the family system, relations between family members, and the family’s reputation. Secondly, directors and managers who are members of the controlling family suffer higher exit costs than non-family ones. Family members adopting the role of stewards have a greater involvement in running the company, as they are responsible for driving the firm’s recovery and survival (Alonso-Dos-Santos & Llanos-Contreras, 2019; Eddleston et al., 2012). Every day that passes with negative outcomes erodes the stewardship role and trust of family shareholders in a family member who is active in the firm’s management. Thirdly, due to the higher exit costs for family leaders, they will be the first to show an interest in taking retrenchment and recovery measures to reverse a situation of poor performance (Laffranchini et al., 2022). In fourth place, the managerial structure and style of family business make it easier to implement a turnaround strategy, thanks to the more centralized, informal structure and clearer family leadership (Hernández-Linares & Arias-Abelaira, 2022; Nordqvist & Melin, 2010). All of this leads us to hypothesize:

Hypothesis 2. The probability that declining family businesses will recover earlier is greater than with respect to non-family businesses

As with closure speed, we expect that firm age will also affect the probability of a rapid or late recovery of family businesses. Family leaders of multi-generational family firms, which usually have a more dispersed ownership structure, experience greater demands from passive family members to solve the negative situation and recover the firm’s performance, profitability, and potential dividends (Lansberg, 1999; Schulze et al., 2001). However, these demands may negatively affect the stewarding relationship of the family members involved in the business and the passive family members, leading to potential conflicts. The more complex ownership structure of older, multi-generational firms may create further problems if they adopt rapid turnaround measures in order to protect SEW, especially when this is linked to their external and internal social capital (Miller et al., 2008). Older family firms accumulate and protect the history on which the family’s business reputation, culture and values are built (Astrachan et al., 2002), meaning that they avoid less popular retrenchment measures, which delays recovery.

Faced with a situation of decline, where measures are being proposed to get out of it, they may have a marked conservative character or, on the contrary, risky. The riskiest strategies (Sutton & D´Aunno, 1989) can help the recovery of the company (along with the most prudent) through measures such as innovation and structural modernization. Zahra (2005) indicates that those older family businesses have a lower level of innovation compared to younger ones, which can delay the recovery of the company. Also, this author indicates that the introduction into new markets and the creation of new business lines can be slowed by the permanence in the business of old managers who are characterized with a more prudent sense and less prone to take risks. For all these reasons, we propose that age has a different effect when we are facing a closure or a recovery. While the age of the company provides a cushion of resources that allows it to endure poor results longer (closing later), it also implies a wide set of routines that prevent it from adopting rapid changes, thus delaying a possible recovery. As a consequence, we propose the following hypothesis:

Hypothesis 2a. The age of the company will have a negative effect on the probability of an early recovery of the company (time between decline and recovery).

Finally, we expect that firm size has a moderation effect on the relationship between the family nature of a business and recovery speed at a time of declining performance. Small family business are entities with a great capacity to adapt to the surrounding environment, especially when large and sudden changes occur. However, although a priori can be a great advantage in declining scenarios, small family businesses frequently due to lack of resources and qualified personnel do not anticipate these environments with the consequent damage it generates (Alonso-Dos-Santos & Llanos-Contreras, 2019). Therefore, access to resources available to larger companies may allow a faster decrease in a decline (Agustí et al., 2021).

As mentioned above, firm size is linked to the firm’s available stock of resources and capabilities (Penrose, 1959). As Josefy et al. (2017, p. 779) state, firm size has emerged as one of the strongest antecedents of survival outcomes. In the case of family business, their stock is combined with family-related resources (Sirmon & Hitt, 2003) that make it possible to hire external, professional and non-family managers and directors, improving human and social capital, as well as other, such as financial, resources (Agustí et al., 2021; Brewton et al., 2010). Larger family firms will be able to take quick turnaround decisions, mobilizing a wider set of resources and capabilities in order to achieve rapid performance recovery. In light of these arguments, our final hypothesis is the following:

Hypothesis 2b. The size of the company will have a positive effect on the probability of early recovery of the family company (time between decline and recovery).

4. Methodology

4.1. Sample

This research is based on a sample of declining family and non-family small and medium-sized enterprises in Spain during the period 2006-2016. We collected the information from the SABI database (Iberian Balance-Sheet Analysis System; Bureau van Dijk, 2015), which includes economic, financial and demographic information of nearly all Spanish companies (rather than individuals) that are legally obliged to file their annual reports with the Mercantile Registry Offices (more than 1 million firms). In order to reduce business heterogeneity, we focused on small and medium-sized firms (SMEs), defined as non-listed private firms with fewer than 250 employees (Naldi et al., 2007; Stockmans et al., 2010) because SMEs are the most common type in family businesses in Spain. We also excluded firms that had been founded up to and including the 10 years prior to the study period, to exclude entrepreneurial ventures. We consider consolidated companies with some experience in the market to assess how the SEW affects the company’s behavior in the face of a decline.

The study only considers firms in decline. Turnaround literature tends to consider a company to be in decline when it meets two conditions (Ndofor et al., 2013): (1) the company experiences a drop in operational profitability (typically ROA, or a similar measure) over two consecutive years (Barbero et al., 2017; Trahms et al., 2013); and (2) a negative ROA in the second year of decline (Barker & Duhaime, 1997). We obtained information from 2006 to 2016. The year 2008 is considered to be when the economic crisis began (finishing in 2014), and 2016 was the last year with available information for the firms’ financial statements. Within this eleven-year period, we identified a total of 213,301 observations (firm-year) relating to declining SMEs.

4.2. Statistical methodology

Our research requires a longitudinal perspective, since the data can be described as survival data. We used the Cox proportional hazards model to test the hypotheses. This method is suitable for measuring the speed of a variable, having been applied in different contexts relating to ‘speed measurement’: the speed of an international response between competing firms (Yu & Cannella, 2007); the speed of the internationalization process (Casillas & Moreno-Menéndez, 2014; Fuenteslaz et al., 2002; Nachum & Song, 2011); and so on. The Cox proportional hazards model has some advantages over conventional regression models, such as its capacity to include events at different moments in time; data normality does not have to be assumed; and its suitability for data with a temporal bias. This method attempts to explain the probability that an event (failure/recovery) will occur as a function of a set of explanatory variables through the following expression:

h(t) = h0(t) exp (β1x1 + β 2x2 + … + βkxk)

where, h0(t) is the baseline hazard function, and β are the regression parameters. The model is estimated through the maximization of the partial likelihood function (Cox, 1975). In this case the model fixes the focal year as the year in which the firm suffers a decline in its performance. From that year, the Cox model estimates the probability of firm failure or recovery in the following years. We estimated the Cox proportional hazard model with multiple-record data and multiple events, to reduce problems of endogeneity.

