European Journal of Family Business (2021) 11, 72-79

International Business Decision-Making in Family Small and-Medium-Sized Enterprises

Jaakko Metsola, Olli Kuivalainen*

Lappeenranta-Lahti University of Technology (LUT), Lappeenranta, Finland

Commentary. Received: 2021-11-17

JEL CLASSIFICATION

M10, M16

KEYWORDS

Family firms, International business, Decision-making, SMEs

CÓDIGOS JEL

M10, M16

PALABRAS CLAVE

Empresa familiar, Empresa internacional, Toma de decisions, PYMEs

Abstract Family firm internationalization has become a topic of interest over the last few decades. However, there has been surprisingly little research about the actual international business decision-making in the family firm literature. The purpose of this article is to highlight specific family firm factors which affect the international business decision-making. Based on examples on international market entry, target market choice, entry mode choice, and entry timing decisions, it is suggested that long-term and regional orientation, knowledge-base and its transfer, bifurcation-bias, and perseverance of family managers are important factors affecting international business decision-making among family small- and medium- enterprises (SMEs).

La toma de decisiones empresariales internacionales en las pequeñas y medianas empresas familiares

Resumen La internacionalización de las empresas familiares se ha convertido en un tema de interés en las últimas décadas. Sin embargo, la literatura sobre empresas familiares ha investigado sorprendentemente poco sobre la toma de decisiones en el ámbito internacional. El objetivo de este artículo es destacar los factores específicos de las empresas familiares que afectan a la toma de decisiones en el ámbito internacional. A partir de ejemplos sobre la entrada en el mercado internacional, la elección del mercado objetivo, la elección del modo de entrada y las decisiones sobre el momento de entrada, se sugiere que la orientación regional y a largo plazo, la base de conocimientos y su transferencia, el sesgo de bifurcación y la perseverancia de los gestores familiares son factores importantes que afectan a la toma de decisiones empresariales internacionales entre las pequeñas y medianas empresas familiares (PYMEs).

https://doi.Falta

Copyright 2021: Jaakko Metsola, Olli Kuivalainen

European Journal of Family Business is an open access journal published in Malaga by UMA Editorial. ISSN 2444-8788 ISSN-e 2444-877X

This work is licensed under a Creative Commons Atribution-NonCommercial-ShareAlike 4.0 International License (CC BY-NC-SA 4.0).

*Corresponding author

E-mail: Olli.Kuivalainen@lut.fi

1. Introduction

Internationalization of small and medium-sized enterprises (SMEs) can be described as entrepreneurial behaviour which is affected by factors such as earlier knowledge base (cf. market knowledge from the work of Johanson and Vahlne, 1977, but also studies focusing on international experience), entrepreneur’s cognition (e.g., Zahra et al., 2005) and firm’s strategic orientation (e.g., Knight & Cavusgil, 2004), and networks (e.g., Coviello, 2006). Internationalization can also be seen as a process of decision-making as there are decisions to be made such as when, where and how a firm should internationalize. Unfortunately, studies focusing on SMEs’ strategic decision-making on internationalization, have been scarce (for some exceptions, see e.g., Ahi et al., 2017; Ji & Dimitratos, 2013; Nummela et al., 2014; Petrou et al., 2020). Many extant studies which focus on SMEs’ decision-making on internationalization have discussed effectuation logic (Sarasvathy, 2001) and how that could explain internationalization of the firm (see e.g., Chetty et al., 2015; Nummela et al., 2014). Effectuation is “closer to emergent or non-predictive strategies” whereas causation is more or less “…consistent with the planned strategy approach” (Gabrielsson & Gabrielsson, 2013, p. 1359). In the mainstream international business (IB) literature decision-making, the primary common reference point is rationality, however (Aharoni et al., 2011; Child & Hsieh, 2014). We tend to expect that the larger and more experienced the firm is, the more rational it is in its strategic decision-making. In larger enterprises the rationality may stem from the corporate governance, as there can be an experienced board of directors guiding the top management team. Hambrick, Misangyi, and Park (2015) suggest that to be able to enhance the value creation the board should possess the following qualities: independence, expertise in the focal domain, bandwidth (i.e., capacity to take part in activities), and motivation. Naturally also the top management team need to possess similar qualities.

