1. Introduction

Family firms play a strategic role in the economic development in countries, since about 85% of companies around the world have had their origin in a family. Family firms are especially important in emerging markets, since they represent 85% in South-East Asia, 75% in Latin America, 67% in India and around 65% in the Middle East (Briano-Turrent, et al., 2020). The market liberalization in Latin America led to an increase in the presence of family firms, showing a strong growth in the last ten years, and generating the 60% of the GPD and 80% of employment in the region (Christensen-Salem et al., 2021; Herrera-Echeverri at al., 2016). In Latin America, private and publicly traded corporations are controlled and owned by families and they face volatile macro-economic policies, political risk, high social and economic inequity, informal economies, among other social challenges (Berrone et al., 2022; Gómez-Mejía et al., 2023; Vazquez, 2017).

Although family firms research have taken great relevance around the world, their implications on the economic value generation through strategies oriented to innovation behavior is limited (Calabrò et al., 2019; Gonzales-Bustos et al., 2020). Innovation becomes a crucial mechanism to develop and maintain the competitive advantages in the ongoing turbulent market (Gonzales-Bustos et al., 2017) but also a key strategy to ensure the company’s long-term survival (Schmid et al., 2014; Torchia et al., 2011). A higher research and development (R&D) investment contributes to the country’s economic growth and long-term success, which motivates to increase the development and society’s quality of life (Kraus et al., 2012). Prior research suggests that firms are different in corporate governance structure and mechanisms, and these differences may partially explain the innovative behaviour adopted by companies (Gonzales-Bustos et al., 2020). However, there are still several gaps and mixed findings regarding how family involvement and contextual factors may impact the innovation activities in family firms (Canale et al., 2023; Kammerlander et al., 2020).

The focus of this study is Latin America, a context characterized by inefficient government, heavy bureaucracy, corruption, high tax rates, political instability, and the low quality of institutions (Fernández-Torres et al., 2019; Transparency International, 2020). Large domestic conglomerates dominate the business sector in the region and the great majority of these groups are family firms with several generations, which hold ownership or leadership positions (Briano-Turrent et al., 2022). From a business dimension, the region is characterized by undeveloped legal, market, and institutional frameworks (Khoury et al., 2015). Thus, Latin America provides a unique context to advance in management and family firms theories (Gómez-Mejía et al., 2023). This paper aims to analyze the relationship between the family element and R&D investment, and how the moderating effect of the board composition affects this relationship, in a sample composed by family and no family firms.

This research contributes significantly in four main dimensions. First, the family culture in business is acknowledged as a possible source of competitive advantage for innovation, since these are hard-to-duplicate resources (Dibrell & Moeller, 2011). Second, Latin America has shown a substantial economic growth over the last two decades and has been home to local and multinational firms (Cadena et al., 2017; Vassolo et al., 2011). However, most of the research has been developed for Anglo-Saxon and European countries (De Massis et al., 2012); consequently, more research is desirable for Latin American landscape, especially as family firm innovation processes and outcomes are likely to differ from governance and ownership archetypes due to the influence of family ownership, risk taking and investment horizons (Aguinis et al., 2020; Lumpkin & Brigham 2011). Third, this study adopts the agency and socio-emotional theories in a context characterized by a weak institutional framework and lower rates on R&D investment compared to other emerging countries. Finally, we compare the empirical results between family vs. no family firms, regarding the influence of the family control on the firm’s long-term strategic orientation (R&D investment and capital expenditures), and towards short-term orientation (ROA, ROE and dividends).

Using a panel data composed by 1,284 observations-year during the period 2004-2014 that integrates four emerging Latin American countries (Argentina, Brazil, Chile and Mexico), results are summarized as follows: 1) family firms favor R&D investment only when the moderating effect of the board structure is included, which suggests that Latin American firms, promote a long-term orientation with the purpose of preserving the wealth for next generations; 2) the board size, the independence on the board, COB-CEO duality and female participation on the board increases the R&D investment; and 3) family firms obtain lower ratios on ROA and dividend payouts compared to non-family firms. This research has practical implications on governance structures and innovation strategies for family firms.

The structure of the paper is composed by four sections. In the second section, the theoretical framework is developed and the study hypotheses are established. Third section establishes the methods, the study variables and the empirical models. Section fourth presents the discussion of empirical results. Section fifth concludes and indicates the limitations and some future research.

2. Theoretical Bakcground

From the perspective of agency theory, the family firm’s innovation behavior differs from non-family companies (Aparicio et al., 2019; Chrisman et al., 2007). According to De Massis et al. (2016), the institutional weaknesses lead to different results, since family members may prioritize economic goals, due to weak property rights protection. However, controlling family members can also promote a better supervision role for management, which reduces the agency costs and favors investment in R&D (Block, 2012).

The family ownership–innovation relationship is also explored through the socioemotional wealth (SEW) perspective (Chrisman & Patel, 2012; Sciascia et al., 2015). Family members are actively involved in the management and governance structures of the company, being the main objective to transfer the wealth to next generations (Basu et al., 2009, Briano-Turrent, 2022). The SEW theory affirms that family owners may be willing to accept greater risks associated with innovation strategies if this required to preserve the family’s SEW for the next generations (Gómez-Mejía et al., 2014; Le Breton-Miller & Miller, 2006). However, results are no conclusive, since depending on the context, family firms may invest less in R&D, when innovation projects are seen as a threat to the preservation of SEW endowments, as they may reduce family control (Pérez-González, 2006). Namely, when the SEW is threatened, family firms inhibit the risky decisions and focus on the short-term results (Gómez-Mejía et al., 2007, 2010). In this context, family firms aim to protect its reputation and long-term visibility on the market, and therefore, may demonstrate greater incentives to increase the R&D investment (Schmid et al., 2014). Corporate governance mechanisms such as the board of directors, have a crucial impact on supervising and monitoring managers and may yield divergent results on innovation (Gonzales-Bustos et al., 2020).

2.1. Effect of family element on the research and development (R&D) investment

R&D investment is an essential resource to promote innovation and business competitiveness (Arzubiaga et al., 2017). When the R&D investment is low, innovation capacity decreases and negatively affects business competitiveness (Kor, 2006). However, R&D investment represents a risky decision in the long-term, since it requires large amounts of financial capital and involves a failure possibility (Wu et al., 2005). Furthermore, financial results are not immediate payback may take several years (Lee & O’Neill, 2003). In this regard, the R&D investment reflects the risk taking orientation from the family firm perspective.

The family ownership may affect risk taking behavior (Fernández & Nieto, 2006) and is a possible source of competitive advantage for innovation (Calabrò et al., 2019). In terms of motivation, if the concentration of family ownership increases, the effect of the family on strategic decisions also increases (Miller et al., 2013). Family business promote an organizational culture characterized by the values of altruism, loyalty, commitment, family ties and stability (Miller & Le Breton-Miller, 2005). These characteristics reduce the incentives to pursue an individual opportunistic behavior and encourage a long-term orientation that seek to protect the interests of the firm’s shareholders (Fama & Jensen, 1985). According to the socioemotional wealth theory, family firms have substantial incentives to protect the family’s reputation and avoid acgtons to reduce long-run firm value (Tsao et al. 2019). Therefore, family firms are oriented towards long-term strategies, promoting higher R&D investment and capital expenditures (Braun & Sharma, 2007).

Additionally, family ownership pursue the interest’s alignment between management and owners, since family members generally hold the CEO position (Lee, 2006). Family CEOs tend to maintain their positions for long periods compared to non-family CEOs, obtaining a greater incentive to act as efficient resource managers (Miller & Le Breton-Miller, 2005; Uhlaner et al., 2007). According to Wu et al. (2005), the leader of the firm plays an important role in the searching of resources and capabilities focused on innovation. In this vein, Jiang, Shi and Zheng (2020), family CEOs enable to family owners to have direct control over firms, making these owners less concerned about potential loss of socioemotional wealth, and therefore, make more intensive R&D investment. Similarly, the family founders aim to transfer the company to next generations. Thus, it is important to strengthen their management team and extend long-term external connections to enhance the transition process (Miller & Le Breton-Miller, 2006). Consequently, the promotion of close relationships with financial institutions may facilitate the access to financial capital, and consequently, an increase is shown for the R&D investment.

Conversely, some studies have found a negative relationship between the family element and R&D investment. In terms of motivation, family controlling shareholders aim to guarantee the legacy for next generations (Fernández & Nieto, 2006; Thomsen & Pedersen, 2000), and therefore there is an increase on the family CEO risk aversion, promoting the stability and continuity of the firm (Graves & Thomas, 2006). According to Cirillo, Ossorio and Pennacchio (2018), family involvement in ownership reduces firms’ R&D investment, and this situation represents a potential threat to the status quo and the wellbeing of the family. Moreover, the participation of family members in the decision-making process limits the wealth generation in the short-term and increases the viability and longevity company’s risks (Wu et al., 2005). In the same line, Choi et al. (2015) found that family ownership is negatively related to R&D investment, but the relationship becomes positive when growth opportunities are present. As a result, family-owned firms would prefer a short-term orientation to avoid risky growth opportunities.

The family firms’ objectives are focused on maintaining employment for family members, while the family control tends to be more important than corporate objectives such as maximizing economic value, growth and innovation. Likewise, in family firms is common the appointment of family members in managerial positions instead of hiring qualified external personnel, which affects risk management and capabilities to promote innovation activities (Sirmon & Hitt, 2003). A common practice in family firms is the nepotism, which leads to inefficiency and favor the opportunistic behavior of family members (Fernández & Nieto, 2006). In this regard, the nomination of family members or unqualified personnel increases corporate risk and inhibits the R&D investment (Chen & Huang, 2006). Family firms are more cautious with the resources optimization because they are making decisions with the family wealth, so their orientation is focused on a cautious use of corporate wealth (Carney, 2005). According to the above, the following hypothesis is established:

Hypothesis 1. Family-owned firms have a significant effect on the R&D investment compared to non-family listed firms.

2.2. Moderating effect of the board composition on the family element and R&D investment.

The board of directors is one of the main corporate governance mechanisms and plays a supervisory role for management action mitigating the agency conflict between majority and minority shareholders, especially if their members are independent (Gillan, 2006). However, if the board members have family ties with the shareholders, independence and financial performance could be affected (Brunninge et al., 2007). Consequently, the moderating effect of the board composition on the family element and R&D investment relationship is relevant for the strategic decision making. We have include four dimensions of the board composition: size, independence, COB-CEO duality and female participation on the board.

2.2.1. Size of the board

Agency theory, affirms that board size may influence the inclusion of a variety number of perspectives on corporate strategy, including innovation in family firms (Gonzales-Bustos et al., 2020). Some authors argue that larger boards favor investment on R&D, increase business information and enhance the efficiency of the board’s supervisory role (Zona et al., 2008). In the context of famly firms, the board tends to focus more on advisory role instead of monitoring and controlling (Brunninge et al., 2007). Board size is relatively smaller in family firms compared with non-family business; therefore, their growth in terms of adding more directors may enhance their capacity for advice, which is expected to have a positive influence on innovation strategies (Hussainey & Al-Najjar, 2012). More directors also imply more eyes capable of noticing problems and ensuring accountability, which are valuable especially if the starting point is a small board, like it is the case, frequently, in family businesses (Lane et al., 2006)

Given the above, the following hypothesis is established:

Hypothesis 2. There is a positive moderation effect of the board size over the family element and the R&D investment relationship.

2.2.2. Independence of the board

Several studies evidence a positive relationship between the influence of external/independent directors on innovation in family firms. Independent directors act as a supervisory mechanism for family members and protect the minority shareholders rights (Aragón et al., 2007). According to Chrisman et al. (2007), independent directors inhibit opportunistic behavior or resources improper use by majority shareholders. In addition, the independence of the board improves the making decision process and mitigates the expropriation of wealth by family members (Miller & Le Breton-Miller, 2006). According to Hillman & Dalziel (2003), independent directors have greater incentives to safeguard the shareholders interests and reduce the opportunistic behavior of family members, which in turn may encourage to family managers to promote greater R&D investment, and therefore, generate a higher long-term profitability. Similarly, Kor (2006) shows that companies with more independent members develop and maintain their innovation capabilities, while companies with less independence on the board limit R&D investment and reduce the corporate value.

According to the approach of agency theory, the presensece of independent directors is positevely associated with innovation (Gonzales-Bustos, 2020), since independent directors offer sufficient experience to identify short-sighted reductions in R&D. In addition, independent directors are related to financial institutions, which promotes greater capital raising from external institutions (Clarysse et al., 2007). Given the above discussion, the following hypothesis is proposed:

Hypothesis 3. There is a positive moderation effect of the independence of the board over the family element and the R&D investment relationship.

2.2.3. COB-CEO Duality

The COB-CEO duality is present when the positions of Chairman of the Board (COB) and Chief Executive Officer (CEO) are held by the same person, and generally, is the founder or a direct family member (Van Essen et al., 2012). Some possible explanations for a positive association between COB-CEO duality and innovation are related to the elimination of ambiguity regarding the company’s leadership and to increase the legitimacy of a strong leader, avoiding confusion about who wins the power of the company (Baliga et al., 1996). However, from the agency theory perspective, the COB-CEO duality leads to a weakness position’s board, in relation to the company’s managers; this fact may complicate in changing the status quo and introducing new ideas to the company which deteriorates innovation (Zahra et al., 2000). In this case, the centralization of power in the top corporate positions causes the adoption of strategies that involve certain risk (Chen & Hsu, 2009). When there is a separation of roles, the board of directors is capable to retain the control in decision making and its monitoring function is more effective, which promotes an interest alignment between majority and minority shareholders in family firms (Braun & Sharma, 2007). Hence, the following hypothesis is established.

Hypothesis 4. There is a negative moderation effect of the COB-CEO duality over the family element and the R&D investment relationship.

2.2.4. Female participation on the board

The presence of women on strategic positions has a significant influence on corporate performance and promotes new perspectives in decision making and the strategies’ formulation. Family firms generally have more women on their boards than non-family business, because female directors are part of the owning family (Bannò et al., 2021). Even if women are more present in family businesses, they usually play informal roles or the spaces available for women are marginal or invisible (Montemerlo & Profeta, 2009). As a consequence, the intersection of gender and innovation appears to favor men (Marlow & McAdam, 2012). In the same line, Francoeur et al. (2008) show that boards with higher women participation operating in complex contexts, tend to be more cautious under risky corporate framework. Barber and Odean (2001) argue that women tend to take fewer risks compared to their male counterparts, since they have a smaller margin for error. Similarly, Faccio et al. (2016) conclude that women who hold strategic positions decrease the leverage level and volatility, but increase the company continuity. Therefore, the following hypothesis is proposed.

Hypothesis 5. There is a negative moderation effect of the female participation on the board over the family element and the R&D investment relationship.

3. Research Methodology

3.1. Sample

The data used in this study includes non-financial firms from the highest liquidity ratios in each country: Argentina (Merval), Brazil (Bovespa), Chile (IPSA) and Mexico (IPyC). These four ratios represent close to 80% of the capitalization of the Latin American capital market (Briano-Turrent, 2022). The initial sample was of 155 listed firms, but 34 companies were excluded of the analysis because their data were incomplete or belonged to the banking sector. The banking sector regulation differs from the rest of the companies and is under stricter scrutiny and supervision by the financial system (Briano-Turrent et al., 2020). Therefore, the final sample is composed by 121 companies (10 for Argentina, 49 for Brazil, 32 for Chile and 30 for Mexico), that is, 1,284 observations/year during the period 2004-2014. The information of the variables related to the family element and the board composition (size, independence, duality COB-CEO and female participation), were obtained from the annual reports through content analysis methodology. We perform content analysis focusing on the volume and intensity of disclosure in the annual reports using the number of words and sentences related to “family ownership” and “board composition” (Briano-Turrent & Rodríguez-Ariza, 2016). The financial variables were extracted from the “Compustat” database. The international classification “Bechmark Industrial Classification (ICB)” is adopted to identify the industrial sectors. The outliers of financial variables were treated and replaced with the values of the 2nd and 98th percentiles to eliminate their effect on the empirical results (Shumway, 2001).

Table 1 describes the study sample. Panel A shows the number of observations per country and per year, which suggests that Brazil accounts with the highest number of companies, 49 companies (40.5%), followed by Chile (26.4%), Mexico (24.8%) and Argentina (8.3%). Panel B shows the study sample by industrial sector and discriminates between family and non-family firms (shareholder control with voting rights [column 1 and 2] and family CEO [columns 3 and 4]). We observe that in most sectors family ownership predominates, with the exception of the energy, oil and gas and telecommunications sectors, which are companies generally controlled by the State (see columns 1 and 2 of panel B). Regarding the participation of family CEOs, it is shown that family firms normally nominate external CEOs to lead the company. The industry sectors with a higher presence of family CEOs are health care, telecommunications and oil and gas (columns 3 and 4, panel B).

Table 1. Sample distribution and summary statistics

Panel A reports the number of observations firm/year of the four selected Latin American countries during the test period from 2004 to 2014. Panel B shows the number of family vs. no family firms according to the Industry Classification Benchmark (ICB). A company is defined as family firm if the 20% or more of the shareholding control are held by the founder family (column 1, panel B), or if the CEO position is occupied by a direct member related to the founder family [parents, children, spouse] (column 3, panel B). Column 2 shows the percentage of non-family firms and column 3 indicates the percentage of companies that promote a non-family CEO or external CEO to lead the firm. The information was manually collected from the Stock Exchanges of each country and from the websites and annual reports of analyzed companies.

|

Panel A. Firm-year distribution by country

|

|

|

Year

|

Argentina

|

Brazil

|

Chile

|

Mexico

|

Total

|

|

|

2004

|

8

|

38

|

24

|

28

|

98

|

|

|

2005

|

8

|

42

|

28

|

29

|

107

|

|

|

2006

|

9

|

45

|

30

|

29

|

113

|

|

|

2007

|

10

|

48

|

31

|

30

|

119

|

|

|

2008

|

10

|

49

|

32

|

30

|

121

|

|

|

2009

|

10

|

49

|

32

|

30

|

121

|

|

|

2010

|

10

|

49

|

32

|

30

|

121

|

|

|

2011

|

10

|

49

|

32

|

30

|

121

|

|

|

2012

2013

|

10

10

|

49

49

|

32

32

|

30

30

|

121

121

|

|

|

2014

|

10

|

49

|

32

|

30

|

121

|

|

|

Total

|

105

|

516

|

337

|

326

|

1,284

|

|

|

Panel B. % family firms according to the shareholding control and Family CEO

|

|

|

Industry type

|

% Family Firms (shareholding control)

(1)

|

% Non-Family Firms (shareholding control)

(2)

|

% Family CEOs Firms

(3)

|

% Non-Family CEOs Firms

(4)

|

|

Basic Materials

|

83.1

|

16.9

|

32.4

|

67.6

|

|

Industrial

|

77.0

|

23.0

|

41.3

|

58.7

|

|

Consumer Goods

|

83.9

|

16.1

|

41.2

|

58.8

|

|

Health Care

|

100.0

|

0.0

|

100.0

|

0.0

|

|

Consumer Services

|

87.7

|

12.3

|

44.4

|

55.6

|

|

Telecommunications

|

51.2

|

48.8

|

54.6

|

43.4

|

|

Energies

|

28.4

|

71.6

|

4.6

|

95.4

|

|

Real State

|

80.0

|

20.0

|

26.7

|

73.3

|

|

Technology

Oil & Gas

|

100.0

54.8

|

0.0

45.2

|

0.0

45.2

|

100.0

54.8

|

|

Total

|

72.0

|

28.0

|

35.1

|

64.9

|

Source: Stock Exchanges from Argentina, Brazil, Chile and Mexico.

3.2. Empirical model and study variables

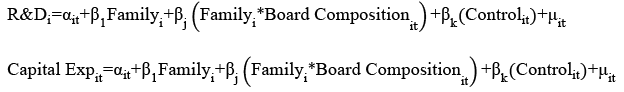

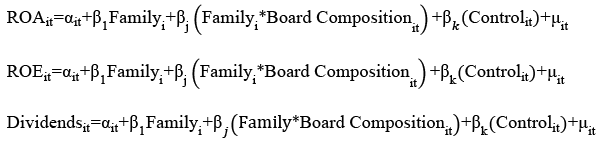

The effect of family dimension over R&D investment is analyzed through five multiple regression models integrating the moderating effect and control variables. Firstly, the family element towards long-term orientation is analyzed. In this model, the corporate governance moderating effect on the R&D investment and capital expenditures is integrated. Secondly, the family element on the short-term orientation is studied. The short-term financial measures are established as the ROA, the ROE and the dividends payment. We have adopted the Ordinary Least Squares (OLS) methods to analyze the relationship, particularly the Huber-White estimator that corrects standard errors. The year, industry type and country are included as control variables in the empirical model. The five empirical models are shown.

1) Long-term orientation of family (R&D Investment)

2) Short-term orientation of family firm (Profitability and Dividends)

3.2.1. Dependent variables

R&D Intensity. R&D expenses to total sales. This ratio is used as an approximation to R&D investment. As mentioned above, R&D expenditures generally do not generate income immediately, so this measure is used as an indicator of company long-term economic orientation (Chrisman & Patel, 2012; Lee & O’Neill , 2003).

Capital Expenditures (CapExp). It is measured as the proportion of capital expenditures to total sales. This variable is adopted as an approximation to the company long-term orientation, since, by promoting greater capital spending, R&D investment is increased (Fahlenbrach, 2009).

Return on assets (ROA). This variable is obtained by dividing net income by total assets at the end of each study year (González et al., 2017). In our model, ROA represents a measure of profitability in the short-term.

Return on capital (ROE). This variable is obtained by dividing the net profit by the stockholders’ equity or the company’s equity for each study year (Yoo & Rhee, 2012). In our model, ROE represents a measure of profitability in the short-term.

Dividends payout (Dividends). This variable reflects the dividends paid by the company, obtained by dividing the dividend per share between earnings per share (Fahlenbrach, 2009; González et al., 2017). This variable represents a measure of profitability for shareholders in the short-term.

3.2.2. Independent variables

Family ownership concentration (OwnFamily). Dichotomous variable that measures the shareholding control with voting rights hold by family members. The variable takes the value of 1 if the majority shareholder is an individual (founder or family member) that holds at least 20% of shares, and 0 otherwise. According to La Porta et al. (1999), corporate control is obtained through the use of pyramidal structures, control chains and dual class shares, and suggest that a significant control could be obtained with at least 20% of the voting rights.

Family CEO (FamCEO). Dichotomous variable that takes the value of 1 if the founder or a direct family member of the firm (person with familiar ties: blood or marriage) holds the CEO position and 0 otherwise (Chrisman & Patel, 2012; Becerra et al., 2020).

3.2.3. Moderating variables

In our empirical model, the board characteristics are adopted as moderating variables.

Board size. Natural logarithm of the members that integrate the board of directors (Upadhyay & Sriram, 2011).

Independence of the board. It is the number of independent directors with respect to the total board members (Su & Lee, 2013).

COB-CEO Duality. Dichotomous variable that takes the value of 1 if both positions are hold by the same person, and 0 otherwise (Chen et al., 2015).

Female participation in the board. Number of women who participate on the board with respect to the total members (Faccio et al., 2016).

3.2.4. Control Variables

We have included in the analysis a group of control variables that reflect the company characteristics: 1) the company size that is measured through the natural logarithm of the total assets, 2) the age of the company, which is referred to the natural logarithm of the number of years since the foundation of the company, 3) long-term leverage, 4) industrial sector, 5) year of analysis, and 6) country (Yoo & Rhee, 2012). The error term is integrated into the models: μit.

4. Analysis of Results

4.1. Descriptive analysis

Table 2 shows the descriptive statistics for the studied variables, as well as the means differences discriminating between family and non-family firms. In panel A, it is observed that when family members hold shareholder´s control (at least 20% of shareholding with voting rights), they inhibit the R&D investment, obtain lower ROE ratios and pay less dividends, compared to non-family firms. Regarding the board composition, results show that family firms promote larger boards (10 vs.9 members), a higher rate of independent members (0.35 vs.0.31) and the adoption of the CoB-CEO duality practice (26.92% vs. 6.96%). In family firms, there is a lower rate of women participation on the board (3.88% vs. 5.86%), while younger companies (30.76 years vs. 33.77 years) and smaller companies (8.17 vs. 8.87).

The table 2 (Panel B) describes the study variables, discriminating between family and non-family firms (family CEO vs. non-family CEO). In companies where the CEO position is occupied by a family member, the R&D investment and dividend payment are reduced, although Family CEOs promote a higher ROA. Regarding board composition, family CEOs firms have larger boards (10 vs.9 members), increase the board independence (0.41 vs.0.31), and adopt the COB-CEO duality practice (49.90% vs.5.88%). Family CEOs firms are younger and smaller compared with non-family CEOs firms. Brazil reaches accounts the highest R&D investment with an average of 0.77, followed by Mexico (0.09), Chile (0.04) and Argentina (0.00).

Table 2. Descriptive statistics for study variables

This table describes the mean and median values for dependent and independent variables used in this study, discriminating between family and non-family firms. We have adopted t-test estimator to analyze the means differences between both group of firms. ***, **, * show the significance level to 1%, 5%, y 10%, respectively. The variables “high R&D investment firms” and “high capital expenditures firms” are dichotomous variables that take the value of 1 if the expense R&D expenses or capital over total sales is greater than the median of a given year and 0 otherwise.

|

Panel A. Family and non-family firms according to the shareholding concentration held by the family founder (20% or more).

|

|

Full sample (N=1,284)

|

Family Firms

(n=925)

|

Non-family

Firms (n= 359)

|

Mean difference

|

|

Dependent Variables

|

Mean

|

Median

|

Mean

|

Median

|

Mean

|

Median

|

t-test

|

|

R&D Investment/Total Sales (%)

|

47.55

|

16.00

|

34.17

|

8.00

|

57.62

|

19.00

|

-1.67*

|

|

High R&D investment firms

|

5.76

|

|

3.03

|

|

12.81

|

|

-6.87***

|

|

Capital Expenditures / Total Sales (%)

|

13.09

|

7.09

|

13.44

|

6.51

|

12.10

|

9.78

|

0.76

|

|

High Capital Expenditures / Total Sales Companies

|

49.82

|

|

45.64

|

|

61.49

|

|

-4.72***

|

|

ROA

|

0.08

|

0.07

|

0.07

|

0.07

|

0.08

|

0.06

|

-1.36

|

|

ROE

|

0.15

|

0.12

|

0.14

|

0.13

|

0.18

|

0.11

|

-2.09**

|

|

Dividends (D/E %)

|

34.24

|

30.18

|

26.77

|

24.67

|

36.60

|

33.42

|

-5.07***

|

|

Independent Variables

|

|

|

|

|

|

|

|

|

Board size

|

9.87

|

9.00

|

10.00

|

9.00

|

9.54

|

9.00

|

2.55***

|

|

Board independence

|

0.34

|

0.33

|

0.35

|

0.33

|

0.31

|

0.25

|

3.22***

|

|

COB-CEO Duality (%)

|

21.34

|

|

26.92

|

|

6.96

|

|

8.02***

|

|

% women on the board

|

4.43

|

0.00

|

3.88

|

0.00

|

5.86

|

0.00

|

-4.25***

|

|

Leverage

|

0.29

|

0.29

|

0.29

|

0.28

|

0.30

|

0.31

|

-0.70

|

|

Company age

|

31.60

|

26.00

|

30.76

|

23.00

|

33.77

|

32.00

|

-3.57***

|

|

Ln (Total Assets)

|

8.37

|

8.31

|

8.17

|

8.07

|

8.87

|

8.88

|

-8.61***

|

|

Panel B. Family and non-family firms according to Family CEOs Firms and Non-family Firms.

|

|

Full Sample (N=1,284)

|

Family CEO Firms

(n=451)

|

Non-family CEO Firms

(n= 833)

|

Mean difference

|

|

Dependent Variables

|

Mean

|

Median

|

Mean

|

Median

|

Mean

|

Median

|

t-test

|

|

R&D Investment/Total Sales (%)

|

47.55

|

16.00

|

13.59

|

7.50

|

53.43

|

16.00

|

-2.05**

|

|

High R&D investment firms

|

5.76

|

|

2.22

|

|

7.68

|

|

-4.03***

|

|

Capital Expenditures / Total Sales (%)

|

13.09

|

7.09

|

12.11

|

6.12

|

13.58

|

7.36

|

-0.88

|

|

High Capital Expenditures / Total Sales Companies

|

49.82

|

|

44.15

|

|

52.68

|

|

-2.70***

|

|

ROA

|

0.08

|

0.07

|

0.07

|

0.07

|

0.07

|

0.06

|

1.61*

|

|

ROE

|

0.15

|

0.12

|

0.14

|

0.13

|

0.14

|

0.11

|

1.32

|

|

Dividends (D/E %)

|

34.24

|

30.18

|

29.14

|

23.75

|

37.12

|

34.02

|

-4.06***

|

|

Independent Variables

|

|

|

|

|

|

|

|

|

Board size

|

9.87

|

9.00

|

10.44

|

10.00

|

9.56

|

9.00

|

3.64***

|

|

Board independence

|

0.34

|

0.33

|

0.41

|

0.40

|

0.31

|

0.29

|

8.53***

|

|

COB-CEO Duality (%)

|

21.34

|

|

49.90

|

|

5.88

|

|

21.38***

|

|

% women on the board

|

4.43

|

0.00

|

4.39

|

0.00

|

4.45

|

0.00

|

-0.16

|

|

Leverage

|

0.29

|

0.29

|

0.28

|

0.27

|

0.30

|

0.30

|

-1.41

|

|

Company age

|

31.60

|

26.00

|

26.99

|

21.00

|

34.09

|

29.00

|

-4.46***

|

|

Ln (Total Assets)

|

8.37

|

8.31

|

8.29

|

8.12

|

8.41

|

8.46

|

-1.54

|

Source: Compustat database.

4.2. Regression analysis

Table 4 shows the regression analysis empirical results using the Ordinary Least Squares (OLS) method and the Huber-White estimator to correct the standard errors. The effect of the year of study, industrial sector and country was integrated in the models through dummy variables. This table shows the influence of the family element and the board composition on R&D investment and capital expenditures, which represent the long-term orientation of the firm. Table 4 (Panel A) shows the direct effect of the independent variables over the R&D investment and capital expenditures. Column 1 demonstrates that ownership concentration in hands of family members does not influence on the R&D investment, although, the board size has a negative and significant influence on R&D investment (p = 0.05), while the company size motivates to an increase of R&D investment (p = 0.01). Column 2 evidences that family CEOs does not influence R&D, while the board size (p = 0.05) has a negative effect and the company size influence. Column 3 show that family ownership concentration significantly favors capital expenditures (p = 0.10), whilst board size, COB-CEO duality, female participation on the board and the company age, decrease capital expenditures. By contrast, the board independence, and company size, promote a higher capital expenditure. Column 4 exhibits that family CEOs do not affect capital expenditure decisions, but as in model 3, corporate governance variables have a significant incidence on capital expenditures.

Table 4 (Panel B) describes the moderating effect of the board of directors’ composition on the relationship between the family element and R&D investment decisions. Results indicate that some variables related to the board composition have a significantly moderation effect in this relationship, which suggests that board composition constitutes a monitoring mechanism of family members’ actions, as a result, motivating an increase of R&D investment (Chen, 2009; Gonzales-Bustos et al., 2020). Column 1 shows that family’s ownership concentration does not have a significant influence on R&D investment, while the moderating effect between the family element and the female participation on the board (p = 0.01) and the moderating effect between the family element and COB-CEO duality (p = 0.10) increases the R&D investment. Column 2 supports that family CEOs does not have a significant impact on R&D investment, although some board characteristics could have a relevant impact. For instance, the moderating effect between the family element and the board size has a positive moderating effect on the R&D investment (p = 0.05). Similarly, there is a positive moderating effect between the board independence and the family element (p = 0.05) and R&D investment, the moderating effect between the COB-CEO duality and the family element and R&D investment (p = 0.01), the moderating effect between the gender diversity in the board and the family element and R&D investment (p=0.01). The company size (p = 0.05) and the company age (p = 0.05) have a positive effect on R&D investment. Columns 3 and 4 show that family firms (family ownership concentration and firms with family CEOs) increase the capital expenditures investment (p = 0.10) compared to no family firms. Regarding the board composition, results evidence a positive moderating effect between the family element and board size (p = 0.10) and the capital expenditures. There is a positive moderating effect between the COB-CEO duality and the family element on the capital expenditures (p = 0.05). By contrast, the company age and the company size (p = 0.01 y p = 0.05) have a negative effect in the capital expenditures variable. These findings are in line with some previous studies (Gonzales-Bustos, 2020; Zona et al., 2008) and support the assumptions of the agency theory that emphasizes the benefits of greater gender diversity in the board achieves a better working environment, more access to a greater knowledge, and therefore promotes a higher innovation level. Regarding the COB-CEO duality, results suggest that a strong leadership held by only one person could enhance innovation strategies in family firms (Gonzales-Bustos, 2020). Van Essen et al. (2012) affirm that larger boards and independent directors may enhance cognitive diversity for decision-making process, which promotes innovations.

Table 4. Family element and R&D regression analysis

This table shows the OLS regression results using the Huber-White method to correct standard errors. Panel A exhibits the direct effect of the independent variables, while panel B shows the moderator effect. Columns 1 and 2 present the analysis for R&D Investment/Total Sales (%), while columns 3 and 4 describe the regression results for the Total Capital Expenditures/Total Sales variable. In columns 1 and 3 the ownership concentration is integrated as an independent variable, while in columns 2 and 4, the effect of family CEO is included. Panel B show the moderating effect of family element and board composition. The rest of the variables remain constant in the four models. The numbers reported in parentheses represent the t statistics in the regression analysis. ***, **, * indicate the level of significance at the 1%, 5%, and 10% levels, respectively.

|

Panel A. Direct effect of the family element, board composition on R&D investment and capital expenditures.

|

|

(1)

|

(2)

|

(3)

|

(4)

|

|

Variables

|

R&D/Total Sales (%)

|

R&D/Total Sales (%)

|

Capital Expenditures

|

Capital Expenditures

|

|

Family Firm

|

0.01

|

|

1.13*

|

|

|

(ownership control)

|

(0.07)

|

|

(1.68)

|

|

|

Family Firm

|

|

-0.12

|

|

-0.40

|

|

(Family CEO)

|

|

(-0.69)

|

|

(-0.58)

|

|

Board Size

|

-0.28**

|

-0.27**

|

-1.91***

|

-1.79***

|

|

(-2.17)

|

(-2.15)

|

(-2.86)

|

(-2.70)

|

|

Board Independence

|

0.20

|

0.24*

|

7.95***

|

8.15***

|

|

(0.52)

|

(0.62)

|

(5.88)

|

(6.23)

|

|

COB-CEO Duality

|

-0.06

|

-0.03

|

-1.71**

|

-2.10***

|

|

(-0.31)

|

(-0.23)

|

(-2.09)

|

(-2.53)

|

|

% women on the board

|

-0.13

|

-0.09

|

-12.48***

|

-12.54***

|

|

(-0.17)

|

(-0.11)

|

(-3.31)

|

(-3.34)

|

|

Leverage

|

-0.74

|

-0.67

|

-0.76

|

-1.21

|

|

(-1.54)

|

(-1.28)

|

(-0.35)

|

(-0.56)

|

|

Company Age

|

-0.03

|

-0.03

|

-2.14***

|

-2.13***

|

|

(-0.35)

|

(-0.28)

|

(-5.01)

|

(-5.03)

|

|

Company Size

|

0.29***

|

0.28***

|

0.46*

|

0.53**

|

|

(2.86)

|

(2.73)

|

(1.77)

|

(1.99)

|

|

Industry Type

|

Yes

|

Yes

|

Yes

|

Yes

|

|

Year

|

No

|

No

|

Yes

|

Yes

|

|

Country

|

Yes

|

Yes

|

Yes

|

Yes

|

|

Constant

|

0.30

|

0.34

|

30.11***

|

31.51***

|

|

(0.29)

|

(0.31)

|

(8.48)

|

(8.74)

|

|

R2 Adjusted

|

0.41

|

0.41

|

0.31

|

0.31

|

|

Observations

|

1,269

|

1,269

|

1,111

|

1,111

|

|

Panel B. Moderating effect of the board composition on the relationship between the family element and the R&D investment and capital expenditures.

|

|

(1)

|

(2)

|

(3)

|

(4)

|

|

Variables

|

R&D/Total Sales (%)

|

R&D/Total Sales (%)

|

Capital Expenditures

|

Capital Expenditures

|

|

Family Firm

|

0.37

|

|

5.36*

|

|

|

(ownership control)

|

(0.58)

|

|

(1.79)

|

|

|

Family Firm

|

|

0.04

|

|

5.41*

|

|

(Family CEO)

|

|

(1.21)

|

|

(1.87)

|

|

Board Size

|

0.07*

|

0.00

|

0.18

|

0.13

|

|

(1.74)

|

(1.35)

|

(1.29)

|

(1.02)

|

|

Family Firm*Board Size

|

0.31

|

0.03**

|

1.32

|

1.93*

|

|

(1.25)

|

(2.18)

|

(1.08)

|

(1.78)

|

|

Board Independence

|

-0.58

|

-0.19**

|

-4.60**

|

-6.41***

|

|

(-1.08)

|

(-2.33)

|

(-2.10)

|

(-4.15)

|

|

Family Firm* Board Ind

|

0.28

|

0.22***

|

3.82

|

4.11

|

|

(0.48)

|

(2.78)

|

(1.31)

|

(1.20)

|

|

COB-CEO Duality

|

-0.81*

|

-0.09***

|

-2.31

|

-0.20

|

|

(-1.79)

|

(-4.40)

|

(-1.56)

|

(-0.17)

|

|

Family Firm*COB-CEO Duality

|

0.96*

|

0.05***

|

4.82***

|

3.29**

|

|

(1.89)

|

(2.42)

|

(2.61)

|

(1.97)

|

|

% women on the board

|

-1.97

|

-0.02

|

-14.31**

|

-11.68***

|

|

(-1.40)

|

(-0.09)

|

(-2.40)

|

(-2.50)

|

|

Family Firm*% women on the

|

5.06***

|

0.16

|

1.05

|

6.63

|

|

Board

|

(2.75)

|

(0.88)

|

(0.14)

|

(0.81)

|

|

Leverage

|

-0.93

|

-0.03

|

-0.74

|

0.56

|

|

(-1.50)

|

(-0.73)

|

(-0.35)

|

(0.26)

|

|

Company Age

|

0.07

|

0.02**

|

-2.03***

|

-2.13***

|

|

(0.57)

|

(2.29)

|

(-4.79)

|

(-4.99)

|

|

Company Size

|

0.21

|

0.03**

|

-0.65**

|

-0.68**

|

|

(1.46)

|

(1.93)

|

(-2.14)

|

(-2.15)

|

|

Industry Type

|

Yes

|

Yes

|

Yes

|

Yes

|

|

Year

|

No

Yes

|

No

Yes

|

Yes

Yes

|

Yes

Yes

|

|

Constant

|

-2.07**

|

-0.15

|

21.92***

|

24.64***

|

|

R2 Adjusted

|

(-2.06)

|

(-1.48)

|

(6.40)

|

(7.00)

|

|

0.46

|

0.31

|

0.32

|

0.32

|

|

Observations

|

1,269

|

1,269

|

1,111

|

1,111

|

Source: Own elaboration.

4.3. The family element effect on the short- term financial performance

Several studies have shown a significant influence of the family element on profitability. For instance, Maury (2006) argue that control in the family hands is associated with higher profitability, since the agency problem between shareholders and management is reduced. Furthermore, Martikainen et al. (2009) suggest that differences on corporate results are explained by the use of technologies and the efficiency of family firms. However, these results are favored if the CEO position is held by an external member. In contrast, other studies suggest that family firms may affect negatively the financial performance in the short-term, since family members tend to establish excessive salaries and benefits for their family, and hire incompetent people to occupy strategic positions (Pérez-González, 2006). Regarding to long-term orientation, family firms tend to emphasizes long-term goals and non-financial aspects of performance, sacrificing short-term benefits such as dividend payments to favor projects that promise future benefits (Chrisman & Patel, 2012; Mahto et al., 2018). For the above, the following hypothesis is established:

Hypothesis 6. The family element influences negatively on the short-term financial performance and favor the long-term financial performance.

Table 5 exhibits that the family element decreases some financial variables in the short-term. For instance, model 1 presents that those family-controlled firms decrease the ROA and leverage level (p = 0.01), while the board size (p = 0.01) and the company age (p = 0.01) have a positive effect. In column 2 there is no significant evidence that family CEO firms account for a higher ROA, although there is a positive association with the board size and the firm age. By contrast, there is a negative influence of the leverage on the ROA. Column 3 evidences that ownership concentration in the family hands (p = 0.01) increases the ROE, as well as the company age (p = 0.01). Column 4 exhibits a no significant relationship between family CEO firms and the ROE, although the company age (p = 0.01) favors it. Finally, columns 5 and 6 indicate that both family ownership concentration and family CEO firms, decrease the dividends (p = 0.05 and p = 0.01, respectively), which suggests the adoption of a long-term orientation and the preference to pay less dividends, investing more in projects that ensure the wealth for next generations (Block, 2012). Furthermore, it is observed that the board independence (p = 0.01) and the leverage level (p = 0.01) inhibit the dividends payment, while the female members in the board (p = 0.01), the company age (p = 0.01) and the company size (p = 0.05) increase dividends. These results confirm those found by Watkins-Fassler (2018), who shows a positive relation between family firms and financial performance, because high family ownership concentration favors long-term relationships in the companies, security and stability, knowledge transfer, which positively impacts investment and financial results.

Table 5. Family element and short-term financial performance regression analysis

This table presents the OLS regression results using the Huber-White method to correct standard errors. Columns 1 and 2 show the analysis for the ROA, columns 3 and 4 describe the regression results for the ROE variable, and columns 5 and 6 describe the results for the dividend payment variable. In columns 1, 3 and 5 the shareholding control is integrated as an independent variable of the family element, while in columns 2, 4 and 6, the effect of family CEO firm variable is included. The rest of the variables remain constant in the six models. The numbers reported in parentheses represent the t statistics in the regression analysis. ***, **, * indicate the level of significance at the levels of 1%, 5%, and 10%, respectively.

|

(1)

|

(2)

|

(3)

|

(4)

|

(5)

|

(6)

|

|

|

Variables

|

ROA

|

ROA

|

ROE

|

ROE

|

Dividends Payment

|

Dividends Payment

|

|

Family Firm

|

-0.01**

|

|

0.08***

|

|

-4.58**

|

|

|

(ownership control)

|

(-2.10)

|

|

(3.03)

|

|

(-2.08)

|

|

|

Family Firm

|

|

0.00

|

|

0.01

|

|

-5.62***

|

|

(Family CEO)

|

|

(0.39)

|

|

(0.21)

|

|

(-2.89)

|

|

Board Size

|

0.03***

|

0.03***

|

-0.00

|

-0.01

|

2.00

|

1.40

|

|

(4.94)

|

(4.83)

|

(-0.12)

|

(-0.46)

|

(0.83)

|

(0.60)

|

|

Board Independence

|

-0.00

|

-0.00

|

-0.02

|

-0.02

|

-14.93***

|

-13.56***

|

|

(-0.12)

|

(-0.03)

|

(-0.51)

|

(-0.32)

|

(-3.40)

|

(-3.11)

|

|

COB-CEO Duality

|

-0.00

|

-0.00

|

-0.00

|

-0.02

|

-2.81

|

-0.34

|

|

(-0.66)

|

(-1.16)

|

(-0.14)

|

(-0.68)

|

(-1.22)

|

(-0.14)

|

|

% women on the board

|

-0.03

|

-0.03

|

-0.10

|

-0.08

|

39.72***

|

39.26***

|

|

(-1.26)

|

(-1.18)

|

(-0.85)

|

(-0.74)

|

(3.32)

|

(3.32)

|

|

Leverage

|

-0.08***

|

-0.09***

|

0.03

|

0.01

|

-19.54***

|

-21.12***

|

|

(-5.47)

|

(-5.81)

|

(0.35)

|

(0.07)

|

(-3.10)

|

(-3.34)

|

|

Company Age

|

0.01***

|

0.01***

|

0.03***

|

0.03***

|

3.90***

|

4.01***

|

|

(5.12)

|

(5.09)

|

(3.04)

|

(3.09)

|

(4.10)

|

(4.17)

|

|

Board Size

|

-0.00

|

-0.00

|

-0.01

|

-0.01

|

1.73**

|

2.08**

|

|

(-0.59)

|

(-0.10)

|

(-1.34)

|

(-0.66)

|

(2.27)

|

(2.70)

|

|

Industry Type

|

Yes

|

Yes

|

Yes

|

Yes

|

Yes

|

Yes

|

|

Year

|

Yes

|

Yes

|

Yes

|

Yes

|

Yes

|

Yes

|

|

Country

|

Yes

|

Yes

|

Yes

|

Yes

|

Yes

|

Yes

|

|

Constant

|

0.08***

|

0.06***

|

0.43***

|

0.32***

|

-1.36

|

-5.85

|

|

(3.20)

|

(2.64)

|

(3.62)

|

(2.85)

|

(-0.15)

|

(-0.65)

|

|

R2 Adjusted

|

0.23

|

0.23

|

0.06

|

0.05

|

0.16

|

0.16

|

|

Observations

|

1,269

|

1,269

|

1,267

|

1,267

|

1,023

|

1,023

|

Source: Own elaboration.

4.4. Robust Analysis (Logit Model)

Table 6 (Panel A) shows a Logit regression analysis which aims to strengthen the presented results in the table 4. The median values for R&D/Total sales and capital expenditures/Total sales were introduced in the models. That is, firms that are above of the median value were categorized as “companies with high R&D investment”, while companies that obtained values below of the median value were classified as “companies with low R&D investment”. Regarding the capital expenditures value, the same criteria was adopted. If the company accounts capital expenditures/Total sales above the median value, the company was classified as “a company with a high capital expenditures investment”, otherwise it is considered as “a company with low capital expenditures investment”. These variables take the value of 1 when they are above of the median value and 0 otherwise. Results of table 6 (Panel A), support that the family element motivates a higher R&D investment (see columns 1 and 2). As in the OLS analysis on the table 4, the board composition directly affects the R&D investment policy. For instance, the size of the board, the COB-CEO duality and the female participation on the board, decrease the R&D investment, while the independence of the board and the company size favor it. The leverage performance inhibits a greater R&D investment. With respect to capital expenditures, columns 3 and 4 show that family participation in the ownership does not significantly influence capital expenditures, although when the CEO is familiar, there is a significant increase (p = 0.01).

The table 6 (Panel B) shows the moderating effect of board composition on the relationship between the family element and R&D investment. Columns 1 and 3 show that the ownership concentration does not impact on the R&D investment or capital expenditures decisions, while family CEOs increase significantly the R&D investment and capital expenditures (see columns 3 and 4). In regard to the moderating effect of the board structure, columns 1 and 2 show that the board size (p = 0.01), board independence (p = 0.01), COB-CEO duality (p = 0.01), women participation on the board (p = 0.05) and leverage (p = 0.01) positively moderate the relationship between the family element and the R&D investment. Columns 2 and 4 exhibit that board size (p = 0.01), board independence (p = 0.01) and company size (p = 0.05) increase the capital expenditures. These findings highlight and confirm through an additional analysis, the effect of board of directors’ composition on innovation strategies in family firms (Gonzales-Bustos et al., 2020).

Table 6. Family element and R&D investment Logit regression

This table describes the results obtained from the Logit regression model, which adopts the Huber-White method to correct standard errors. Columns 1 and 2 show the analysis for R&D Investment / Total sales (%), while columns 3 and 4 describe the Logit regression results for the Total capital expenditures/Total sales variable. In columns 1 and 3 the ownership concentration is integrated as an independent variable of the family element, while in columns 2 and 4, the effect of the family CEO is included. The rest of the variables remain constant in the four models. The numbers reported in parentheses represent the z statistics in the Logit analysis. ***, **, * indicate the significance at 1%, 5%, and 10% levels, respectively.

|

Panel A. Logit regression: direct effect of the independent variables on R&D and capital expenditures

|

|

(1)

|

(2)

|

(3)

|

(4)

|

|

Variables

|

High RD investment firm

|

High RD investment firm

|

High capital expenditures firm

|

High capital expenditures firm

|

|

Family Firm

|

1.56***

|

|

0.27

|

|

|

(ownership control)

|

(4.84)

|

|

(1.23)

|

|

|

Family Firm

|

|

1.51***

|

|

0.55***

|

|

(Family CEO)

|

|

(3.49)

|

|

(2.62)

|

|

Board Size

|

-1.29***

|

-1.34***

|

-0.06

|

-0.06

|

|

(-2.41)

|

(-2.54)

|

(-0.29)

|

(-0.27)

|

|

Board Independence

|

1.12*

|

1.57***

|

2.29***

|

2.40***

|

|

(1.72)

|

(2.43)

|

(5.52)

|

(5.76)

|

|

COB-CEO Duality

|

-1.04**

|

-0.52

|

-0.54***

|

-0.94***

|

|

(-2.17)

|

(-1.05)

|

(-2.48)

|

(-3.59)

|

|

% women on the board

|

-3.08**

|

-1.98

|

-2.41**

|

-2.65***

|

|

(-1.92)

|

(-1.21)

|

(-2.26)

|

(-2.47)

|

|

Leverage

|

-2.20***

|

-1.61***

|

-0.71

|

-0.76

|

|

(-4.04)

|

(-2.66)

|

(-1.32)

|

(-1.40)

|

|

Company Age

|

0.02

|

0.12

|

-0.13

|

-0.11

|

|

(0.18)

|

(0.89)

|

(-1.49)

|

(-1.23)

|

|

Board Size

|

0.34***

|

0.51***

|

0.09

|

0.07

|

|

(3.18)

|

(5.69)

|

(1.22)

|

(1.04)

|

|

Industry Type

|

Yes

|

Yes

|

Yes

|

Yes

|

|

Year

|

No

|

No

|

No

|

No

|

|

Country

|

Yes

|

Yes

|

Yes

|

Yes

|

|

Constant

|

-1.32

|

-3.33**

|

1.41

|

1.95**

|

|

(-0.72)

|

(-2.13)

|

(1.50)

|

(2.21)

|

|

R2 Adjusted

|

0.24

|

0.26

|

0.20

|

0.20

|

|

Observations

|

1,269

|

1,269

|

1,002

|

1,002

|

|

Panel B Logit regression: moderating effect of board composition on the relationship between the family element and the R&D investment and capital expenditures.

|

|

(1)

|

(2)

|

(3)

|

(4)

|

|

Variables

|

High RD investment firm

|

High RD investment firm

|

High capital expenditures firm

|

High capital expenditures firm

|

|

Family Firm

|

1.86

|

|

0.23

|

|

|

(ownership control)

|

(1.06)

|

|

(0.27)

|

|

|

Family Firm

|

|

1.17**

|

|

0.47**

|

|

(Family CEO)

|

|

(2.01)

|

|

(2.04)

|

|

Board Size

|

0.20***

|

0.13**

|

0.04

|

0.02

|

|

(3.01)

|

(2.07)

|

(1.00)

|

(0.53)

|

|

Family Firm* Board Size

|

2.45***

|

1.60***

|

0.44

|

0.56***

|

|

(3.00)

|

(5.92)

|

(1.27)

|

(3.31)

|

|

Board Independence

|

-0.13

|

-0.25

|

-0.79

|

-0.92

|

|

(-0.16)

|

(-0.31)

|

(-1.16)

|

(-1.41)

|

|

Family Firm*Board

|

4.36***

|

4.90***

|

2.13***

|

2.01***

|

|

Independence

|

(3.24)

|

(3.83)

|

(2.37)

|

(2.41)

|

|

COB-CEO Duality

|

-12.29***

|

-12.50***

|

1.58

|

1.56

|

|

(-23.52)

|

(-24.50)

|

(1.45)

|

(1.43)

|

|

Family Firm*COB-CEO

|

11.73***

|

12.68**

|

-1.00

|

-0.70

|

|

Duality

|

(17.89)

|

(15.48)

|

(-0.90)

|

(-0.63)

|

|

% women on the board

|

-2.33

|

-2.54

|

-0.09

|

-0.17

|

|

(-0.94)

|

(-1.05)

|

(-0.05)

|

(-0.09)

|

|

Family Firm*%women on

|

7.47*

|

7.88**

|

3.23

|

3.24

|

|

the board

|

(1.81)

|

(1.91)

|

(1.39)

|

(1.41)

|

|

Leverage

|

1.37**

|

1.53***

|

-0.65

|

-0.71

|

|

(2.29)

|

(2.62)

|

(-1.21)

|

(-1.29)

|

|

Company Age

|

0.14

|

0.14

|

-0.20**

|

-0.17*

|

|

(0.94)

|

(0.89)

|

(-2.07)

|

(-1.87)

|

|

Company Size

|

0.16

|

0.19*

|

0.19**

|

0.19**

|

|

(1.37)

|

(1.62)

|

(2.15)

|

(2.21)

|

|

Industry Type

|

Yes

|

Yes

|

Yes

|

Yes

|

|

Year

|

No

|

No

|

No

|

No

|

|

Country

|

Yes

|

Yes

|

Yes

|

Yes

|

|

Constant

|

-5.81***

|

-5.14***

|

-0.99

|

-0.74

|

|

(-3.76)

|

(-3.41)

|

(-1.05)

|

(-0.84)

|

|

R2 Adjusted

|

0.28

|

0.28

|

0.22

|

0.22

|

|

Observations

|

1,269

|

1,269

|

1,002

|

1,002

|

Source: Own elaboration.

5. Conclusions

This study contributes to the body of research in corporate governance and innovation strategies in family firms. Firstly, based in the agency and socio-emotional theories (Berrone et al., 2010), we extend the comparative literature in Latin America, by studying the innovation behavior of family firms, analyzing the moderating effect of board composition as the most important mechanism of corporate governance over the family element and the R&D investment. Latin America is characterized by inefficient government, heavy bureaucracy, corruption, high tax rates, political instability, and low quality of institutions (Fernández-Torres et al. 2019). Consequently, family business and their corporate governance structures and innovation strategies may vary compared to another addressed contexts. The empirical results confirm that Latin American family firms reach higher R&D ratios compared to non-family companies when the moderating effect of the board characteristics is introduced. The same results are evinced in the case of family CEOs in family firms, who obtain higher ratios on R&D investment and capital expenditures. Therefore, the H1 hypothesis is partially accepted, which holds that family firms favors the R&D investment to protect the socio-emotional wealth and guarantee the continuity of the firm to the next generations, encouraging a long-term orientation (Fuetsch, 2022; Mahto et al., 2018). These results suggests that board composition constitutes a monitoring mechanism of family members’ actions, as a result, promoting an increase of R&D investment (Chen, 2009; Gonzales-Bustos et al., 2020).

Secondly, it is observed that larger boards, the incorporation of more independent members, the COB-CEO duality and the presence of women into the board have a positive and significant moderating effect on the relationship between family firms and R&D and capital expenditures investment. Thus, hypotheses H2, H3 are accepted, while H4 and H5 are not supported. These findings are confirmed by Chen et al. (2015), who argue that the board independence provides objective points of view and facilitates access to external resources. Similarly, larger boards may enhance their capacity for advice, which is expected to have a positive influence on innovation strategies (Hussainey & Al-Najjar, 2012). Regarding COB-CEO duality, some possible explanations for the opposite obtained result in this study, is the elimination of ambiguity regarding the company’s leadership and to increase the legitimacy of a strong leader, avoiding confusion about who wins the power of the company (Baliga et al., 1996). In the same vein, women into the boards increase the monitoring function of the board and pay more attention to audit and risk oversight and control, which may favor innovation (Hernández-Lara & Gonzales-Bustos, 2020).

Family firms in Latin America have a preference towards long-term orientation, limiting the corporate results in the short-term. According to Tsao et al. (2015), R&D affects short-term profitability negatively because firms expense R&D spending immediately. In our case, family firms obtain lower profitability ratios and dividends compared to non-family firms, hence hypothesis H6 is accepted. These results have practical implications for family business in Latin America, highlighting the relevance of R&D investment and capital expenditures to ensure the family firms continuity. Moreover, the board composition plays an important role to favor the long-term orientation and innovation strategies. Its important to note, that in the context of family firms, the role of women on the board enhances innovation strategies, therefore, it is necessary to increase the participation of independent women directors through policies and regulations to analyze its contribution in future research.

The study recognizes some limitations and identifies future research. First, the study focuses on the most liquid companies in Latin America, excluding those companies that do not belong to those ratios and small and medium size companies. In this regard, future research could address new samples of study such as small and medium companies from the region. Second, some other variables related to the family element and governance structures are excluded in this research (e.g., generation of the firm, support committees of the board, socio-demographic characteristics of the board members), which may influence R&D decisions. Future research may extend this study adding new variables of corporate governance. Finally, the study is limited to four Latin American countries, so an interesting future research could incorporate emerging countries from other regions.

References

Aguinis, H., Villamor, I., Lazzarini, S. G., Vassolo, R. S., Amoro’s, J. E., & Allen, D. G. (2020). Conducting management research in Latin America: Why and what’s in it for you? Journal of Management, 46(5), 615–636. https://doi.org/10.1177/0149206320901581

Aparicio, G., Iturralde, T., & Sanchez-Famoso, V. (2019). Innovation in family firms: A holistic bibliometric overview of the research field. European Journal of Family Business, 9(2), 71-84. https://doi.org/10.24310/ejfbejfb.v9i2.5458

Aragón, J.A., García, V.J., & Cordón, E. (2007). Leadership and organizational learning’s role on innovation and performance: lessons from Spain. Industrial Marketing Management, 36(3), 349–359. https://doi.org/10.1016/j.indmarman.2005.09.006

Arzubiaga, U., Maseda, A., & Iturralde, T. (2017). Exploratory and exploitative innovation in family businesses: the moderating role of the family firm image and family involvement in top management. Review of Managerial Science, 13, 1-31. https://doi.org/10.1007/s11846-017-0239-y

Baliga, B., Moyer, R., & Rao, R. (1996). CEO duality and firm performance: What’s the fuss? Strategic Management Journal, 17, 41-53. https://www.jstor.org/stable/2486936

Bannò, M., Coller, G., & D’Allura, G.M. (2021). Family firms, women, and innovation. Sinergie. Italian Journal of Management, 39(2), 59-74. https://doi.org/10.7433//s115.2021.04

Barber, B.M. & Odean, T. (2001). Boys will be boys: Gender, overconfidence, and common stock investment. The Quarterly Journal of Economics, 116(1), 261–292, https://doi.org/10.1162/003355301556400

Basu, N., Dimitrova, L., & Paeglis, I. (2009). Family control and dilution in mergers. Journal of Banking & Finance, 33(5), 829-841. https://doi.org/10.1016/j.jbankfin.2008.09.017

Becerra, M., Cruz, C., & Graves, C. (2020). Innovation in family firms: The relative effects of wealth concentration versus family-centered goals. Family Business Review, 33(4), 1-21. https://doi.org/10.1177/089448652095370

Berrone, P., Cruz, C., Gómez-Mejía, L., & Larraza-Kintana, M. (2010). Socioemotional wealth and corporate responses to institutional pressures: Do family-controlled firms pollute less? Administrative Science Quarterly, 55, 82-113. https://doi.org/10.1080/0969160X.2011.593832

Berrone, P., Duran, P., Gómez-Mejía, L. R, Heugens, P. P., Kostova, T., & van Essen, M. (2022). Impact of informal institutions on the prevalence, strategy, and performance of family firms: A meta-analysis. Journal of International Business Studies, 53, 1153–1177. https://doi.org/10.1057/s41267-020-00362-6

Block, J. (2012). R&D investments in family and founder firms: An agency perspective. Journal of Business Venturing, 27, 248-265. https://doi.org/10.1016/j.jbusvent.2010.09.003

Braun, M. & Sharma, A. (2007). Should the CEO also be chair of the board? An empirical examination of family-controlled public firms. Family Business Review, 20(2), 111-126. https://doi.org/10.1111/j.1741-6248.2007.00090.x

Briano-Turrent, G.C., Rodríguez-Ariza, L., & Watkins-Fassler, K. (2022). Family CEOs and CSR performance in Ibero-American family firms. The Mexican Journal of Economics and Finance, 17(4), 1-16. https://doi.org/10.21919/remef.v17i4.755

Briano-Turrent, G.C., & Rodriguez-Ariza, L. (2016). Corporate governance ratings on listed companies: An institutional perspective in Latin America. European Journal of Management and Business Economics, 25, 63-75. https://doi.org/10.1016/j.redeen.2016.01.001

Briano-Turrent, G.C., Watkins-Fassler, K., & Puente-Esparza, M.L. (2020). The effect of the board composition on dividends: The case of Brazilian and Chilean family firms. European Journal of Family Business, 10, 43-60. https://doi.org/10.24310/ejfbejfb.v10i2.10177