4.3. Variables

4.3.1. Dependent variables

We have used two different dependent variables to investigate the two sets of hypotheses. The first is closure speed. This is measured as the time that elapses between the year of decline and the year of failure (cessation its regular activity). The cessation of the activity may be the consequence of a business bankruptcy, when the strategies adopted have not taken effect. Failure includes different situations, such as bankruptcy, closure, and so on, that indicate that the firm has ceased its regular activity. The probability of closing speed is measured by the time that elapses since it enters decline and its activity ceases. Each year it is assigned a value: 0 if it survives and 1 if its activity ceases. The second dependent variable is recovery speed. This variable has been measured as the difference between the year of recovery and the year of decline. We consider, following Dawley, Hoffman, and Lamont (2002) and Barker and Duhaime (1997), that firm recovery occurs when the business is able to reach, as a minimum, the same positive ROA as in the year prior to the process of decline. As in the previous variable, given the methodology used, we have employed a dummy variable for each firm-year, assigning the value 1 if the firm recovers and 0 if it does not.

4.3.2. Independent and moderator variables

Family nature: Due to the diversity of family business definitions and in order to categorize a company as a family business or non-family business, we followed the methodology developed by Casillas et al. (2015) which is similar to that used in prior investigations (Franks et al., 2012; Pindado & Requejo, 2015).

This classification is based on the ownership structure and family members’ participation on the board of directors. Specifically, we differentiate between (a) firms with a concentrated ownership structure (a shareholder controls more than 50.01% of the ownership), where a family company is considered to be one in which family shareholders have a high controlling ownership (50.01%) or where shareholder-directors’ holding is above 50.01%; and (b) firms with a dispersed ownership structure (no shareholder controls more than 50.01%), when a family company is considered to be one in which an individual has a shareholding of 5% or a family has a shareholding of 20%. In this case, we require family-owners to show a direct involvement on the board in order for it to be considered as a family firm.

Two further moderator variables have been included in our estimations: Firm age has been measured by the logarithm of the year previous to growth (Log Age i), previously standardized to be included as a moderator variable; and Firm size, measured as the logarithm of the number of employees in each year, previously standardized for its moderation effect (Log Size i).

The reason for choosing these two moderating variables is due to their impact on strategic decision making in family businesses. The age and size of the family business are two of the variables that have the most impact on turnaround strategies in the face of a decline in business performance. The age of the company influences the accumulated experience to face a decline, in the adequate management of resources and capacities, flexibility and elasticity in the face of complicated situations and also in the evolution of the SEW over the years (internal relations, external, risk, generational transmission, etc.). On the other hand, size affects the availability and access to financial resources, the professionalization of the company, the maintenance or reduction of the number of workers, the taking of risky or conservative decisions and ultimately the maintenance of the SEW.

4.3.3. Control variables

Our models include five additional variables. The first is the Legal form of the companies, differentiating between the two main types of societies in Spain: (a) public limited company; and (b) private limited company, measured through a dummy variable (value 0 for Ltd). The legal form influences ownership structure and how owners are connected, which may potentially affect exit decisions (Harhoff et al., 1998), and is the primary reference point for performance (Kotlar et al., 2014). We also consider four financial variables as controls, given their potential influence on turnaround strategies: (1) ROAi as a measure of performance for each year; (2) ∆ROAi, as the difference between ROAi and ROAi-1, in order to consider performance in two consecutive years: it is positive if the firm is improving its outcomes, and negative if these are dropping; (3) Leverage, taken to be the ratio of long-term debt to total assets (Lim et al., 2013); and (4) Cash flow, in logarithmic form (Pearce & Robbins, 1993), as an indicator of financial liquidity. Finally, we have included three industry dummy variables, differentiating between manufacturing (the reference sector), trade, and building and service sectors.

5. Results

As we indicate in the methodology section, the data refers to declining businesses over an eleven-year period (2006-2016). The complete sample includes 23,331 firms ¾63.34 per cent of which are family-businesses (14,778 firms) and 36.66 per cent are non-family businesses (8,553 firms). Table 1 sets out the descriptive statistics and correlation matrix. The average number of employees is 60, with family firms being smaller than non-family firms (34 versus 104 employees). Firm age is similar in both groups of firms (22.3 years for family business and 23.6 years for non-family businesses). Table 1 also shows the zero-order correlations between the variables in the models. All correlations are below 0.3, with all variable inflation factors below the threshold of 5 (max VIF = 3.401). Although all firms in the sample experienced a decline in their performance, with two consecutive decreases in ROA and a negative ROA in the second year at least, only 2,753 cases ended in bankruptcy or a similar state of closure; and 9,157 cases were able to recover, regaining higher levels of ROA than in the year prior to the initial decrease that drove the company into decline.

Table 1. Descriptives and correlation matrix

Table 2 sets out the results of the models relating to hypothesis 1. These models use the Cox proportional hazard models to consider the probability of failure, that is, the probability that the closure is slower or faster. Hazard ratios (odd ratios) represent the proportional change in the hazard rate for a one-unit increase in the independent variable. Model 1a is the baseline model, including only the control variables, taking firm age and size as controls. Model 1b adds family business as a direct effect. Models 1c and 1d include the separate moderation effects of firm age and firm size, while Model 1e shows the two moderations jointly. Model 1a shows the probability of a quick closing of the company when firm age is lower and when firm size is higher1. Model 1b shows a positive coefficient of the family nature of firms explaining closure speed. That is, we find that family firms close sooner than non-family ones. When the moderation effects of firm age and firm size are included separately, the results in Models 1c and 1d show a negative coefficient for firm age moderation and a positive one for the moderating influence of firm size. Finally, Model 1e includes all variables simultaneously: the control, independent and moderation variables. The log-likelihood ratio tests show that the inclusion of all variables significantly improves the fit of the model. Model 1e therefore provides the most rigorous test of the hypothesized effects and offers the greatest explanatory power (Bowen & Wiersema, 2004). To summarize the results, Model 1e shows that (1) the probability that declining family businesses close earlier is higher than those that are non-family businesses (h.z.=1.592; p<0.001); (2) The age of the company will have a negative effect on the probability of early closing of the company (h.z.=0.812; p<0.010); and (3) the size of the company will have a positive effect on the probability of early closing of the company (h.z.=1.395; p<0.001).

Table 3 summarizes the results relating to hypothesis 2, where the Cox proportional hazard models estimate the probability of recovery, and consequently the dependent variable represents recovery speed, that is, the probability that recovery is slower or faster. Model 2a, as the baseline model, shows the direct effect of firm age and firm size, showing that a high age slows down the speed of quick recovery. The effect of firm size is less clear, with a hazard ratio slightly over 1, showing a positive relationship between firm size and quick recovery. Model 2b suggests a non-significant influence of the family nature of firms on recovery speed. Models 2c and 2d demonstrate that the hazard ratios of the individual moderation effects of firm age and firm size are around 1, or slightly below in the case of firm age, and above this threshold for firm size. Finally, Model 2e integrates all of the effects, showing the lower log-likelihood ratio tests and the best explanatory power. A summary of the results of Model 2e show that (1) the family nature of firms has no significant influence on recovery speed; however (2) firm age and its family nature exert a negative interaction effect, in such a way that older family firms experience a probability slower recovery speed (h.z.=0.938; p<0.05); and (3) there is a positive interaction effect of firm size and its family nature (h.z.=1.077; p<0.01).

Table 2. Cox-proportional hazard model. Failure = Closure

|

Model 1a

|

Model 1b

|

Model 1c

|

Model 1d

|

Model 1e

|

|

Firm age

|

0.445***

(0.029)

|

0.421***

(0.028)

|

0.510***

(0.055)

|

0.420***

(0.028)

|

0.551***

(0.061)

|

|

Firm size

|

1.045*

(0.023)

|

1.117***

(0.027)

|

1.114***

(0.027)

|

0.938*

(0.035)

|

0.924*

(0.035)

|

|

Family

|

|

1.644***

(0.086)

|

1.672***

(0.089)

|

1.559***

(0.078)

|

1.592***

(0.080)

|

|

Age x Fam

|

|

|

0.866*

(0.055)

|

|

0.812**

(0.053)

|

|

Size x Fam

|

|

|

|

1.365***

(0.063)

|

1.395***

(0.065)

|

|

Legal form

|

0.970

(0.049)

|

0.907†

(0.047)

|

0.903†

(0.047)

|

0.912†

(0.047)

|

0.907†

(0.047)

|

|

ROA

|

0.993***

(0.000)

|

0.993***

(0.000)

|

0.993***

(0.000)

|

0.992***

(0.001)

|

0.992***

(0.001)

|

|

∆Roa

|

0.999**

(0.000)

|

0.999**

(0.000)

|

0.999**

(0.000)

|

0.999**

(0.000)

|

0.999**

(0.000)

|

|

Liquidity

|

1.000

(0.000)

|

1.000

(0.000)

|

1.000

(0.000)

|

1.000

(0.000)

|

1.000

(0.000)

|

|

Leverage

|

0.999

(0.001)

|

0.999

(0.001)

|

0.999

(0.001)

|

0.999

(0.001)

|

0.999

(0.001)

|

|

Observations

|

67,843

|

67,843

|

67,843

|

67,843

|

67,843

|

|

Failures

|

2,119

|

2,119

|

2,119

|

2,119

|

2,119

|

|

Wald chi2

|

287,28***

|

330,19***

|

365,41***

|

397,85***

|

445,84***

|

|

Log-likelihood

|

-23,089

|

-23,030

|

-23,036

|

-23,019

|

-23,014

|

† p< 0.1; * p< 0.05; ** p< 0.01; *** p < 0.001

Table 3. Cox-proportional hazard model. Failure = Recovery

|

Model 1a

|

Model 1b

|

Model 1c

|

Model 1d

|

Model 1e

|

|

Firm age

|

0.588***

(0.020)

|

0.587***

(0.020)

|

0.620***

(0.030)

|

0.587***

(0.020)

|

0.629***

(0.031)

|

|

Firm size

|

1.085***

(0.130)

|

1.087***

(0.013)

|

1.086***

(0.014)

|

1.060***

(0.016)

|

1.056**

(0.017)

|

|

Family

|

|

1.017

(0.025)

|

1.029

(0.026)

|

1.007

(0.024)

|

1.023

(0.027)

|

|

Age x Fam

|

|

|

0.951†

(0.055)

|

|

0.938*

(0.030)

|

|

Size x Fam

|

|

|

|

1.069**

(0.025)

|

1.077**

(0.026)

|

|

FJ

|

0.770***

(0.020)

|

0.768***

(0.020)

|

0.766***

(0.020)

|

0.770***

(0.020)

|

0.767***

(0.020)

|

|

ROA

|

0.993***

(0.000)

|

0.993***

(0.000)

|

0.993***

(0.000)

|

0.993***

(0.000)

|

0.993***

(0.000)

|

|

∆Roa

|

0.999**

(0.000)

|

0.999**

(0.000)

|

0.999**

(0.000)

|

0.999**

(0.000)

|

0.999**

(0.000)

|

|

Liquidity

|

1.000

(0.000)

|

1.000

(0.000)

|

1.000

(0.000)

|

1.000

(0.000)

|

1.000

(0.000)

|

|

Leverage

|

0.999**

(0.001)

|

0.999**

(0.001)

|

0.999**

(0.001)

|

0.999**

(0.001)

|

0.999**

(0.001)

|

|

Observations

|

67,843

|

67,843

|

67,843

|

67,843

|

67,843

|

|

Failures

|

7,545

|

7,545

|

7,545

|

7,545

|

7,545

|

|

Wald chi2

|

432,18***

|

431,53***

|

365,09***

|

438,65***

|

440,65***

|

|

Log-likelihood

|

-81,665

|

-81,665

|

-81,664

|

-81,662

|

-81,660

|

† p< 0.1; * p< 0.05; ** p< 0.01; *** p < 0.001

6. Discussion and Conclusion

By adopting a longitudinal perspective, the present study seeks a clearer understanding of how fast family businesses react when faced with declining performance and in particular, when they finally are forced to exit or are able to regain their positive performance. The first hypotheses propose that family businesses try to avoid exit, delaying the decision for as long as possible, although this effect is contingent on firm age and size. With respect to hypothesis 1, the results show a significant but positive relation between the family nature of the firm and the probability of an early closure (cessation) of the activity, which is the opposite of what was proposed in hypothesis 1, and we therefore reject it. Our results suggest that declining family firms close sooner than non-family firms. Different arguments would point out that this is not the expected result. Firstly, the lower level of resources and capabilities of family firms would render them more fragile and weaker, forcing them to close earlier than their non-family counterparts. For example, small family businesses suffer from a lack of access to financial resources, and can only depend on family resources, which may be insufficient in a period of deteriorating performance and in the context of a financial crisis. Secondly, family firms would be able to diagnose the severity of the economic crisis and react faster than non-family businesses, reaching an agreement between family members that facilitates a quick exit and avoids greater loss of the family’s SEW. In a period of declining performance it may be possible for family relatives to agree to close more quickly than it would be for non-family partners. Finally, closure speed may be contingent on the type of family business, with regard to firm age and firm size, as we discuss in the following paragraph.

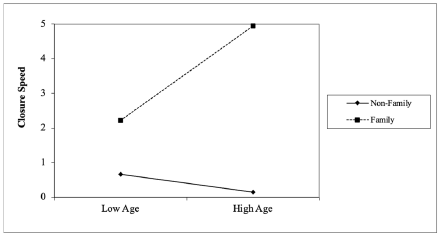

Hypothesis 1a proposes that older family businesses are more likely to close later than non-family businesses. Model 1e shows a significant negative interaction effect between the firm’s family nature and firm age (odd ratio below 1). In order to interpret these results, we have represented the moderation effect in Figure 1a, showing that as the family business gets older, the likelihood of an earlier closure is lower compared to non-family businesses.

This result supports hypothesis 1a. Hypothesis 1b proposes that larger family businesses will experience a probability of closing later with respect to non-family businesses. As we have mentioned above, Model 1e in Table 2 shows a significant and positive interaction effect of the firm’s family nature and size on closure speed. Figure 1b represents this effect, showing that in larger family firms the probability of closing will accelerate rather than decrease, as proposed in hypothesis 1b, and so we reject it. In this case, we find that while the probability of an early closure is lower as the company increases in size, the probability of an early closure of large family businesses is greater when there is a decline. A possible explanation of this unexpected result may be rooted in the more fluid relationship that exists between relatives than the relationship between non-related partners, which is tested when they have to take difficult decisions such as whether to exit. We propose that delaying the closure of a declining family business may undermine family SEW and family relationships. At the same time, the family’s embeddedness in the business may mean that the family is reluctant to sell the business, preferring instead to close it. This behavior may allow the family to save as much as possible and to start a new venture in a more benevolent future environment. Conversely, larger non-family firms may find it more difficult to close the business due to potential disagreements between the partners, and furthermore they have more options and less resistance to selling the business on to a third party.

Figure 1. Interaction effect. Cox-proportional hazard Model. Failure = Bankrupcy

a. Firm age

b. Firm size

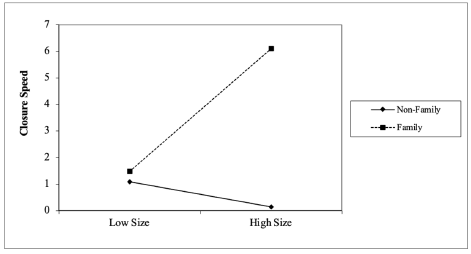

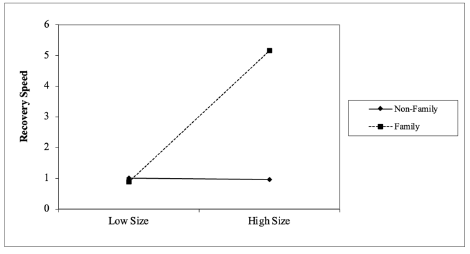

The second hypothesis proposes that family firms react faster than non-family firms in adopting turnaround measures and achieving recovery; a relationship that is moderated by firm age and firm size. Our results show there is no significant relationship between the family nature of companies and recovery speed, so we cannot support hypothesis 2. With regard to the effect of firm age, firstly we observe a negative effect of firm age on the probability of an early recovery. In relation to the interaction effect, our results show a significant and negative interaction influence on the probability of an early recovery, an effect that is represented in Figure 2a. We see that the probability of an early recovery is lower as companies get older, get older in non-family business in non-family businesses, which supports hypothesis 2a. Finally, Figure 2b represents the interaction effect of the family nature of the firm and firm size on recovery speed. As this figure shows, larger family businesses increase their probability of rapid recovery, while this acceleration is not observed in non-family businesses, as proposed in hypothesis 2b, and it is therefore supported.

Figure 2. Interaction effect. Cox-proportional hazard Model. Failure = Recovery

a. Firm age

b. Firm size

In summary, our findings show that, contrary to expectations, declining family firms will close their business sooner than non-family ones. We also find that firm age reduces the probability of early closure and firm size increases the probability of early closure, and this is more marked among family businesses than non-family ones. These findings show that exit is not always the last option for family businesses, which is likely to be because family members prioritize the preservation of the family’s SEW over financial business outcomes (DeTienne & Chirico, 2013). With regard to recovery speed, our findings are closer to the hypotheses proposed. Although we are unable to find a direct effect of the family nature of the firm on recovery speed, the results show that the probability of a speedy recovery is lower among older family businesses and higher in larger ones. These findings support the idea of the greater agility and speed of family firms when taking decisions (Casillas et al., 2019; Nordqvist & Melin, 2010). In summary, the results show that older companies seem to have more experience and resources that allow them to endure bad results for longer, although it also means dragging more inertia in decisions, thus also delaying the chances of recovery.

6.1. Theoretical implications

This research contributes to the family business literature in a number of ways. First, it refines our knowledge of the effect of SEW on business behavior (Davila et al., 2022; Gómez-Mejía et al., 2007), showing that exit is not always the last option for underperforming family firms (King et al., 2022). Our results show that declining family businesses close sooner than non-family businesses; this is most likely to be in order to rapidly protect the family’s SEW (Cennamo et al., 2012). However, this probability of early closure decreases as the age of the family firm rises, showing that firm age helps to generate greater family involvement with the company and reinforces the concept of the firm as a family legacy (Berrone et al., 2012). Secondly, our research underlines the greater agility of family businesses when adopting turnaround decisions (King et al., 2022). Our results show that family businesses are able to take decisions faster than non-family firms —particularly larger firms— which is likely to be due to their specific ownership and governance structure (Mellahi & Wilkinson, 2004), and their lower structural rigidity (MacMillan & Overall, 2017). Thirdly, by adopting a longitudinal perspective, this research shows the dynamic differences between family and non-family businesses. Prior research argues that family and non-family firms differ in their conception of “time” (Lumpkin & Brigham, 2011). Our research adds to this line of investigation, showing that the two types of firms react at different speeds when they face declining performance in the context of a global economic crisis.

6.2. Implications for practitioners

From an applied point of view, our work underscores the importance of making quick and flexible decisions in the face of uncertain and difficult environments. It is not only important for family businesses to make the right decisions in the face of declining results, but also to adopt them quickly. Likewise, our findings underline the role of resources when the company goes through bad results. Larger companies better withstand periods of crisis, which should call the attention of family businesses, generally less growth-oriented, with a very small average size. Finally, the results reveal the role of routines and organizational inertia in crisis and uncertainty environments and how it can slow down and even prevent the recovery of family and non-family businesses.

6.3. Limitations and future research

However, our research also has limitations, which point to future areas of research. First, our study only uses secondary data from Spanish firms. The available data does not allow us to directly measure relevant variables such as SEW, family involvement, or long-term orientation. Future research should make further advances by trying to obtain direct primary data or at least secondary information as proxies that measure some of these relevant variables. Second, our research was conducted within a specific time frame and country context. While we consider this context to be of particular relevance, given the deep economic crisis in Spain during the period analyzed, we recognize that it will be difficult to generalize our results in other economic and geographical environments. We therefore suggest a replication of the research to test the robustness of our results, using different samples in a variety of industry, geographical, and environmental contexts (Bettis et al., 2016). Third, apart from the considerations of size and age, we have taken family and non-family firms as homogeneous samples for our categories, while the prior literature has stressed the heterogeneity of family businesses (DeTienne & Chirico, 2013; Kotlar et al., 2014; Stockmans et al., 2010), and the need to consider the family nature of the firm more in terms of degrees rather than as a single category (Astrachan et al., 2002; Shanker & Astrachan, 1996). We believe that this study will open new avenues of research and improve our understanding of family business behavior; especifically when these businesses face financial difficulties. Finally, in this article, we do not consider mergers, acquisitions and sales as exit strategies used by family businesses in the face of a decline in corporate performance (Chirico et al., 2018). This decision is due to the fact that this consideration would entail greater difficulty in the statistical analysis and could also be incorporated into a new line of research.

Acknowledge: This manuscript has been financed by the Ministry of Economy and Competitiveness (PID2021-126358NB-I00), and Junta de Andalucía (Project P20_00496)

References

Acquaah, M., Amoako-Gyampah, K., & Jayaram, J. (2011). Resilience in family and nonfamily firms: An examination of the relationships between manufacturing strategy, competitive strategy and firm performance. International Journal of Production Research, 49(18), 5527-5544.

https://doi.org/10.1080/00207543.2011.563834

Agustí, M., Ramos, E., & Acedo, F. J. (2021). Reacting to a generalised crisis. A theoretical approach to the consumption of slack resources in family firms. European Journal of Family Business, 11(2), 100-110. https://doi.org/10.24310/ejfbejfb.v11i2.10626

Aldrich, H., & Auster, E. R. (1986). Even dwarfs started small: liabilities of age and size and their strategic implications. Research in Organizational Behavior, 8, 165-198.

Alonso-Dos-Santos, M., & Llanos-Contreras, O. (2019). Family business performance in a post-disaster scenario: the influence of socioemotional wealth importance and entrepreneurial orientation. Journal of Business Research, 101, 492-498. https://doi.org/10.1016/j.jbusres.2018.12.057

Argenti, J. (1976). Corporate planning and corporate collapse. Long Range Planning, 9(6), 12-17. https://doi.org/10.1016/0024-6301(76)90006-6

Arogyaswamy, K., Barker, V., & Yasai-Ardekani, M. (1995). Firm turnarounds: an integrative two-stage model. Journal of Management Studies, 32(4), 493-525. https://doi.org/10.1111/j.1467-6486.1995.tb00786.x

Arregle, J-L., Hitt, M. A., Sirmon, D. G., & Very, P. (2007). The development of organizational social capital: attributes of family firm. Journal of Management Studies, 44(1), 73-95.

https://doi.org/10.1111/j.1467-6486.2007.00665.x

Astrachan, J. H., Klein, S. B., & Smyrnios, K. X. (2002). The F-PEC scale of family influence: a proposal for solving the family business definition problem. Family Business Review, 15(1), 45-58. https://doi.org/10.1111/j.1741-6248.2002.00045.x

Barbero J. L., Casillas J. C., & Feldman H. D. (2012). Managerial capabilities and paths to growth as determinants of high-growth small and medium-sized enterprises. International. Small Business Journal, 29(6), 671-694. https://doi.org/10.1177/0266242610378287

Barbero, J. L. Ramos, A., & Chiang, C. (2017). Restructuring in dynamic environments: a dynamic capabilities perspective. Industrial and Corporate Change, 26(4), 593-615. https://doi.org/10.1093/icc/dtw042

Barbero, J. L., Martínez, J. A., & Moreno-Menéndez, A. M. (2020). Should declining firms be aggressive during the retrenchment process? Journal of Management, 40(5), 694–725. https://doi.org/10.1177/0149206318811563

Barker, V. L., & Duhaime, I. (1997). Strategic change in the turnaround process: theory and empirical evidence. Strategic Management Journal, 18(1), 13-38.

https://doi.org/10.1002/(SICI)1097-0266(199701)18:1<13::AID-SMJ843>3.0.CO;2-X

Barker, V. L., & Mone, M. A. (1994). Retrenchment: cause of turnaround and consequence of decline? Strategic Management Journal, 15(5), 195-205.https://doi.org/10.1002/smj.4250150506

Belling, M., Pidun, U., & Knyphausen-Aufseß, D. (2022). Restructuring in family firms: Balancing family objectives and economic prosperity. Long Range Planning, 55(6), 102184. https://doi.org/10.1016/j.lrp.2022.102184

Berrone, P., Cruz, C., & Gómez-Mejía, L. R. (2012). Socio-emotional wealth in family firms: theoretical dimensions, assessment approaches and agenda for future research. Family Business Review, 25(3), 258-279. https://doi.org/10.1177/0894486511435355

Bettis, R., Ethiraj, S., Gambardella, A., Helfat, C., & Mitchell, W. (2016). Cresting repeatable cumulative knowledge in strategic management: a call for a broad and deep conversation among authors, referees, and editors. Strategic Management Journal, 37(2), 257-261.

https://doi.org/10.1002/smj.2477

Bowen, H. P., & Wiersema, M. F. (2004). Modeling limited dependent variables: methods and guidelines for researchers in strategic management. In D. Bergh, & D.J. Ketchen (Eds), Research methodology in strategy and management, 1 (pp. 87-134). Oxford: Elsevier.

https://doi.org/10.1016/S1479-8387(04)01104-X

Brewton, K. E., Danes, S. M., Stafford, K., & Haynes, G. W. (2010). Determinants of rural and urban family firm resilience. Journal of Family Business Strategy, 1(3), 155-166..

https://doi.org/10.1016/j.jfbs.2010.08.003

Burton, M. D., & Beckman, C.M. (2007). Leaving a legacy: position imprints and successor turnover in young firms. American Sociological Review, 72(2), 239-266.

https://doi.org/10.1177/000312240707200206

Cameron, K., Sutton, R., & Whetten, D. (1988). Readings in organizational decline: frameworks, research and prescriptions. Cambridge, MA: Ballinger.

Casillas, J. C., & Moreno-Menéndez, A. M. (2014). Speed of the internationalization process: the role of diversity and depth in experiential learning. Journal of International Business Studies, 45, 85-101. https://doi.org/10.1057/jibs.2013.29

Casillas, J. C., López-Fernández, C., Meroño-Cerdán, A., Pons, A., & Baiges, R. (2015). La Empresa Familiar en España. Ed. Instituto de la Empresa Familiar, Madrid.

Casillas, J. C., Moreno-Menendez, A. M., Barbero, J. L., & Clinton, E. (2019). Retrenchment strategies and family involvement: the role of survival risk. Family Business Review, 32(1), 58–75. https://doi.org/10.1177/0894486518794605

Cater III, J. J., & Schwab, A. (2008). Turnaround strategies in established small family firms. Family Business Review, 21(1), 31-50. https://doi.org/10.1111/j.1741-6248.2007.00113.x

Cennamo, C., Berrone, P., Cruz, C., & Gómez-Mejía, L. (2012). Socio-emotional wealth and proactive stakeholder engagement: why family-controlled firms care more about their stakeholders. Entrepreneurship Theory and Practice, 36(6), 1153-1173.

https://doi.org/10.1111/j.1540-6520.2012.00543.x

Chirico, F., Salvato, C., Byrne, B., Akhter, N., Arriaga Múzquiz, J. (2018). Commitment escalation to a failing family business Journal of Small Business Management, 56(3), 494-512. https://doi.org/10.1111/jsbm.12316

Corbetta, G., & Salvato, C. (2012). Strategies for longevity in family firms. A European perspective. NewYork: Palgrave-Macmillan. https://doi.org/10.1057/9781137024589

Cox, D. R. (1975). Partial likelihood. Biometrika, 62(2), 269-276. https://doi.org/10.1093/biomet/62.2.269

Davila, J., Durán, P., Gómez-Mejía, L., & Sánchez-Bueno, M. J. (2022). Socioemotional wealth and family firm performance: a meta-analytic integration. Journal of Family Business Strategy, in press. https://doi.org/10.1016/j.jfbs.2022.100536

Dawley, D. D., Hoffman, J. J., & Lamont, B. T. (2002). Choice situation, refocusing, and post-bankruptcy performance. Journal of Management, 28(5), 695-717. https://doi.org/10.1177/014920630202800507

Deephouse D. L., & Jaskiewicz, P. (2013). Do family firms have better reputations than non-family firms? An integration of socioemotional wealth and social identity theories. Journal of Management Studies, 50(3), 337-360. https://doi.org/10.1111/joms.12015

DeTienne, D. R. (2010). Entrepreneurial exit as a critical component of the entrepreneurial process: theoretical development. Journal of Business Venturing, 25(2), 203-215. https://doi.org/10.1016/j.jbusvent.2008.05.004

DeTienne, D. R., & Chirico, F. (2013). Exit strategies in family firms: how socio-emotional wealth drives the threshold of performance. Entrepreneurship Theory and Practice, 37(6), 1297-1318. https://doi.org/10.1111/etap.12067

Doughty, K., & Hill, L. (2000). Francisco de Narváez at Tía: selling the family business. Harvard Business School, 9, 401-017.

Eddleston, K. A., Kellermanns, F. W., & Zellweger, T. M. (2012). Exploring the entrepreneurial behavior of family firms: does the stewardship perspective explain differences? Entrepreneurship Theory and Practice, 36(2), 347-367. https://doi.org/10.1111/j.1540-6520.2010.00402.x

Ensley, M. D., & Pearson, A. W. (2005). An exploratory comparison of the behavioral dynamics of top management teams in family and non-family new ventures: cohesion, conflict, potency, and consensus. Entrepreneurship Theory and Practice, 29(3), 267-284.

https://doi.org/10.1111/j.1540-6520.2005.00082.x

Franks, J., Mayer, C., Volpin, P., & Wagner, H. F. (2012). The life cycle of family ownership: international evidence. The Review of Financial Studies, 25(6), 1676-1712. https://doi.org/10.1093/rfs/hhr135

Fuenteslaz, L., Gómez, J., & Polo, Y. (2002). Followers’ entry timing: evidence from the Spanish banking sector after deregulation. Strategic Management Journal, 23(3), 245-264.

https://doi.org/10.1002/smj.222

Gersick, K., Davis, J., Hampton, M., & Lansberg, I. (1997). Generation to generation: life cycles of the family business. Boston, MA: Harvard Business School Press.

Gimeno, J., Folta, T., Cooper, A., & Woo, C. (1997). Survival of the fittest? Entrepreneurial human capital and the persistence of underperforming firms. Administrative Science Quarterly, 42(4), 750-783. https://doi.org/10.2307/2393656

Gómez-Mejía, L. R., Haynes, K., Nuñez-Nickel, M., Jacobson, K. J. L., & Moyano-Fuentes, J. (2007). Socio-emotional wealth and business risks in family-controlled firms: evidence from Spanish olive oil mills. Administrative Science Quarterly, 52(1), 106-137. https://doi.org/10.2189/asqu.52.1.106

Gómez-Mejía, L. R., Núñez-Nickel, M., & Gutiérrez, I. (2001). The role of family ties in agency contracts. Academy of Management Journal, 44(1), 81-95. https://doi.org/10.2307/3069338

Gómez-Mejía, L., & Herrero, I. (2023). Back to square one: the measurement of socioemotional wealth (SEW). Journal of Family Business Strategy, 13(4), 100480. https://doi.org/10.1016/j.jfbs.2021.100480

Graves, C., & Shan, Y. G. (2014). An empirical analysis of the effectof internationalization on the performance of unlisted family and nonfamily firms in Australia. Family Business Review, 27(2), 142-160. https://doi.org/10.1177/0894486513491588

Greene, W. H. (2018). Econometric analysis, 8th ed., Pearson, New York, NY.

Hambrick, D. (1985). Turnaround strategies. In W. Guth (Ed.), Handbook of business strategy (pp. 101-132). Warren, Gorham and Lamont.

Hambrick, D., & D’Aveni, R. (1988). Large corporate failures as downward spirals. Administrative Science Quarterly, 33(1), 1-23. https://doi.org/10.2307/2392853

Hambrick, D., & Schecter, S. (1983). Turnaround strategies for mature industrial-product business units. Academy of Management Journal, 26(2), 231-248. https://doi.org/10.2307/255972

Harhoff, D., Stahl, K., & Woywode, M. (1998). Legal form, growth and exit for west German firms-results for manufacturing, construction, trade and service industries. The Journal of Industrial Economics, XLVI, 453-488. https://doi.org/10.1111/1467-6451.00083

Haynes, G. W., Walker, R., Rowe, B. R., & Hong, G.-S. (1999). The intermingling of business and family finances in family-owned businesses. Family Business Review, 12(3), 225–239. https://doi.org/10.1111/j.1741-6248.1999.00225.x

Hernández-Linares, R., & Arias-Abelaira, T. (2022). Adapt or perish! A systematic review of the literature on strategic renewal and the family firm. European Journal of Family Business, 12(2), 137-155. https://doi.org/10.24310/ejfbejfb.v12i2.14718

Hernández-Linares, R., Kellermanns, F. W., López-Fernández, M. C., & Sarkar, S. (2019). The effect of socioemotional wealth on the relationship between entrepreneurial orientation and family business performance. Business Research Quarterly. https://doi.org/10.1016/j.brq.2019.03.002

Josefy, M., Harrison, J., Sirmon, D., & Carnes, C. (2017). Living and dying: synthesizing the literature on firm survival and failure across stages of development. Academy of Management Annals, 11(2), 770-799. https://doi.org/10.5465/annals.2015.0148

Kammerlander, N. (2016). I want this firm to be in good hands: emotional pricing of resigning entrepreneurs. International Small Business Journal, 34(2), 189-214.

https://doi.org/10.1177/0266242614541287

King, D. R., Meglio, O., Gomez‐Mejia, L., Bauer, F., & De Massis, A. (2022). Family business restructuring: a review and research agenda. Journal of Management Studies, 59(1), 197-235. https://doi.org/10.1111/joms.12717

Kotlar, J., de Massis, A., Fang, H., & Frattini, F. (2014). Strategic reference points in family firms. Small Business Economics, 43(3), 597-619. https://doi.org/10.1007/s11187-014-9556-6

Lansberg, I. (1999). Succeeding generations. Boston, MA: Harvard Business School Press.

Lim, D. S. K., Celly, N., Morse, E. A., & Rowe, W. G. (2013). Rethinking the effectiveness of asset and cost retrenchment: the contingency effects of a firm’s rent creation mechanism. Strategic Management Journal, 34(1), 42-61. https://doi.org/10.1002/smj.1996

Lumpkin, G. T., & Brigham, K. H. (2011). Long-term orientation and intertemporal choice in family firms. Entrepreneurship Theory and Practice, 35(6), 1149-1169.

https://doi.org/10.1111/j.1540-6520.2011.00495.x

Lumpkin, G. T., Brigham, K. H., & Moss, T. W. (2010). Long-term orientation implications for the entrepreneurial orientation and performance of family businesses. Entrepreneurship and Regional Development, 22, 241-264. https://doi.org/10.1080/08985621003726218

MacMillan, C. J., & Overall, J. S. (2017). Crossing the chasm and over the abyss: perspectives on organizational failure. Academy of Management Perspectives, 31(4), 271-287. https://doi.org/10.5465/amp.2017.0018

Mellahi, K., & Wilkinson, A. (2004). Organizational failure: a critique of recent research and a proposed integrative framework. International Journal of Management Reviews, 5/6(1), 21-41. https://doi.org/10.1111/j.1460-8545.2004.00095.x

Micelotta, E., & Raynard, M. (2011). Concealing or revealing the family? Corporate brand identity strategies in family firms. Family Business Review, 24(3), 197-216. https://doi.org/10.1177/0894486511407321

Miller, D. & Friesen, P. H. (1984). Organizations: a quantum view. Englewood Cliffs, NJ: Prentice Hall.

Miller, D., & Le Breton-Miller, I. (2005). Managing for the long run: lessons in competitive advantage from great family businesses. Cambridge, MA: Harvard Business School Press.

Miller, D., Le Breton-Miller, I., & Scholnick, B. (2008). Stewardship vs. stagnation: an empirical comparison of small family and non-family businesses. Journal of Management Studies, 45(1), 51-78. https://doi.org/10.1111/j.1467-6486.2007.00718.x

Moreno-Menéndez, A. M. & Casillas, J. C. (2021). How do family businesses grow? Differences in growth patterns between family and non-family firms. Journal of Family Business Strategy, 12(3), 100420. https://doi.org/10.1016/j.jfbs.2021.100420

Nachum, L., & Song, S. (2011). The MNE as a portfolio: interdependencies in MNE growth trajectory. Journal of International Business Studies, 42(3), 381-405. https://doi.org/10.1057/jibs.2010.60

Naldi, L., Nordqvist, M., Sjöberg, K., & Wiklund, J. (2007). Entrepreneurial orientation, risk taking, and performance in family firms. Family Business Review, 20(1), 33-47.

https://doi.org/10.1111/j.1741-6248.2007.00082.x

Ndofor, H. A., Vanevenhoven, J., & Barker, V. L. (2013). Software firm turnarounds in the 1990s: an analysis of reversing decline in a growing, dynamic industry. Strategic Management Journal, 34(9), 1123-1133. https://doi.org/10.1002/smj.2050

Nordqvist, M., & Melin, L. (2010). Entrepreneurial families and family firms. Entrepreneurship and Regional Development, 22(3-4), 211-239. https://doi.org/10.1080/08985621003726119

Pearce II, J. A., & Robbins, D. K. (1994a). Entrepreneurial recovery strategies of small market share manufacturers. Journal of Business Venturing, 9(2), 91-108. https://doi.org/10.1016/0883-9026(94)90003-5

Pearce II, J. A., & Robbins, D. K. (1994b). Retrenchment remains the foundation of business turnaround. Strategic Management Journal, 15(5), 407-417. https://doi.org/10.1002/smj.4250150507

Pearce II, J. A., & Robbins, K. (1993). Toward improved theory research on business turnaround. Journal of Management, 19(3), 613-636. https://doi.org/10.1177/014920639301900306

Penrose, E. (1959). The theory of the growth of the firm. New York: Wiley.

Pindado, J., & Requejo, I. (2015). Family business performance from a governance perspective: a review of empirical research. International Journal of Management Reviews, 17(3). 279-311. https://doi.org/10.1111/ijmr.12040

Price, L. L., Arnould, E. J., & Folkman-Curasi, C. (2000). Older consumers’ disposition of special possessions. Journal of Consumer Research, 27(2), 272-382. https://doi.org/10.1086/314319

Revilla, A. J., Pérez-Luño, A., & Nieto, M. J. (2016). Does family involvement in management reduce the risk of business failure? The moderating role of entrepreneurial orientation. Family Business Review, 29(4) 365-379. https://doi.org/10.1177/0894486516671075

Robbins, D. K., & Pearce, J. A. (1992). Turnaround: Retrenchment and recovery. Strategic Management Journal, 13(4), 287-309. https://doi.org/10.1002/smj.4250130404

Schmitt, A., & Raisch, S. (2013). Corporate turnarounds: the duality of retrenchment and recovery. Journal of Management Studies, 50(7), 1216-1244. https://doi.org/10.1111/joms.12045

Schulze, M., & Bövers, J. (2022). Family business resilience. The importance of owner-manager’s relational resilience in crisis response strategies. European Journal of Family Business, 12(2), 100-123. https://doi.org/10.24310/ejfbejfb.v12i2.14657

Schulze, W. S., Lubatkin, M. H., Dino, R. N., & Buchholtz, A. K. (2001). Agency relationships in family firms. Organization Science, 12(2), 99-116. https://doi.org/10.1287/orsc.12.2.99.10114

Sciascia, S., Mazzola, P., Astrachan, J. H., & Pieper, T. M. (2012). The role of family ownership in international entrepreneurship: exploring nonlinear effects. Small Business Economics, 38(1), 15-31. https://doi.org/10.1007/s11187-010-9264-9

Shanker, M. C., & Astrachan, J. H. (1996). Myths and realities: family businesses’ contribution to the US economy - A framework for assessing family business statistics. Family Business Review, 9(2), 107-123. https://doi.org/10.1111/j.1741-6248.1996.00107.x

Shepherd, D., & Haynie, J.M. (2011). Venture failure, stigma, and impression management: a self-verification, self-determination view. Strategic Entrepreneurship Journal, 5(2), 178-187.

https://doi.org/10.1002/sej.113

Sirmon, D. G., & Hitt, M. A. (2003). Managing resources: linking unique resources, management, and wealth creation in family firms. Entrepreneurship Theory and Practice, 27(4), 339-358. https://doi.org/10.1111/1540-8520.t01-1-00013

Slatter, S. (1984). Corporate recovery. (P. Books, Ed.). Harmandsworth, Middlesex: Penguin Books.

Stinchcombe, A. L. (1965). Social structure and organizations. In: March, J.G. (Ed.), Handbook of Organizations (pp. 142-193). Rand McNally and Co., Chicago.

Stockmans, A., Lybaert, N., & Voordeckers, W. (2010). Socioemotional wealth and earnings management in private family firms. Family Business Review, 23(3), 280-294.

https://doi.org/10.1177/0894486510374457

Suárez, F. F., & Utterback, J. M. (1995). Dominant designs and the survival of firms. Strategic Management Journal, 16(6), 415-430. https://doi.org/10.1002/smj.4250160602

Sutton, R., & D´Aunno, T. (1989). Decreasing organizational size: untangling the effects of money and people. Academy of Management Review, 14(2), 194–212. https://doi.org/10.5465/amr.1989.4282091

Swab, R. G., Sherlock, C., Markin, E., & Dibrell, C. (2020). “SEW” What do we know and where do we go? A review of socioemotional wealth and a way forward. Family Business Review, 33(4), 424-445. https://doi.org/10.1177/0894486520961938

Thornhill, S., & Amit, R. (2003). Learning about failure: bankruptcy, firm age, and the resource-based view. Organization Science, 14(5), 497-509. https://doi.org/10.1287/orsc.14.5.497.16761

Trahms, C. A., Ndofor, H. A., & Sirmon, D. G. (2013). Organizational decline and turnaround: a review and agenda for future research. Journal of Management, 39(5), 1277-1307. https://doi.org/10.1177/0149206312471390

Weitzel, W., & Jonsson, E. (1989). Decline in organizations: a literature integration and extension. Administrative Science Quarterly, 34(1), 91-109. https://doi.org/10.2307/2392987

Williams, T. A., Gruber, D. A., Sutcliffe, K. M., Shepherd, D. A., & Zhao, E. Y. (2017). Organizational response to adversity: fusing crisis management and resilience research streams. Academy of Management Annals, 11(2), 733-769. https://doi.org/10.5465/annals.2015.0134

Yu, T., & Cannella, A. A. (2007). Rivalry between multinational enterprises: an event history approach. Academy of Management Journal, 50(3), 665-686. https://doi.org/10.5465/amj.2007.25527425

Zahra, S. (2005). Entrepreneurial risk taking in family firms. Family Business Review, 18(1), 23-40. https://doi.org/10.1111/j.1741-6248.2005.00028.x

Zellweger, T. M., & Astrachan, J. H. (2008). On the emotional value of owning a firm. Family Business Review, 21(4), 347-363. https://doi.org/10.1177/08944865080210040106

Zellweger, T. M., Nasson, R. S., & Nordqvist, M. (2012). From longevity of firms to transgenerational entrepreneurship of families: introducing family entrepreneurial orientation, Family Business Review, 25(2), 136-155. https://doi.org/10.1177/0894486511423531