Family firm (FF) can be defined as “…one that is majority family owned and has at least one family owner in the management team” (Graves & Thomas, 2006, p. 208). Being an FF can make a firm different in relation to decision-making structure, governance, resources and strategies when comparing to other type of firms. What would be the decision-making about internationalization like in the FFs and what factors affect the decision-making? FFs typically appear to be less inclined to expand their international activities as they may be focused on longevity and stability instead of risky foreign growth (Casillas et al., 2010; Fernández and Nieto, 2005; Okoroafo, 1999). Further, FFs’ governance structures may be heterogenous (D’Angelo et al., 2016). They typically possess a complex, even long-standing stakeholder structure that incorporates family members, top management, and a board of directors (Mustakallio et al., 2002) and this may lead to differences in the internationalization. It has also been noted that FFs differ from other firms in relation to attitudes, orientations and behaviors of decision-makers when internationalizing (Casillas et al., 2010; Graves & Thomas, 2006), and in their internationalization strategies in general (e.g., Boellis et al., 2016; Fernández & Nieto, 2005; Mariotti et al., 2021; Musso & Francioni, 2020).

There are few studies published which have shown that there are different internationalization patterns also among FFs (e.g., Jorge et al., 2017; Kontinen & Ojala, 2012; Musso & Francioni, 2020) and that internationalization of FFs have gained increasing attention (Mariotti et al., 2021). However, a recent JIBS paper suggests that family business scholars would often ‘…focus on family-driven phenomena and rarely explore questions motivated by IB theory” and that “…existing research has offered varied and at times incompatible findings on how family ownership and management shape internationalization” (Arregle et al., 2021, p. 1159-1160). Consequently, the goal of this paper is to present and highlight certain specific factors which affect IB decision-making in family SMEs (as most of the FFs are SMEs) and which we feel should be researched about. These are as follows: 1) long-term and regional orientation in IB decision-making, 2) knowledge-based and -transferred IB decision-making within the family, 3) bifurcation-biased IB decision-making and how to avoid it, and 4) unleashing the perseverance of family managers in critical incidents. After discussing each of these factors by providing real-life case examples explicating the decision-making process on international market entry, target market choice, entry mode choice, or entry timing, as a summary we provide a model which shows the factors which we consider affecting especially IB-related decision-making process in in FFs. With this we aim to provide guidance for family business researchers studying internationalization of family SMEs and offer ideas for future research endeavors.

2. Long-Term and Regional Orientation in International Business Decision-Making

Family SMEs tend to make IB decisions with a long-term perspective to the past and the future, emphasizing the strong foreign relationships or partnerships they have built over years. Geographically, family SMEs tend to target their international market entry-related decision-making in the nearby markets. For example, for Finnish family SMEs, Nordic countries are perceived to have safer and culturally suitable environment (cf. Uppsala model of Johanson and Vahlne, 1977), which would make the often-complex IB decision to be more simplified effort, and which could be seen to bear fruit more easily. Alpha, a Finnish provider of wood products, initiated a customer relationship with a Norwegian customer in 1994, since then the relationship has grown into a strong partnership. To respond to the loyalty of the customer, including a big loan this customer provided to Alpha to invest in production, Alpha provided the customer a ten-year exclusive right to sell their products in Norway in 2010s. This decision was not purely based on benevolence though; Alpha and its third-generation family chief executive officer (CEO) estimated that this deal would provide stable cash flow and predictability in the long term. In the sawmill industry, heavily dependent on the development of market prices, Alpha has succeeded relatively well, with stable but profitable business.

A similar Finnish-Norwegian case was with Beta, a provider of filling stations and tanks. The family CEO of Beta had done over ten years of footwork before finalizing a deal with potential Norwegian customer, which eventually became a partner to manage various value chain activities related to filling stations in Norway. A long-term partnership was made to prepare Beta to respond to the incoming technological disruptions in the field and not just capitalize on the Norwegian market. The collaboration has been fruitful, with regular communication and meetings.

The combination of long-term orientation and regional orientation to nearby markets in IB decision-making reflects the goal orientations and organizational structures of the family SMEs themselves. FFs tend to make decisions with future generations in mind and in a tight, communal, and trusting group, including not just family members but also employees and customers (Miller et al., 2008). These tendencies manifest in IB decision-making in that business relationships are planned and decided to span years and even decades, with the foreign partner or customer “embedded” in the familial community of the FF. As owning and managing family members tend to build close relationships within their networks, they want to build business relationships in nearby markets to have smooth, trusting and culturally suited operations. The long-term strategies, including internationalization strategies, are easier to control when the geographical and relational distances are not high. As Alpha and Beta examples show, the decision-making processes can become easier through regular communication and predictable roadmap for both the FF and the customer or partner to follow. Further, it is important to remember that the internationalization process can take a long time and there might be several epochs or episodes containing several IB decisions. All in all, time and the process approaches should be incorporated better into FF internationalization studies (cf. Arregle et al., 2021; Metsola et al., 2020).

3. Knowledge-Based and -Transferred International Business Decision-Making Within the Family

Family SMEs also tend to make knowledge based IB decisions, in the process of which knowledge is effectively transferred within different family generations in the ownership and management positions. Gamma, a Finnish manufacturer of mobile hydraulic equipment, internationalized to Sweden and Central Europe in 1990s thanks to the active door-to-door sales by the founder family CEO. Some experiences led to decisions that hold even today and which are embraced by the second-generation Executive Vice President (EVP), who is currently responsible for international sales. Such a decision relates to partners’ exclusive rights to sell in the host markets; an ineffective first Swedish partner taught the founder that no exclusive rights to sell should be given, and the consequent multi-channel approach remains today. Active footwork to make foreign deals has endured, with “flight tickets to salespeople being the best investment” and is also reflected in participating in trade fairs and dealer meetings. EVP has further embraced this active approach by promoting production of videos and social media presence, with herself being visible and showing the face of the family business in all types of promotion material.

Accordingly, the advantage of FFs and especially family SMEs can be the effective transfer of knowledge within generations that facilitates decision-making (Davis et al., 2007; Zahra et al., 2004). New generations can benefit from the accumulated knowledge the older generations have gained when building and internationalizing the company, while older generations still involved in the business can benefit from the new and modern ideas newer generations possess. We would encourage more studies which would focus on FF as a knowledge repository, and when focusing on internationally operating FFs, studying in detail what could be advantages of the knowledge creation and transfer also by utilizing IB literature and theories such as works of Kogut and Zander (1992, 1993). Would an FF be a more social community than another type of firm, for example, and would it create an advantage for FFs?

4. Bifurcation-Biased International Business Decision-Making and How to Avoid It

A critical thing for family SMEs to tackle in their decision-making processes is the avoidance of bifurcation bias, i.e., the ‘de facto differential treatment of family or heritage assets versus nonfamily assets’, ‘…a unique, affect-based barrier to short and medium run efficient decision making in family firms’ (Kano & Verbeke, 2018, pp. 158, 163). The previous long-term-oriented and knowledge-based decision-making examples show how knowledge can be effectively transferred within family managers and how the pursuit of long-term family legacy provides perseverance, but the dark side can be that the operations within a ‘family vacuum’ stagnate and even deteriorate IB performance. In practice, this may mean that family managers are biased to prefer family managers over nonfamily managers, even if the latter ones would be more functional and professional for IB decision-making.

This bias stems from the preservation of socioemotional wealth (SEW), which relates to family SMEs or FFs in general preserving various affective needs, such as identity, family control and generational continuity in the business (Gomez-Mejia et al., 2007). In strategic decision-making, FFs engage in so-called ‘mixed gamble’, by which family managers consider the possible socioemotional gains and losses of different decisions, with general tendency to being risk-averse to decisions that potentially cause losses to SEW, the ‘affective wealth-at-risk’ (Gomez-Mejia et al., 2014, p. 1354). Decisions that contribute to the SEW endowment are likely to be done (Gomez-Mejia et al., 2018), but that may come with under-utilization of financial opportunities and, thus, financial wealth being at risk (Debicki et al., 2016; Gomez-Mejia et al., 2007).

However, like the bifurcation bias definition (Kano & Verbeke, 2018) indicates, FFs usually learn to cope with the bias and alter actions accordingly in the long run. There is also empirical evidence to support the theory. Delta, a Finnish provider of liquid monitoring and control devices, was run by first- and second-generation family CEOs until 2014, with stable but a bit stagnated IB presence. One reason for the unfulfilled IB potential was the deteriorated relationships within the first-generation founder, i.e., the father and his sons, the former of whom exercised an authoritarian role, forcing his sons to be involved in the business but not letting them be strongly involved in decision-making. The constant veto rights of the father hampered rational decision-making. Having served as the CEO for almost 20 years and his father having passed away, the second-generation son decided eventually to professionalize the top management of the company by appointing a nonfamily CEO. The first nonfamily CEO did not prove to be internationally active as was wished, so another nonfamily CEO was recruited, with strong task orientation to initiate new and nurture existing foreign partner (agent) and customer contacts. This time the appointment was successful, and the further fieldwork expanded Delta’s international partner and customer network. Through second-generation son’s (who is now Chairman of the Board) daughter, who worked in a university, Delta gained new additional information about how to develop their partner network. For instance, student assignments showed that there were agents Delta had not contacted for a while and they were representing competitors’ products.

Overall, