1. Introduction

In today’s business world, small and medium-sized enterprises (SMEs) constantly face challenges and opportunities in a dynamic and competitive environment. A crucial aspect that determines the success of these organizations is their capacity to manage their financial resources efficiently, particularly their working capital (Kayani et al., 2019). Mann (1918) defines working capital as money required to perform the existing operations of an entity. This is also known as the net working capital, i.e., the amount required to keep the business running. While Schaal and Haley (1991) consider working capital management as the management of current assets and current liabilities. This is an essential component when optimizing the cash conversion cycle and for financial management in firms as it allows their operations to function properly and provides the liquidity needed to face market challenges. Working capital in SMEs becomes particularly relevant because of the characteristics and limitation of these firms, such as the scale of operations, limited access to finance, and sensitivity to market fluctuations. There are specific implications of individual versus cooperative working capital management in a supply chain. In this regard, Huang et al. (2022) take up the work of Hofmann and Kotzab (2010), who recommend that managers establish long-term collaborative relationships, particularly in cooperative working capital management, in order to finance the weaker members and improve overall performance instead of benefiting just some of the participants.

Working capital management has been key throughout modern history to provide liquidity in supply chains (SCs), by means of financial collaboration tools within the framework of Supply Chain Finance (SCF), and the financial solutions that have stemmed from this such as Factoring (Gelsomino et al., 2016b; Gomm, 2010; Liebl et al., 2016). Since the mid-20th century, SCF has stood out as an important support medium for commercial and financial activities throughout a swathe of industrial sectors at an international level. SCF has attracted attention by being an innovative model that allows businesses, particularly SMEs—which are mainly family run (D’Angelo et al., 2016)—to convert their credit sales into cash sales without incurring additional liabilities. SCF seeks to optimize financial flows on an inter-firm level by using solutions implemented by financial intermediaries (Camerinelli, 2009) or technology providers (Lamoureux & Evans, 2011) in order to align financial flows with product and information flows within the SC (Gelsomino et al., 2016a; Wuttke et al., 2013b).

This collaboration between firms is particularly important for SMEs, because, within the supply chain framework, they present bottlenecks in financing (Gereffi & Fernández-Stark, 2018). Cooperation networks and mechanisms for guaranteeing the operational flow of finance have a major influence on growth and innovation (Alos-Simo et al., 2022; Araya-Castillo, 2022; Moon, 2022), especially in developing countries (Ayyagari et al., 2015). In this setting, it is important to emphasize the significance of commercial credit, which is used by firms of various sizes and for a variety of financial reasons (Abdulsaleh & Worthington, 2013).

SCF has been characterized by two-digit growth rates in many countries, an increase in the number of firms providing SCF solutions worldwide, and a swift adoption of electronic data exchange (Bickers, 2021). As a result of the health and economic crisis caused by the Covid-19 pandemic, more recently exacerbated by the crisis in Russia and Ukraine, SCs are being put to the test (Kilpatrick, 2022), leaving firms in serious financial difficulties. According to Bickers (2021), the short-term impact of the pandemic has been a 6.5% decrease in the volume of SCF operations through Factoring in 2020, which was the second drop this century, being preceded by that of the 2009 financial crisis. One of the major questions in the post Covid-19 era is how the end of financial support measures from governments will affect SCF markets (Bickers, 2021). Currently, the most vulnerable firms are trying to increase trade credit from their suppliers in order to complement other forms of finance, while organizations less affected by this credit crisis are taking on the role of liquidity providers, accepting longer payment terms. These effects contribute to the need for solutions and programs that optimize working capital, of which SCF is one of the most important. Thus, in this scenario of uncertainty, efficient finance management in SCs through profound changes in the near future takes on greater significance (Ishida, 2020; Kumar & Mishra, 2020; Pérez-Elizundia et al., 2020).

It should be borne in mind that SCs are dominated by multinational firms that take up the first levels of the chain. However, in recent years there have been increasingly more SMEs joining SCs, although their negotiating power is still limited (Lampón et al., 2018, 2022; Rodríguez-De la Fuente & Lampón, 2020). In terms of financing, this asymmetrical power structure often results in the imposition of long payment terms and transfer of the financing costs to suppliers located on the SCs’ lower levels (Lind et al., 2012). Furthermore, access to financing continues to be a major obstacle facing SMEs (Jansen et al., 2018). All these factors combined can affect the whole SC, which can lead to distribution problems for the leading buyers by exposing them to manufacturing or delivery interruptions (Brandenburg, 2016). SCF is the means used on many occasions to solve such financing problems, focusing on SMEs (Ali et al., 2020; Wuttke et al., 2013b). In this context, this work shines a light on the role of SMEs in SCF as they make up two thirds of the firms worldwide, and of these, family firms represent around 85% (D’Angelo et al., 2016).

By means of a literature review and bibliometric and content analysis on SCF, this work aims to identify the trends in scientific research on SCF in the area of SMEs, most of which are family run, and to introduce the theoretical approaches traditionally used on SFC, its most closely related topic areas, and future lines of research based on the emerging trends. The following research question (RQ) is therefore proposed:

RQ: What are the trends in scientific research on SCF found from 1970 to 2021 and what implications do they have for SMEs?

In answering this question, we will expose the existing limitation derived from fragmentation in the literature and semantics that prevails in this field of knowledge, and which creates a great deal of conceptual confusion. Therefore, we contribute to the debate on creating a holistic conceptual framework based on a consensus of universally accepted theories and terms. This is all done to improve understanding of SCF at both theoretical and practical levels and allow commercial stakeholders and regulatory authorities for SCs to make the most of opportunities and guide their policies.

Although there are previous bibliometric studies dealing with SCF analysis, they show limitations in search criteria as they do not consider the fragmentation that exists in the literature and semantics in this field of study, which was pointed out by Gelsomino et al. (2016a), Xu et al. (2020), and Parida et al. (2020). At the same time, none of the prior studies performs a bibliometric analysis on SCF centered on SMEs as this one does. The relevance of our work at a theoretical level consists in performing bibliometric analysis through science mapping with more robust criteria than those proposed by the previous literature. Analysis using these criteria made it possible, on the one hand, to identify the driving topics surrounding SCF (Supply Chain Management, Delayed Payments, and Sustainability), and the most relevant articles, journals, and authors in subjects linked to SCF (Reverse Factoring, Trade Credit, Working Capital Management, Risk Management, and SME Financing) in addition to the driving topics. On the other hand, this analysis made it possible to confirm the fragmentation and pave the way towards the construction of a comprehensive conceptual framework for universally accepted SCF for future research. Furthermore, this study takes up the most important questions identified by other authors in SCF and identifies aspects such as innovation, collaboration, and resilience as key factors in the development of SCF with the technological support of FinTechs, the adoption of Blockchain, and Artificial Intelligence to promote the sustainable performance of SCs.

The implications of this work for family firms lies in the advantages derived from their belonging to SCs, as well as the topic trends identified in SCF for decision making. The literature recognizes SMEs—the vast majority of which are family firms—as one of the main drivers of economic and social development worldwide. They play a crucial role in generating jobs and wealth, and their size allows them to adapt quickly to changes in the market and consumer demands (Hernández-Linares & Arias-Abelaira, 2022; Saavedra & Tapia, 2014). However, SMEs face major challenges to access sources of finance, which limits their growth and competitiveness. It is thus relevant to belong to SCs in order to access improvement flows that favor their growth and development. In this sense, the inclusion of SMEs in SCs can facilitate access to finance by having the support of a large corporation that governs the SC and have the benefit of guaranteed long-term contracts (Romero-Luna, 2009). Additionally, SMEs obtain further benefits by being integrated in the SCs, such as access to other markets, greater demand and price stability, improved administration and planning practices, the creation of a credit history, and access to training and technical assistance (Inegi, 2018). Furthermore, this study is of great interest for stakeholders, including banks, SMEs, commercial partners, employers, educational institutions, and public administrations, as it provides them with relevant information on current trends in SCF. This makes it possible to identify commercial opportunities and guide policies. These contributions take on particular relevance in the complex environment SCs are facing in the post Covid-19 era and in the new geopolitical context characterized by the conflict between Russia and Ukraine.

To respond to the research question, the article is organized as follows. Section 2 presents the literature review on theoretical approaches to SCF and the bibliometric analysis. Section 3 outlines the methodology and offers information on the methods used to select the data and analysis techniques. Sections 4 and 5 show the results and the discussion, respectively, based on analysis of science mapping. Finally, section 6 summarizes the conclusions, limitations, and future lines for research.

2. Literature Review

2.1. Theoretical approaches in supply chain finance

Together with the expansion of the SCF market over the last two decades, interest in this field of knowledge has been growing among academics. The number of scientific articles focusing on SCF has increased significantly. In the literature, there are many attempts to develop generalized views of SCF, both from a finance-oriented perspective (More & Basu, 2013) and a Supply Chain perspective (Wuttke et al., 2013a). However, these works are relatively scarce, and tackle their analysis without providing a comprehensive framework for study. Moreover, they still do not bridge the gap between both perspectives, that is, they do not offer either a holistic reference framework (Gelsomino et al., 2016a; Xu et al., 2020), or consensus on the terms used by the scientific community. With this high degree of fragmentation in mind, it is imperative that the volume of quality research available is organized in a unified literary corpus for future research (Gelsomino et al., 2016b; Parida et al., 2021).

Historically, SCF has been studied from three different approaches, ranging from the general to the specific (Liebl et al., 2016). (1) Financial Supply Chain Management, centered on the supplier/buyer relationship, particularly the cashflow that accompanies the physical supply of products (Thangam, 2012; Wuttke et al., 2013b). (2) The optimization of working capital and liquidity of the commercial parties in SCs (Supply Chain Financing), which includes financing before and after product dispatch (Meijer & Bruijn, 2013; Moon, 2022; More & Basu, 2013). (3) Financing for suppliers under Reverse Factoring schemes (Gelsomino et al., 2016a; Gomm, 2010; Huang et al., 2022; Klapper, 2006; Liebl et al., 2016; More & Basu, 2013; Tanrisever et al., 2015; Pérez-Elizundia et al., 2020; Wuttke et al., 2013b), which involve the assignment of collection rights to financial intermediaries based on the credit strength of a large buyer (Supplier Finance).

The topics surrounding SCF consider financial collaboration (Jin et al., 2019; Lampón et al., 2021; Pérez-Elizundia et al., 2023; Wandfluh et al., 2016), particularly trust and transparency (Dello Iacono et al., 2015; Liebl et al., 2016), and the search for a reasonable balance between payment terms and interest rates for the parties involved (Lampón et al., 2021; Shuzhen et al., 2014). Another instrument that is closely linked to SCF is Trade Credit, which has also been used and researched for many years (Cotler, 2015; Gelsomino et al., 2016a y 2016b; Klapper, 2006; Rodríguez-Rodríguez, 2008; Wuttke et al., 2013b). In addition to these dominant instruments (Reverse Factoring and Trade Credit), there are other emerging instruments for SCF, such as inventory finance (Buzacott & Zhang, 2004; Chen & Cai, 2011; Hofmann & Locker, 2009; Modansky & Massimino, 2011; Yan & Sun, 2013). We found no evidence of studies specializing in SCF in SMEs, or central considerations regarding their size, age, or ownership regime, although there is evidence of a growth in general study of family firms as a unit of analysis (Araya-Castillo et al., 2022).

2.2. Finance in supply chains and bibliometric studies

This section covers several bibliometric studies on SCF, from both a theoretical and methodological perspective. Xu et al. (2018) identified four major directions for research in all the studies on SCF: (1) Deterioration of the inventory model in the trade credit policy framework; (2) Inventory decisions with trade credit policy in more complex situations; (3) Interaction between replenishment decisions and deferred payment strategies in SCs; and (4) Functions of the finance service in SCs.

Liu et al. (2015) explored a new vision of the SCF field in China, the leading country in terms of scientific production on SCF. Parida et al. (2021) proposed a research framework based on the finance perspectives of the buyer and of the SCs, where the main contribution was identification of operational coverage strategies that lead towards sustainable SCF in line with the Sustainable Development Goals, as well as some of the emerging research areas in which SCF is still at a fledgling stage of application.

Tseng et al. (2021) proposed a bibliometric analysis from a regional geographical perspective in order to illustrate a general concept of sustainable SCF, which also revealed certain key indicators for continued improvement. Minh (2022) identified that technology development is a research trend for SCF, together with FinTech topic areas, such as data analysis, digital data storage, artificial intelligence, and Blockchain, among others.

Huang et al. (2022) highlighted that, in the context of constantly evolving SCF, existing literature reviews are limited due to the lack of integration of recent findings from 2010 to 2021. Prompted by this limitation, they attempt to fill this gap by researching new achievements that have been reported in the current literature.

In sum, all these works provide interesting ideas and trends in the SCF area. However, all of them warn of the limitations in the search criteria as they do not consider the literary and semantic fragmentation that prevails in this field of study. Table 1 summarizes the main bibliometric studies on SCF, the most relevant aspects, and the types of analysis and technique used.

Table 1. Main bibliometric studies on SCF

|

Work

|

Relevant aspects

|

Type of analysis and bibliometric technique

|

|

Huang et al. (2022)

|

Exhaustive study of all aspects of SCF, which warns of the lack of integration of SCF findings in the last decade and the need to update the SCF framework.

|

Exhaustive systematic literature review, combined with descriptive and content analysis in four stages:

1. Question formulation.

2. Document location.

3. Choice and assessment of materials.

4. Analysis and synthesis of contents.

|

|

Liu et al. (2015)

|

New view of China—leader in scientific production on SCF.

|

Analysis of contents in leading articles on China, comprising four steps:

1. Journal selection.

2. Article identification.

3. Category classification.

5. Topic assessment.

|

|

Minh (2022)

|

Study that identifies China as the leading country in SCF research and science and technology as the trend for research in this field.

|

Systematic literature review, network maps of international affiliation, and keywords, supported by the VOSviewer visualization tool.

|

|

Parida et al. (2021)

|

Sustainable SCF with a finance perspective

|

1. Exhaustive and systematic literature review.

2. Networks analysis and cluster analysis, citation and co-citation analysis supported by VOSviewer, CiteScape and Tableau & CitNetExplorer visualization tools.

3. Triangulation method to identify research perspectives.

|

|

Tseng et al. (2021)

|

Sustainable SCF with regional perspective.

|

1. Bibliometric analysis based on big data in the literature.

2. Keyword co-occurrence analysis supported by VOSviewer.

3. Hybrid analysis (quantitative and qualitative) of fuzzy methods for tackling uncertainty of the context, based on:

i) Fuzzy Delphi method.

ii) Entropy weight method.

iii) Fuzzy decision-making trial and evaluation laboratory.

|

|

Xu et al. (2018)

|

Interrelation between inventory models and trade credit policies.

|

Exhaustive systematic literature review combined with bibliometric analysis, network analysis (citation and co-citation), and content analysis, supported by BibExcel analysis tool.

|

Source: Elaboration by the authors

3. Material and Method

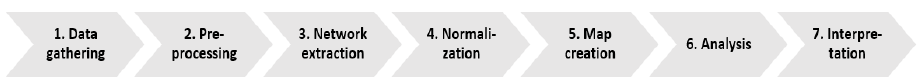

This paper uses bibliometric analysis to define the theoretical structure of SCF based on performance and science mapping analyses, and co-citation and contents analyses with the support of SciMAT software. Bibliometric analysis is defined as the part of Scientometrics that uses mathematical and statistical methods to analyze the scientific activities in a research field (Callon et al., 1991; Cobo et al., 2011), and allows perspectives to be opened up on the contents and structure of that field (Mazandarani & Royo-Vela, 2022). The SciMAT software (Cobo et al., 2012) is used for its flexibility when selecting measures for obtaining and visualizing bibliometric networks, which is why it has become a popular tool among leading authors in bibliometric analysis (Aparicio et al., 2019; Arteche-Bueno et al., 2019; Cobo et al., 2014; López-Herrera et al., 2012; Mazandarani & Royo-Vela, 2022; Paule-Vianez et al., 2020). A performance analysis was developed using various basic bibliometric indicators (number of documents published, number of citations received, etc.) and the h-index. For a better interpretation of the results and categorization of the issues detected, both Strategic Diagrams and Thematic Networks were used. The process of applying science mapping analysis to define the conceptual structure of SCF consisted of seven steps (see Figure 1).

Figure 1. Workflow of science mapping analysis

Source: Cobo et al. (2012)

First, the various sources and databases for data gathering were identified, which, in our case, was Web of Science (Step 1). Usually, data extracted from bibliographical sources contain errors, which means data pre-processing must be performed, including filtering out duplicated or misspelt keywords (Step 2). A bibliometric network is then constructed using one unit of analysis, which, in our case, was the keyword. In this work, a cooccurrence relationship of terms has been used (Step 3), which is produced when two terms appear simultaneously in at least the title or the abstract of a specific article such that the more articles the terms coincide in, the stronger those terms are considered as being related to each other (Callon et al., 1991; Cobo et al., 2012; Coulter et al., 1998).

To obtain significant information about the area through the analysis, the bibliometric network obtained must be normalized (Step 4), in order to relativize the relationships between two units of analysis (Cobo et al., 2011), attaching more importance to those units with a low frequency and a high frequency of cooccurrence compared to those units with a high frequency and a low frequency of cooccurrence (Cobo et al., 2012). The measure for normalization used in this work is the eij equivalence index (Callon et al., 1991), expressed by the equation eij = cij2 / cicj, where cij represents the number of documents in which two words i and j cooccur, while cicj represents the number of documents in which each word i and j appears. In this way, if two words always appear together, the index will be equal to one, and if they never appear together in any document, the index is equal to zero.

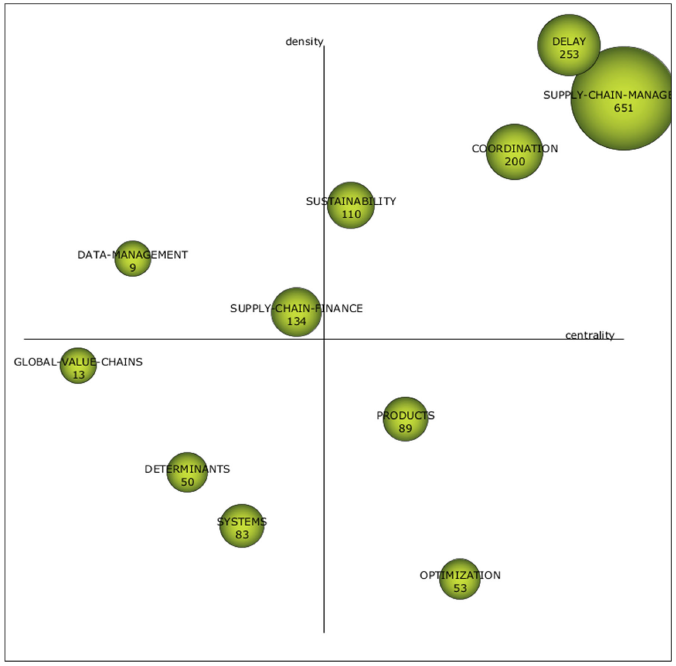

Once the network is normalized, the topics can be extracted by using clustering techniques to divide the set of elements into different subsets (Step 5), whose nodes are closely linked to each other (clusters), and scarcely linked to the rest (Callon et al., 1991; Cobo et al., 2012; Mazandarani & Royo-Vela, 2022). This work uses the clustering algorithm based on Simple Centers, which has the advantage of assigning the word most related to the rest as the name of the topic (Cobo et al., 2012). To assess the position of each item in the area, we present the different clusters in what is called the Strategic Diagram (Callon et al., 1991), which allows us to place topics according to their centrality (X axis) and density (Y axis). Centrality measures the degree of interaction of a topic with the others, as well as its importance in the overall development of the scientific field (Cobo et al., 2012). Density measures the degree of cohesion for a topic, i.e., the internal force of the different links of the nodes within a cluster and can be understood as the topic’s measure of development. (Cobo et al., 2012). In this context, the literature classifies the topics in four categories in the Strategic Diagram (Callon et al., 1991; Cobo et al., 2011; Coulter et al., 1998):

— Driving topics: located in the upper right quadrant and showing strong centrality and density. They are well developed and important to the scientific field.

— Specialized topics: topics that are highly developed and specialized but isolated from the rest are located in the upper left quadrant. These topics show low centrality but high density and are marginally important to the scientific field.

— Emerging or declining topics: in the lower left quadrant and showing low centrality and density. These are little developed and marginal.

— Basic or overarching topics: located in the lower right quadrant, showing strong centrality but low density. These are interconnected with the other topics but scarcely developed.

In a bibliometric network, each unit of analysis can have a group of documents associated with it, which are used for the performance analysis (Cobo et al., 2012). This study has used bibliometric indicators for quality based on the number of documents associated with a topic, citations obtained, and the h-index (Cobo et al., 2012) as a later measure of performance (Step 6). Once the science mapping analysis is finished, the results and the maps must be interpreted using the experience and knowledge of the authors in order to discover and extract useful information that can be applied in decision making (Step 7).

We performed a longitudinal analysis covering 1970 to 2021 (full period), divided into three subperiods: 1970 to 2000 (SP-1), 2001 to 2018 (SP-2), and 2019 to 2021 (SP-3). Although there are some works on aspects related to SCF from the beginning of the 20th century, they are few and far between. It was towards the 1970s when formal research into SCF began to emerge (Huang et al., 2022; Xu et al., 2018), and so 1970 was chosen at the start point for this study. The year 2000 was chosen as the first cut-off point because publications on SCF, which had been practically non-existent in the 20th century, began to become relevant as the new century began. This was when the first formal definition of this field of study emerged(Xu et al., 2018). Likewise, 2018 is the second cut-off point because the first years of this century saw relatively scant scientific production on SCF. It should be noted that, in order to detect the topics of a discipline correctly, the defined subperiods need to be more or less in line with the number of documents (Cobo et al., 2012; López-Herrera et al., 2012). For a longitudinal analysis, division into sub-periods all of the same number of years does not make sense, bearing in mind the limited number of articles published in the last century and during the first decade of this one. Additionally, this criterion is justified by previous studies on science mapping analysis (Arteche-Bueno et al., 2019; Cobo et al., 2011, 2012).

This study uses the Web of Science (WoS) database, property of Clarivate Analytics, which enjoys recognition for works of this type (Arteche-Bueno et al., 2019; Paule-Vianez et al., 2020; Van Raan, 2014). WoS allows access to current and retrospective information in the highest impact research journals since 1900 and has the most complete quality coverage of all the scientific disciplines, including finance. The search only included articles indexed in the SSCI and ESCI databases, thus ensuring the high quality of the literature reviewed. One limitation that we must warn of is that the databases with international recognition prioritize the English language and omit contributions which are more local in nature and that identify particularities of the object of study.

The selection of search chains and keywords bore in mind that the SCF topic area does not have a unified concept and is seen differently by authors depending on their research approach (Gelsomino et al., 2016a; Minh, 2022; Pérez-Elizundia et al., 2020). Moreover, SCF is made up of the terms “Supply Chain” and “Finance” and is interdisciplinary, straddling logistics, SC management, and finance within SCs (Hofmann & Johnson, 2016; Liebl et al., 2016). To ensure that both terms are completely captured by the keywords, we chose two search criteria according to both previous bibliographical reviews on similar subjects (Minh, 2022; Xu et al., 2018), and the professional and research experience of the authors in the field of SCF and Global Value Chains within business management and the economy.

The first search criterion contains terms that characterize the SCF topic area introduced at the beginning of this section, such as Factoring, Inventory Finance, and Trade Credit, in line with the criteria chosen in the bibliometric study by Xu et al. (2018). The second search criterion contains terms related with Finance and which are in turn associated with Supply Chain, with the following search string: (Terms associated with SCF) OR (Terms associated with Finance AND Terms associated with Supply Chain) (Table 2).

The search was performed by topic using the Topic (TS) command in WoS, which includes terms from the research topic area located in the title, in the abstract, and in the keywords. It should be clarified that we opted to use the operator NEAR/x, an operator modality of AND. NEAR/x was used to find records that appear in the same document, but where the terms joined by the operator are within a particular number of words from each other. Thus, the operator NEAR/8 was used (Table 2). The search TS = (financ* NEAR/8 “supply chain*”) (i) finds records that contain financ* and supply chain* that are at most 8 words from each other, e.g., “It is critical for automobile industry supply chains to find seamless financing to operate”, and (ii) excludes records that contain, for example, the term “financial accounting” at the beginning of an article’s abstract and the term “supply chain” at the end. Despite the possibility of some records being excluded from the search, the number of results obtained allowed us to identify the main topic area of SCF dealt with in the literature. In order to guarantee that the NEAR/8 operator captured the records associated with SCF and disregarded those that are not, a visual review was performed on the titles and abstracts of a random sample of 50% of the records obtained. Later, with the help of SciMAT, it was possible to filter the records base even further.

Table 2. Search strings and key terms

|

Search criteria

|

Key terms

|

Search strings

|

|

Search Criteria 1

|

SCF related terms

|

“supply chain financ*” OR “supplier* financ*” OR “receivables financ*” OR “invoice discount*” OR “invoice financ*” OR “inventory financ*” OR “financial supply chain management” OR “reverse factoring” OR “factoring financ*” OR “financ* supply chain*” OR “financ* the supply chain*” OR “channel financ*” OR “value chain financ*” OR (“factoring” AND “financ*” AND “supply chain*”) OR (“factoring” AND (“SME” OR “SMEs”))

|

|

OR

|

|

|

Search Criteria 2

|

Financing related terms

|

financ* OR “buyer* financ*” OR “seller* financ*” OR “working capital” OR “financ* risk” OR “credit risk” OR “commercial credit” OR “trade credit” OR “trade-credit” OR “bank credit” OR “bank-credit” OR “credit” OR “lend*” OR “early payment*” OR “delay* payment*” OR “delay* in payment*” OR “payment* delay*” OR “deferred payment*” OR “payment* deferral” OR “advanc* payment*” OR “capital constrain*” OR capital-constrain* OR “financ* constrain*” OR financ*-constrain* OR “cash conversion cycle*”

|

|

NEAR/8

|

|

|

Supply Chain related terms

|

“supply chain*” OR “value chain*” OR “production network*”

|

Source: Elaboration by the authors from the advanced search engine of WoS

4. Analysis and Results

This article contributes to the identification of leading, new, and emerging topics that currently characterize SCF based on more robust search criteria than those used previously in the literature. Indeed, Parida et al. (2021) warned that no other study on SCF had used an exhaustive combination of keywords as search criteria in the literature review as they did not consider all the financial and operational aspects. This work seeks to contribute towards correcting those previous shortcomings.

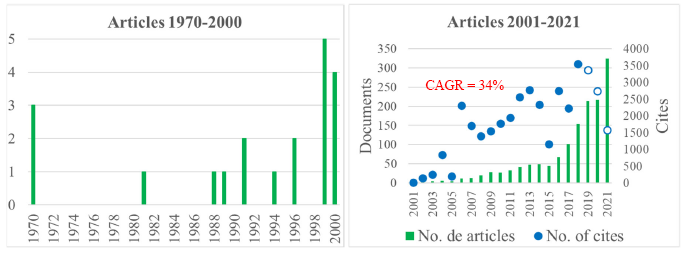

4.1. Historical evolution and performance analysis of the scientific production

The trends in the evolution and development of SCF have been very uneven throughout its history, characterized by an incipient interest in the mid-20th century, followed by accelerated growth in the last two decades. It can be seen that during the 20th century, no significant development was recorded in this area, with the first article being published in 1912 in the Journal of Accountancy followed by very sparse production until the 1980s, when it began to pick up marginally to reach a maximum in 1999 of five articles (Figure 2). The citations shown for articles published in the last century are practically nil. As this field of knowledge began to emerge, it can be observed that the SCF scientific community tends to use few keywords in its publications (1 or 2 words). The dearth of information in this subperiod prevents an analysis of word cooccurrence or scientific mapping being performed.

In the 21st century, scientific production in the field shows a compound annual growth rate (CAGR) of 34% from 2001 to 2021, and accelerated growth from 2015 (39%). 81.2% of all production on SCF is concentrated in the last eight years (2014-2021), while citations grow at an accelerated pace from the turn of the century, showing a maximum of 3,548 in 2018. An upward trend is identified from 2001 to 2018 (blue circles). This analysis reveals growing interest and development in the topic area, showing that SCF represents an important area for research in the future. It should be noted, however, that the more recent the publication date, the lower the number of citations due to the shorter time that articles have been available to the scientific community since first appearing.

Figure 2. Number of SCF studies on Web of Science database

Source: Elaboration by the authors based on WoS output

After obtaining the evolution data described above, the keywords were classified. The prepared file from WoS was imported into SciMAT to carry out the necessary corrections, categorizations, and analysis. Thus, duplicated keywords in articles were omitted in a filtering process to improve the accuracy and quality of the results (Cobo et al., 2012). The result was a total of 4,567 keywords that appeared in at least one document, of which 50 were concentrated in 34% of the total appearance frequency for keywords over the whole 1970-2021 period.

Using the word cloud technique, the ten most used keywords in the SCF field are Trade Credit, Supply Chain Finance, Supply Chain Management, Supply Chain, Management, Impact, Model, Performance, Policy, and Risk (Figure 3). It is worth noting that the first four keywords in this list coincide with those identified by Minh (2022), a leading author in SCF Bibliometry.

Analyzing the authors with the greatest scientific production in line with SCF (Table 3) reveals that the author with the most articles is Xiangfeng Chen, with 16 (left-hand section of the table). The most cited authors are Norris Krueger, Michael Reilly and Alan Carsrud with 2,116 citations from an article called “Competing models of entrepreneurial intentions” on incentives for entrepreneurship (right-hand section). However, it should be noted that although Table 3 shows the authors with the greatest production in topics related to SCF, Minh (2022) and Parida et al. (2021) identify the leading authors in SCF as a main research line, among whom are Hans-Christian Phol, Moritz Gomm, Luca Mattia Gelsomino, Alessandro Perego, Angela Tumino, Nina Yan, Xinhan Xu, David Wuttke, Dileep More, Preetam Basu, Federico Caniato, and John Liebl.

Figure 3. Top keywords in SCF field

Source: Elaboration by the authors from both “Words manager” module provided by SciMAT and www.nubedepalabras.es

Table 3. Performance by authors

|

Authors with most articles

|

|

Authors with most citations

|

|

Authors

|

Documents

|

Cites

|

|

Authors

|

Documents

|

Cites

|

|

Chen, Xiangfeng

|

16

|

784

|

|

Krueger, Norris F.

|

1

|

2,116

|

|

Bi, Gongbing

|

11

|

134

|

|

Reilly, Michael D.

|

1

|

2,116

|

|

Hofmann, Erik

|

10

|

384

|

|

Carsrud, Alan L.

|

1

|

2,116

|

|

Yan, Nina

|

10

|

223

|

|

Boons, Frank

|

1

|

923

|

|

Yan, Honglin

|

10

|

107

|

|

Ludeke, Florian

|

1

|

923

|

Source: Elaboration by the authors from the “Authors manager” and “Documents manager” modules provided by SciMAT

The five journals with most articles published include 17.5% of all articles (Table 4). They prioritize subjects of industrial organization, administration, and sustainability of SCs as a response to growing concern and increased awareness surrounding environmental protection (Zhao, 2018). That is, topics related directly to SCs, which is why these are the most productive journals on questions of SCF. This centers the subject within the area of logistics and production process administration.

Table 4. Most productive journals in the area

|

Journal

|

Launch date

|

Documents

|

%

|

|

International Journal of Production Economics

|

1991

|

89

|

6.2

|

|

Sustainability

|

2009

|

59

|

4.1

|

|

Computers & Industrial Engineering

|

1976

|

43

|

3.0

|

|

International Journal of Production Research

|

1961

|

32

|

2.2

|

|

Journal of Cleaner Production

|

2003

|

29

|

2.0

|

Source: Elaboration by the authors from the module “Journals manager” of SciMAT

4.2. Science mapping analysis

Science mapping analysis is a technique that aims to follow a scientific area over time in order to understand its structure, development, and its main participants (Noyons et al., 1999). The different types of information that can be used are known as units of analysis. The unit of analysis chosen for this study is “keyword”.

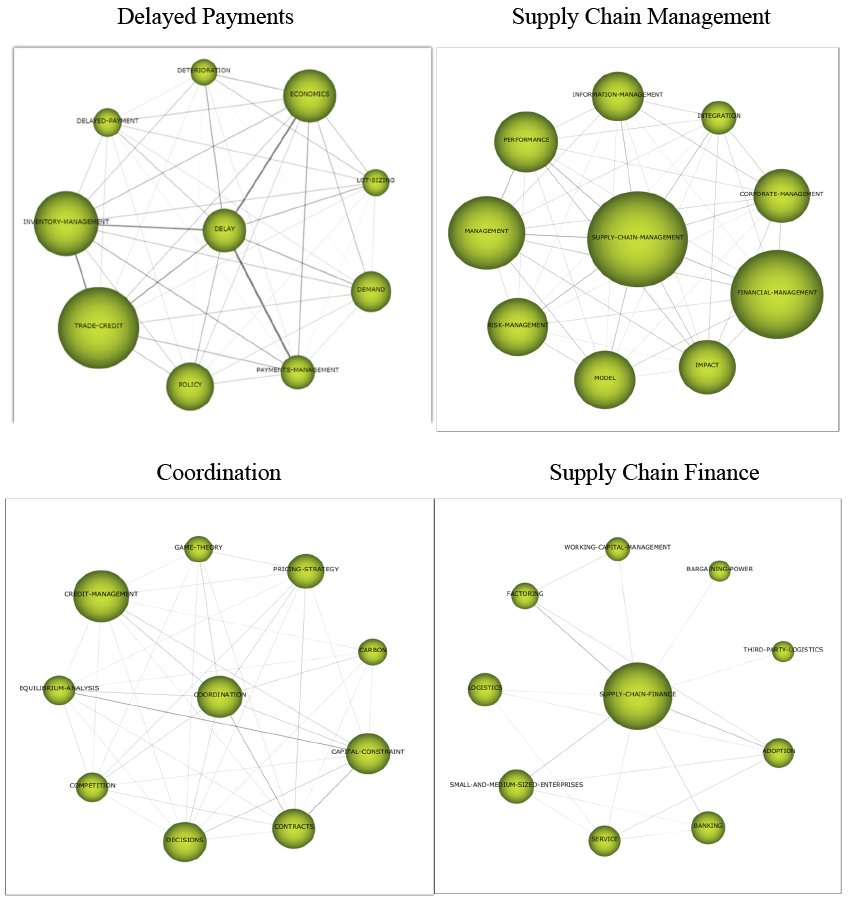

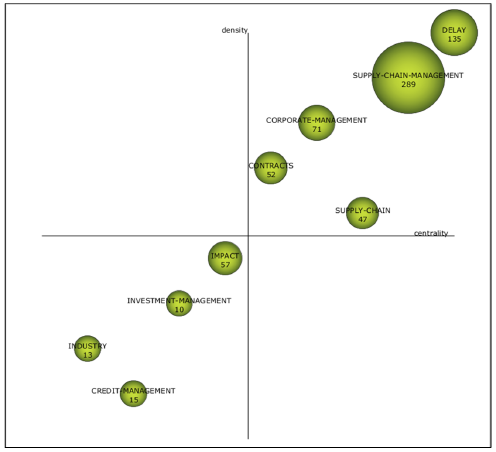

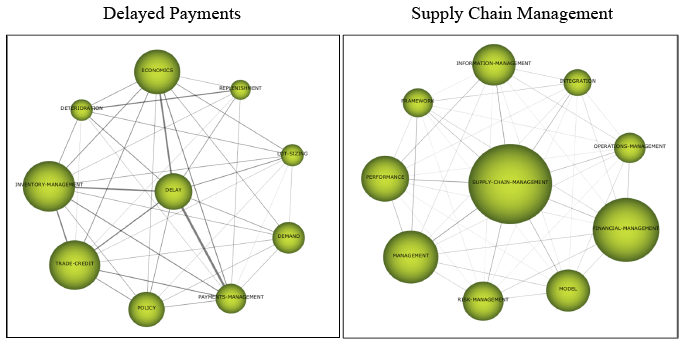

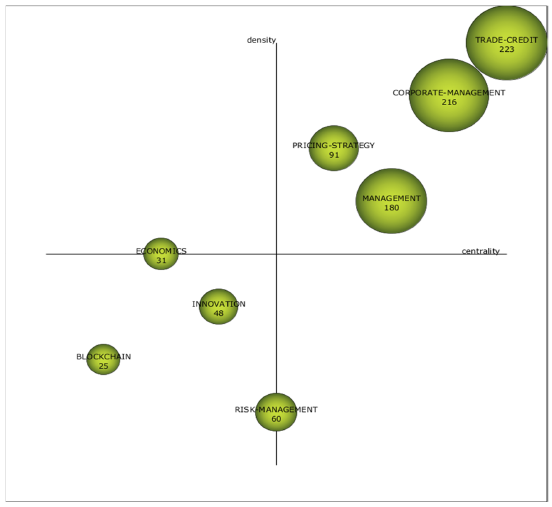

To perform an analysis using SciMAT, both a Strategic Diagram and Thematic Network are constructed. These make it possible to identify the main topics within a scientific field, showing their conceptual and cognitive aspects (Cobo, 2012). This analysis included both the whole 1970-2021 period and the 2001-18 (SP-2) and 2019-21 (SP-3) subperiods, shown in Figures 4, 5, and 6, respectively. The volume of the spheres is proportional to the number of documents associated with each topic in both the Strategic Diagram and the Thematic Network, and, in the latter, the thickness of the link between two spheres is proportional to the equivalence index, i.e., the degree of co-occurrence of two keywords in the same document.

1970-2021 period

Based on the Strategic Diagram (Figure 4a) and quantitative metrics (Table 5) for the entire 1970-2021 period, it is notable that the SCF topic area has a low centrality and density and is subordinated to SCM (driving topic) as a field of knowledge of greater breadth, centered on supply chain logistics and processes administration management. Regarding the metrics for the number of documents, later citations, and impact (h-index), it can be observed that : (1) Supply Chain Management is the main driving topic, standing out in relation to all others in terms of number of documents, citations, and h-index, followed by Delayed Payments, Coordination, and Sustainability; (2) The specialized topics show that SCF has positive results in the three criteria and Data Management scores low in them; (3) The basic and overarching topics, Products and Optimization, were found in fewer documents, obtained fewer citations, and had a lower subsequent impact; (4) The emerging or declining topics Global Value Chains, Determinants, and Systems showed poor performance in all three criteria; (5) The topics with high centrality and number of received citations show strong correlation.

From the thematic network (Figure 4b), a close relationship can be observed that exists between one of the topics emerging in the Strategic Diagram and the following subtopics:

(1) Delay with Trade Credit, Inventory Management, Payments Management, and Economics; (2) Supply Chain Management with Financial Management, Performance, and Risk Management; (3) Coordination with Credit Management, Capital Constraint, and Equilibrium Analysis; (4) Supply Chain Finance with Factoring, Working Capital Management, Banking, and SME; (5) Determinants with Collaboration, Competitive Advantage, and Supplier Financing; and (6) Global Value Chains with Globalization, Governance, and Shareholder Value.

2001-18 (SP-2) and 2019-21 (SP-3) subperiods

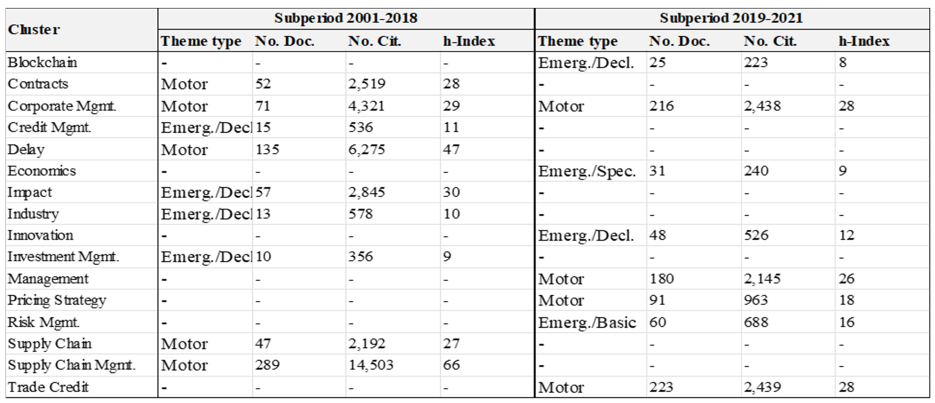

An analysis of the Strategic Diagrams for SP-2 (Figures 5a and 6a, and Table 6) reveals that the most relevant driving topics in terms of quality indicators start with Supply Chain Management, which is a long way ahead of Delayed Payments, Corporate Management, and Supply Chain. The driving topics for SP-3 are Trade Credit, Corporate Management, and Management, a long way ahead of Pricing Strategy. It is worth highlighting that the topic of SCF no longer appears in the strategic diagrams of any subperiod but in the thematic networks as a marginal topic associated with Trade Credit (2019-21). Likewise, the topic Corporate Management is also notable not only for prevailing during both subperiods but also because it becomes significantly strengthened in the second, increasing from 71 to 216 documents (Table 6). It can also be seen that, despite the major relevance of the Supply Chain Management topic in SP-2 as a driving topic, it does not appear in SP-3. However, it does represent an important topic associated with the thematic network for Corporate Management.

Figure 4. Strategic diagram and thematic network of the SCF field 1970-2021

a) Strategic diagram

b) Thematic network

Source: Elaboration by the authors from the “Analysis view” module provided by SciMAT

Table 5. Performance metrics 1970-2021

Source: Elaboration by the authors from the “Analysis view” module provided by SciMAT

Figure 5. Strategic diagram and thematic network of the SCF field 2001-2018

a) Strategic diagram

b) Thematic network

Source: Elaboration by the authors from the “Analysis view” module provided by SciMAT

Figure 6. Strategic diagram and thematic network of the SCF field 2019-2021

a) Strategic diagram

b) Thematic network

Source: Elaboration by the authors from the “Analysis view” module provided by SciMAT

Regarding the topics with low centrality and density located in the third quadrant of the Strategic Diagram for SP-2 (Credit Management, Impact, Industry, and Investment Management), they can be considered as in decline as they do not reappear in SP-3. The topics located in the same quadrant for SP-3 (Blockchain, Economics, Innovation, and Risk Management), can be considered as emerging on the basis of the new trends identified in the literature review.

Table 6. Performance metrics per subperiod

Source: Elaboration by the authors from the “Analysis view” module provided by SciMAT

5. Discussion

The findings in this study suggest that scientific production on SCF was sluggish throughout the last century and the beginning of this one, which expresses how the phenomenon under study has evolved in reality. Although the history of research into SCF dates back to the 1970s (Huang et al., 2022; Xu et al., 2018), the first formal definition does not appear until the start of the 21st century (Xu et al., 2018). Budin and Eapen (1970) investigated the impact of trade credit and inventory management on generated cash flow. Haley and Higgins (1973) used a lot-size model to study the relationship between trade credit policy and inventory policy. Likewise, vertical integration of intra-firm SCs in the case of firms operating in the international market, and local market features in the case of SMEs, could explain the lack of interest in a topic which was not a challenge at the time. Financing was resolved by firms’ internal administrative logistics and the instruments of the traditional banking system. However, the globalization that began with the financial crisis of the 1970s has driven, beyond trade, a fragmentation of production and service delivery, making the administration of finance between companies more complex due to the growth in subcontracting. The relationship with suppliers goes beyond the classical one of buying and selling and has evolved towards associative and cooperative mechanisms. The SC evolves from intra-firm logistics to an inter-firm one, which leads to a need to clarify ad hoc finance mechanisms.

Current research into SCF dates back to the last global financial crisis of 2008-2009 (Huang et al., 2022). Due to a lack of knowledge on working capital management, firms and their SCs suffered liquidity problems and found themselves with immense difficulties accessing finance from banks (Gelsomino et al., 2016a; Liebl et al., 2016; More & Basu, 2013; Wandfluh et al., 2016).

Regarding scientific production on SCF, it has shown a notable increase since 2014 as a result of uncertainty in the global financing of SCs (Olan et al., 2022), and it is possible to appreciate concerns about the new finance mechanism of the Digital Economy, the role technological advances play in accelerated adoption of SCF in the post-pandemic context, and the challenge of financing ecological projects that contribute to sustainability goals. The need to deal with these questions became increasingly urgent for firms, especially for SMEs with difficulties accessing finance (Caniato et al., 2016; Gelsomino et al., 2016a), a question that has been favorably tackled by SCF.

Regarding the two subperiods analyzed in this study, SP-2 is particularly important in economic terms because it falls between two major crises: 2001 (dot com bubble) and 2007-2009 (real estate bubble), and the contraction or regionalization of global value chains. During this period, the presence of large global suppliers (especially from Asia) grew and, in this sense, SC analysis paid special attention to these economic agents. Likewise, development of the topic is concentrated in SC corporate administration. This can be explained by the growth in large supplier firms, contracts associated with the complexity of logistics, and links to payment delays. For SP-3, inventory models integrated into SCs consider payment delays and price strategies as key variables that define the success of a commercial relationship between the trading parties in SCs (Chen & Kang, 2010). Additionally, demand is considered in the literature as being sensitive not only to the price offered to the buyer, but also the publicity costs incurred and the financial cost for deferring the payment. Given that SCF is now increasingly attracting attention, the volume of literature has increased as a consequence (Huang et al., 2022). However, research into SCF or the interface of operations and finance is still in its infancy due to its novel character. Furthermore, it should be noted that the challenges in financing go beyond the realm of the firm and enter matters of public policy on regulation.

Likewise, through the keyword analysis and word cloud, this study evinces great semantic fragmentation in the SCF field, on top of the disconnection between the theories that attempt to explain it. The large number of terms arising around SCF contain similar, but unclear, meanings, creating confusion in semantic aspects (e.g., Supply Chain Finance, Supplier Finance, Receivables Finance, Factoring, Reverse Factoring, Confirming, etc.). One of the most commonplace instruments for SCF is Reverse Factoring and both terms (SCF and Reverse Factoring) are often used indistinctly (Huang et al., 2022), despite having different meanings. The concept of SCF is partially isolated from all the other topic areas and is subordinated to SCM as a field of knowledge of greater breadth, which has to do with logistics and production process management in SCs. This can also be seen in the most productive journals on SCF matters, which are characterized by being about production process management (Table 4). Indeed, the strategic diagrams for each subperiod show that SCF does not even emerge as a relevant topic, but rather as a marginal one in the thematic networks (Figures 5 and 6). The apparent dissociation for SCF from SCM could be due to a possible development of SCF rendered invisible by semantic questions derived from a high degree of literary fragmentation and a dearth of consensus on terms (Gelsomino et al., 2016a; Xu et al., 2020). This situation complicates the study of SCF and deepens the concern that studies on SCF are far from offering a comprehensive framework (Gelsomino et al., 2016a; Parida et al., 2021). This, in turn, highlights the need to classify, order, and unify the theories and terms that make up the field of SCF and the financing solutions that stem from it, thus managing a consensus definition that is widely accepted by the scientific and business community and which eases its understanding, analysis, and development.

Additionally, a close relationship can be seen in the thematic networks between SCF and Factoring, due to the latter being a tool in the SCF framework. Also of note is the relationship between SCF and SMEs due to the challenges that such firms have in their financing strategy, although the link between SMEs and Factoring is noticeable by its absence. There is, on the other hand, a relationship between the size of firms (SMEs), services, and Banking, pointing perhaps to more traditional models of financing given the relationship between Banking and SCF. This relationship, however, must be analyzed by considering the size and age of the firm, which are aspects that have considerable influence on financing decisions (Cassar, 2004).

Regarding delayed payment, this emerges as a driving topic in SP-2 and shows a close relationship with the Trade Credit topic in the thematic networks. This is because, in essence, trade credit consists of a short-term loan granted by a supplier that finances the acquisition of a good or service, allowing the buyer to defer payment, and it is considered one of the most widely used sources of liquidity by firms (Gelsomino et al., 2016b). In this sense, trade credit constitutes a form of financial disintermediation closely linked to SCF, and can be considered a valuable coordination tool within an SC. This form of finance is used more in countries with greater barriers for SMEs when accessing finance and mobilizes large volumes of funds (Klapper, 2006).

Finally, in line with the findings of other authors of bibliometric analyses (Minh, 2022; Xu et al., 2018), a preliminary analysis of more recent SCF studies (2019–2022) reveals that topics of great potential are emerging such as Sustainability (Parida et al., 2021; Tseng et al., 2021; Xu et al., 2018; Zhao, 2018) and new technologies like Blockchain (Du et al., 2020; Fabrizio et al., 2019; Rijanto, 2021), key elements for the future development of financial management, resilience, and stability in SCs within a framework of sustainability in the context of crises like those brought on by the Covid-19 pandemic and the conflict between Russia and Ukraine.

Indeed, practically all authors of bibliometric analyses agree on the importance of sustainability in SCs in the development of SCF as a response to the growing concern and greater awareness surrounding environmental protection (Tseng et al., 2021; Xu et al., 2018; Zhao, 2018). Parida et al. (2021) suggest that, in the context of the pandemic, the regulatory authorities and trading parties involved need to focus more on critical aspects of SCs to make them more sustainable. SCs are as strong as their weakest link and, according to Bickers (2021), the firms that form them are increasingly aware of the risks posed by climate change. The data suggest that those firms with SC strategies oriented towards sustainability are better positioned to cope with the environmental disruptions that may occur.

Regarding new technology, several authors on Bibliometry agree that the emergence of Blockchain is a central topic area in SCF development (Minh, 2022; Parida et al., 2021; Tseng et al., 2021). Indeed, technological innovation is a constant in the SCF market, characterized by new players, FinTech and electronic platforms (Bickers, 2021), strengthened by Blockchain technologies that digitize global value chains (Hofmann et al., 2017). Likewise, given its level of security, Blockchain is highly likely to become an interesting technology in the future of SCF as when it is incorporated into public registries for both assets and accounts receivable assigned to third parties through SCF operations, it translates into increased legal certainty about the legitimacy of the invoices, thus reducing the risks of fraud through double discounts through Factoring (Lycklama et al., 2017). Bearing in mind the complex nature of SCs today, Blockchain is expected to speed up processes and make them more reliable (Cole et al., 2019; Kim & Laskowski, 2016). Indeed, the advance of this technology offers an opportunity for innovation in the development of the so-called smart Factoring (Hofmann et al., 2017), which is closely linked to the SCF topic field.

6. Conclusions

SCF is a fundamental tool in the global economy that facilitates the operation and growth of firms, particularly in an increasingly interconnected world. This type of finance is especially important for SMEs, many of which are family run firms, as they often face greater financial limitation and cash account problems than large firms. However, when they belong to a supply chain, SMEs can access finance more easily as they have the backing of large corporations governing the SCs and can benefit from guaranteed long-term contracts. In turn, SMEs can strengthen the financing of the SC by establishing solid relationships with suppliers, implementing digital payment and invoicing systems, considering the various finance options offered by banks to the SC, overseeing cashflow and payment terms, and seeking expert advice.

In order to identify and visualize the conceptual structure of SCF focusing on SMEs, this study has performed a bibliometric analysis which has assessed the performance of scientific production in the area, identifying the main trends in scientific research in this area of knowledge. The study is based on more robust search criteria than those used previously in the literature, as well as a longitudinal analysis from 1970 to 2021.This analysis shows that SCF is at the core of SCM as a broader field of knowledge, which encompasses the production and logistics processes in SCs. The bibliometric analysis has shown that SCF is partially disconnected from other driving topics such as SCM, Trade Credit, and Delayed Payments, because semantic questions around the concept of SCF may render it invisible.

This study has made it possible to identify, on the one hand, how interest in SCF has grown in recent years, particularly since 2019, which contrasts with the scant interest of the 20th century. It has been an evolution in which intra-firm SCs shifted at the end of the last century towards associative and cooperative commercial relationships in which SCF, as a financial mechanism, began to gain relevance in the literature. Over recent decades, technological innovation and the digital economy have had a major impact on SCF, favoring the development of new products, processes, and customers. The rapid rise in the growth of FinTechs is beginning to eat into the market share of traditional financial intermediaries, which has made SCF more accessible and versatile as a response to customer needs. The post Covid-19 crisis has opened up a new era for the SCF market with remote working or the adoption of digital technologies. Some of these changes may remain, particularly the greater take up of digitalization, which opens up a path of opportunities for SCF.

SCF is a burgeoning area of research, shifting from the old, non-cooperative financing models of the 20th century to the cooperative models we have seen in SCs in recent years. In this paper, we note new trends, such as more collaborative determinants of adoption as opposed to the operational determinants highlighted by previous literature.

One of the main results of this work has been to clarify the different driving topics that are leading the trends in SCF as an area of research. For the entire period analyzed (1970-2021), SCM, Delayed Payments, Coordination, and Sustainability stand out. If we focus on the most recent subperiod (SP-3), these are Trade Credit, Corporate Management, Management, and Pricing Strategy. Further, in this more recent period, topics with great potential have emerged such as Blockchain and Innovation, which are key for the future development and stability of SCs. Regarding the productivity and the impact of each topic, we have observed that SCM clearly stands out for both reasons, followed by Delayed Payments.

The findings of this research underscore the great fragmentation in the literature surrounding SCF, and, therefore, the need to create a comprehensive conceptual framework for this field of knowledge, identifying the main elements that make up its essence, as well as the need to guide stakeholders throughout SCs and regulatory authorities so that they understand current trends in SCF. This would make it possible to identify the commercial opportunities and orientate policy. These contributions gain particular relevance in the complex environment that SCs are facing in the post Covid-19 era, where SCF can play a vital role. In this context, greater transparency and digitalization can release the potential for providing more finance to support firms and boost economic recovery.

The review of the works analyzed here allows identification of emerging future lines for research. Innovation, collaboration, and resilience are intrinsic aspects to the development of competitiveness, where SCF is key. Additionally, the adoption of new technologies such as Blockchain to contribute towards the sustainable performance of SCs through increased trust and transaction data validation is an area of great potential for future works on SCF. Moreover, we propose research that contrasts the findings of this paper with new research that uses different criteria for dividing up the subperiods than those used here such as, for example, using 2015 as a cut-off year, considering it to be when scientific production on SCF really took off. Finally, the way is opened up to research into the creation of a comprehensive framework for the analysis of SCF that would overcome the main limitation found in previous works on SCF, which lack a robust theoretical framework for analysis.

Funding

This work was supported by the Spanish Ministry of Science and Innovation under Grant number PID2020-116040RB-I00.

References

Abdulsaleh, A. M., & Worthington, A. C. (2013). Small and medium-sized enterprises financing: a review of literature. International Journal of Business and Management, 8(14), 36-54. https://doi.org/10.5539/ijbm.v8n14p36

Ali, Z., Gongbing, B., Mehreen, A., & Ghani, U. (2020). Predicting firm performance through supply chain finance: a moderated and mediated model link. International Journal of Logistics Research and Applications, 23(2), 21-138. https://doi.org/10.1080/13675567.2019.1638894

Alos-Simo, L., Verdu-Jover, A. J., & Gómez-Gras, J. M. (2022). The influence of evolution of the environment on export in family firms. European Research on Management and Business Economics, 29(1), 100204. https://doi.org/10.1016/j.iedeen.2022.100204

Aparicio, G., Iturralde, T., & Maseda, A. (2019). Conceptual structure and perspectives on entrepreneurship education research: a bibliometric review. European Research on Management and Business Economics, 25(3), 105-113. https://doi.org/10.1016/j.iedeen.2019.04.003

Araya-Castillo L., Hernández-Perlines F., Millán-Toledo C., Ibarra Cisneros, M. A. (2022). Bibliometric analysis of studies on family firms. Economic Research-Ekonomska Istrazinvanja, 35(1), 4778-4800. https://doi.org/10.1080/1331677X.2021.2018003

Arteche-Bueno, L., Prado-Román, C., & Fernández-Portillo, A. (2019). Private equity focused on family firms & small and medium sized companies: review and science mapping analysis of the recent scientific field. European Journal of Family Business, 9(2), 146-158. https://doi.org/10.24310/ejfbejfb.v9i2.5285

Ayyagari, M., Demirgüç-Kunt, A., & Maksimovic, V. (2012). Financing of firms in developing countries: lessons from research. World Bank Policy Research Working Paper 6036. https://ssrn.com/abstract=2039204

Bickers, M. (2021). World factoring yearbook. BCR Publishing Ed., Bromley, UK.

Brandenburg, M. (2016). Supply chain efficiency, value creation and the economic crisis - An empirical assessment of the European automotive industry 2002–2010. International Journal of Production Economics, 171(3), 321-335. https://doi.org/10.1016/j.ijpe.2015.07.039

Budin, M., & Eapen, A. (1970). Cash generation in business operations: some simulation models. The Journal of Finance, 25(5), 1091-1107. https://doi.org/10.2307/2325581

Buzacott, J. A., & Zhang, R. Q. (2004). Inventory management with asset-based financing. Management Science, 50(9), 1274-1292. https://doi.org/10.1287/mnsc.1040.0278

Callon, M., Courtial, J. P., & Laville, F. (1991). Co-word analysis as a tool for describing the network of interactions between basic and technological research: the case of polymer chemistry. Scientometrics, 22(1), 155-205. https://doi.org/10.1007/BF02019280

Camerinelli, E. (2009). Supply chain finance. Journal of Payments Strategy & Systems, 3(2), 114-128.

Caniato, F., Gelsomino, L. M., Perego, A., & Ronchi, S. (2016). Does finance solve the supply chain financing problem? Supply Chain Management: An International Journal, 21(5), 534-549. https://doi.org/10.1108/SCM-11-2015-0436

Cassar, G. (2004). The financing of business start-ups. Journal of Business Venturing, 19(2), 261-283. https://doi.org/10.1016/S0883-9026(03)00029-6

Chen, X., & Cai, G. (2011). Joint logistics and financial services by a 3PL firm. European Journal of Operational Research, 214(3), 579-587. https://doi.org/10.1016/j.ejor.2011.05.010

Chen, L. H., & Kang, F. S. (2010). Integrated inventory models considering permissible delay in payment and variant pricing strategy. Applied Mathematical Modelling, 34(1), 36-46. https://doi.org/10.1016/j.apm.2009.03.023

Cobo, M. J. (2012). SciMat: herramienta software para el análisis de la evolución delconocimiento científico. Propuesta de una metodología de evaluación. Spain: Doctoral dissertation, University of Granada, Granada.

Cobo, M. J., Chiclana, F., & Collopo, A. (2014). A bibliometric analysis of the intelligent transportation systems research based on science mapping. IEEE Transactions on Intelligent Transportation Systems, 15(2), 901-908. https://doi.org/10.1109/TITS.2013.2284756

Cobo, M. J., López-Herrera, A. G., Herrera-Viedma, E., & Herrera, F. (2011). An approach for detecting, quantifying, and visualizing the evolution of a research field: a practical application to the fuzzy sets theory field. Journal of Informetrics, 5(1), 146-166. https://doi.org/10.1016/j.joi.2010.10.002

Cobo, M. J., López-Herrera, A. G., Herrera-Viedma, E., & Herrera, F. (2012). SciMAT: a new science mapping analysis software tool. Journal of the Association for Information Science and Technology, 63(8), 1609-1630. https://doi.org/10.1002/asi.22688

Cole, R., Stevenson, M., & Aitken, J. (2019). Blockchain technology: implications for operations and supply chain management. Supply Chain Management, 24(4), 469-483. https://doi.org/10.1108/SCM-09-2018-0309

Cotler, P. (2015). Crédito de proveedores, tamaño de empresa e informalidad. El Trimestre Económico, 82(327), 559-582.

Coulter, N., Monarch, I., & Konda, S. (1998). Software engineering as seen through its research literature: A study in co-word analysis. Journal of the American Society for Information Science, 49(13), 1206-1223.

D’Angelo, A., Majocchi, A., & Buck, T. (2016). External managers, family ownership and the scope of SME internationalization. Journal of World Business, 51(4), 534-547. https://doi.org/10.1016/j.jwb.2016.01.004

Dello Iacono, U., Reindorp, M., & Dellaert, N. (2015). Market adoption of reverse factoring. International Journal of Physical Distribution & Logistics Management, 45(3), 286-308. https://doi.org/10.1108/IJPDLM-10-2013-0258

Du, M., Chen, Q., & Xiao, J. (2020). Supply chain finance innovation using blockchain. IEEE Transactions on Engineering Management, 67(4), 1045-1058. https://doi.org/10.119/TEM.2020.2971858

Fabrizio, N., Rossi, E., & Martini, A. (2019). Invoice discounting: a Blockchain-based approach. Frontiers in Blockchain, 2(13), 1-10. https://doi.org/10.3389/fbloc.2019.00013

Gelsomino, L. M., Mangiaracina, R., & Perego, A. (2016a). Supply chain finance: a literature review. International Journal of Physical Distribution and Logistics Management, 46(4), 348-366. https://doi.org/10.1108/IJPDLM-08-2014-0173

Gelsomino, L. M., Mangiaracina, R., & Perego, A. (2016b). Supply chain finance: modeling a dynamic discounting programme. Journal of Advanced Management Science, 4(4), 283-291. https://doi.org/10.12720/joams.4.4.283-291

Gereffi, G., & Fernández-Stark, K. (2018). Global value chain analysis: a primer. In Gereffi G. (Ed.), Global value chains and development. Redefining the contours of 21st century capitalism. Cambridge University Press.

Gomm, M. (2010). Supply chain finance: applying finance theory to supply chain management to enhance finance in supply chains. International Journal of Logistics Research and Applications, 13(2), 133-14. https://doi.org/10.1080/13675560903555167

Haley, C. W., & Higgins, R. C. (1973). Inventory policy and trade credit financing. Management Science, 20(4), 464-471. https://doi.org/10.1287/mnsc.20.4.464

Hernández-Linares, R., & Arias-Abelaira, T. (2022). Adapt or perish! A systematic review of the literature on strategic renewal and the family firm, European Journal of Family Business, 12(2), 137-155. https://doi.org/10.24310/ejfbejfb.v12i2.14718

Hofmann, E., & Johnson, M. (2016). Supply chain finance (SCF) – some conceptual thoughts reloaded. International Journal of Physical Distribution & Logistics Management, 46(4), 1-8. https://doi.org/10.1108/IJDLM-01-2016-0025

Hofmann, E., & Kotzab, H. (2010). A supply chain-oriented approach of working capital management. Journal of Business Logistics, 31(2), 305-330. https://doi.org/10.1002/j.2158-1592.2010.tb00154.x

Hofmann, E., & Locker, A. (2009). Value-based performance measurement in supply chains: a case study from the packaging industry. Production Planning and Control, 20(1), 68–81. https://doi.org/10.1080/09537280802685272

Hofmann, E., Strewe, U. M., & Bosia, N. (2017). Supply chain finance and blockchain technology. The case of reverse securitization. Springer, Cham.

Huang, C., Chan, F. T., & Chung, S. H. (2022). Recent contributions to supply chain finance: towards a theoretical and practical research agenda. International Journal of Production Research, 60(2), 493-516. https://doi.org/10.1080/00207543.2021.1964706

Instituto Nacional de Estadística, Geografía e Informática (Inegi) (2018). Encuesta nacional sobre productividad y competitividad de las micro, pequeñas y medianas empresas (Enaproce). https://www.inegi.org.mx/programas/enaproce/2018/

Ishida, S. (2020). Perspectives on supply chain management in a pandemic and the post-Covid-19 era. IEEE Engineering Managment Review, 48(3), 146-152. https://doi.org/10.1109/EMR.2020.3016350

Jansen, J. H, Taschner, A., & Beyer, H. (2018). Supply chain finance in SMEs: a comparative study in the automotive sector in Germany and the Netherlands, Tijdschrift voor Toegepaste Logistiek, 5, 58-81. http://www.kennisdclogistiek.nl/publicaties/supply-chain-finance-in-smes-a-comparative-study-in-the-automotive-sector-in-germany-and-the-netherlands

Jin, W., Zhang, Q., & Lou, J. (2019). Non-collaborative and collaborative financing in a bilateral supply chain with capital constraints. Omega, 88, 210-222. https://doi.org/10.1016/j.omega.2018.04.001

Kayani, U. N., De Silva, T. A., & Gan, C. (2019). A systematic literature review on working capital management – an identification of new avenues. Qualitative Research in Financial Markets, 11(3), 352-366. https://doi.org/10.1108/QRFM-05-2018-0062

Kilpatrick, J. (2022). Supply chain implications of the Russia-Ukraine conflict. Retrieved from Deloitte insights. https://www2.deloitte.com/xe/en/insights/focus/supply-chain/supply-chain-war-russia-ukraine.html

Kim, H. M., & Laskowski, M. (2016). Towards an ontology-driven blockchain design for supply chain provenance. Intelligent Systems in Accounting, Finance, and Management, 25(1), 18-27. https://doi.org/10.1002/isaf.1424

Klapper, L. (2006). The role of factoring for financing small and medium enterprises. Journal of banking & Finance, 30(11), 3111-3130. https://doi.org/10.1016/j.jbankfin.2006.05.001

Kumar, R., & Mishra, R. (2020). COVID-19 global pandemic: impact on management of supply chain. International Journal of Emerging Technology and Advanced Engineering, 10(4), 132-139.

Lamoureux, J. F., & Evans, T. A. (2011). Supply chain finance: a new means to support the competitiveness and resilience of global value chains, Working paper 2179944, Social Science Research Network, Rochester, NY. http://dx.doi.org/10.2139/ssrn.2179944

Lampón, J. F., Cabanelas, P., & Delgado-Guzmán, J. A. (2018). Claves en la evolución de México dentro de la cadena de valor global de la industria de autopartes. El caso del Bajío. El Trimestre Económico, 85(3), 483-514. https://doi.org/10.20430/ete.v85i339.259

Lampón, J. F., Pérez-Elizundia, G., & Delgado-Guzmán, J. A. (2021). Relevance of the cooperation in financing the automobile industry’s supply chain: the case of reverse factoring. Journal of Manufacturing Technology Management, 32(5), 1094-1112. https://doi.org/10.1108/JMTM-11-2020-0452

Lampón, J. F., Rodríguez-De La Fuente, M., & Fraiz-Brea, J. A. (2022). The dilemma of domestic suppliers on the periphery of the automotive industry global value chain. Kybernetes, 51(12), 3637-3655. https://doi.org/10.1108/K-01-2021-0073

Liebl, J., Hartmann, E., & Feisel, E. (2016). Reverse factoring in the supply chain: Objectives, antecedents, and implementation barriers. International Journal of Physical Distribution & Logistics Management, 46(4), 393-413. https://doi.org/10.1108/IJPDLM-08-2014-0171

Lind, L., Pirttilä, M., Viskari, S., Schupp, F., & Kärri, T. (2012). Working capital management in the automotive industry: financial value chain analysis. Journal of Purchasing and Supply Management, 18(2), 92-100. https://doi.org/10.1016/j.pursup.2012.04.003

Liu, X., Zhou, L., & Wu, Y. C. J. (2015). Supply chain finance in China: business innovation and theory development. Sustainability, 7(11), 14689-14709. https://doi.org/10.3390/su71114689

López-Herrera, A. G., Herrera-Viedma, E., Cobo, M. J., Martínez, M. A., Kou, G., & Shi, Y. (2012). A conceptual snapshot of the first decade (2002-2011) of the international journal of information technology & decision making. International Journal of Information Technology & Decision Making, 11(02), 247-270. https://doi.org/10.1142/S0219622012400020

Lycklama, H., Oudejans, J., & Erkin, Z. (2017). DecReg: a framework for preventing double-financing using blockchain technology. Cyber Security Group, Department of Intelligent Systems, Delft University of Technology. https://doi.org/10.1145/3055518.3055529

Mann, O. A. (1918). Working capital for rate-making purposes. Journal of Accountancy (Pre-1986), 26(5), 340-342.

Mazandarani, M. R., & Royo-Vela, M. (2022). Firms’ internationalization through clusters: a keywords bibliometric analysis of 152 top publications in the period 2009-2018. Management Letters, 22(1), 229-242. https://doi.org/10.5295/cdg.211483mr

Meijer, C. R. W., & Bruijn, M. (2013). Cross-border supply-chain finance: an important offering in transaction banking. Journal of Payments Strategy & Systems, 7(4), 304-318.

Minh, N. (2022). A bibliometric analysis of the supply chain finance research. International Journal of Advanced and Applied Sciences, 9(1), 84-90. https://doi.org/10.21833/ijaas.2022.01.010

Modansky, R. A., & Massimino, J. P. (2011). Asset-based financing basics. Journal of Accountancy, . https://www.journalofaccountancy.com/issues/2011/aug/20113992.html

Moon, B. (2022). Unleash liquidity constraints or competitiveness potential: the impact of R&D grant on external financing on innovation. European Research on Management and Business Economics, 28(3), 100195. https://doi.org/10.1016/j.iedeen.2022.100195

More, D., & Basu, P. (2013). Challenges of supply chain finance: a detailed study and a hierarchical model based on the experiences of an Indian firm. Business Process Management Journal, 19(4), 626-647. https://doi.org/10.1108/BPMJ-09-2012-0093

Noyons, E. C., Moed, H. F., & Luwel, M. (1999). Combining mapping and citation analysis for evaluative bibliometric purposes: a bibliometric study. Journal of the Association for Information Science and Technology, 50(2), 115-131. https://doi.org/10.1002/(SICI)1097-4571(1999)50:2<115::AID-ASI3>3.0.CO;2-J

Olan, F., Arakpogun, E. O., Jayawickrama, U., Suklan, J., & Liu, S. (2022). Sustainable supply chain finance and supply networks: the role of artificial intelligence. IEEE Transactions on Engineering Management. https://doi.org/10.1109/TEM.2021.3133104

Parida, R., Dash, M. K., Kumar, A., Zavadskas, E. K., Luthra, S., & Mulat-weldemeskel, E. (2021). Evolution of supply chain finance: a comprehensive review and proposed research directions with network clustering analysis. Sustainable Development, 30(5), 1-27. https://doi.org/10.1002/sd.2272

Paule-Vianez, J., Gómez-Martínez, R., & Prado-Román, C. (2020). A bibliometric analysis of behavioural finance with mapping analysis tools. European Research on Management and Business Economics, 26(2), 71-77. https://doi.org/10.1016/j.iedeen.2020.01.001

Pérez-Elizundia, G., Delgado-Guzmán, J. A., & Lampón, J. F. (2020). Commercial banking as a key factor for SMEs development in Mexico through factoring: a qualitative approach. European Research on Management and Business Economics, 26(3), 155-163. https://doi.org/10.1016/j.iedeen.2020.06.001

Pérez-Elizundia, G., Lampón, J. F., Delgado Guzmán, J. A. (2021). Covid-19 liquidity crisis: May reverse factoring be the solution to SME financing in Mexico? ESIC Market Economics and Business Journal, 52(3), 571-596. https://doi.org/10.7200/esicm.168.0523.3

Pérez-Elizundia, G., Lampón, J. F., Delgado-Guzmán, J. A. (2023). Cooperación en el financiamiento: implicaciones para la cadena de suministro automotriz en México. Revista de Estudios Regionales, 133, forthcoming.

Rijanto, A. (2021). Blockchain technology adoption in supply chain finance. Journal of Theoretical and Applied Electronic Commerce Research, 16(7), 3078-3098. https://doi.org/10.3390/jtaer16070168

Rodríguez-De la Fuente, M., & Lampón, J. F. (2020). Regional upgrading within the automobile industry global value chain: the role of the domestic firms and institutions. International Journal of Automotive Technology and Management, 40(3), 319-340. https://doi.org/10.1504/IJATM.2020.110409

Rodríguez-Rodríguez, O. M. (2008). El crédito comercial: marco conceptual y revisión de la literatura. Investigaciones Europeas de Dirección y Economía de la Empresa, 14(3), 35-54. https://doi.org/10.1016/S1135-2523(12)60065-3

Romero-Luna, I. (2009). PYMES y cadenas de valor globales. Implicaciones para la política industrial en las economías en desarrollo. Análisis Económico, 24(57), 199-216.

Saavedra, M. L., & Tapia, B. (2014). La determinación de la competitividad de las PYME en el Distrito Federal. Ciudad de México: Publicaciones Empresariales UNAM.

Schaal, L. D., & Haley, C. W. (1991). Introduction to Financial Management. New York, NY: Mcgraw-Hill

Shuzhen, C., Liang, L., & Zheng, Z. (2014). The financing role of factoring in China context. International Business and Management, 9(1), 103-110.

Tanrisever, F., Cetinay, H., & Reindorp, M. (2015). Value of reverse factoring in multistage supply chains. http://dx.doi.org/10.2139/ssrn.2183991

Thangam, A. (2012). Optimal price discounting and lot-sizing policies for perishable items in a supply chain under advance payment scheme and two-echelon trade credits. International Journal of Production Economics, 139(2), 459-472. https://doi.org/10.1016/j.ijpe.2012.03.030

Tseng, M. L., Bui, T. D., Lim, M. K., Tsai, F. M., & Tan, R. T. (2021). Comparing world regional sustainable supply chain finance using big data analytics: a bibliometric analysis. Industrial Management & Data Systems, 121(3), 657-700. https://doi.org/10.1108/IMDS-09-2020-0521

Van Raan, A. F. J. (2014). Advances in bibliometric analysis: Research performance assessment and science mapping. In W. Blockmans, L. Engwall, & D. Weaire (Eds.), Bibliometrics: use and abuse in the review of research performance, London: Portland Press Ltd.

Wandfluh, M., Hofmann, E., & Schoensleben, P. (2016). Financing buyer–supplier dyads: an empirical analysis on financial collaboration in the supply chain. International Journal of Logistics Research and Applications, 19(3), 200-217. https://doi.org/10.1080/13675567.2015.1065803

Wuttke, D. A., Blome, C., Foerstl, K., & Henke, M. (2013a). Managing the innovation adoption of supply chain finance – Empirical evidence from six European case studies. Journal of Business Logistics, 34(2), 148-166. https://doi.org/10.1111/jbl.12016

Wuttke, D. A., Blome, C., & Henke, M. (2013b). Focusing the financial flow of supply chains: an empirical investigation of financial supply chain management. International Journal of Production Economics, 145(2), 773-789. https://doi.org/10.1016/j.ijpe.2013.05.031

Xu, X., Chen, X., Jia, F., Brown, S., Gong, Y., & Xu, Y. (2018). Supply chain finance: a systematic literature review and bibliometric analysis. International Journal of Production Economics, 204, 160-173. https://doi.org/10.1016/j.ijpe.2018.08.003

Xu, S., Zhang, X., Feng, L., & Yang, W. (2020). Disruption risks in supply chain management: a literature review based on bibliometric analysis. International Journal of Production Research, 58(11), 3508-3526. https://doi.org/10.1080/00207543.2020.1717011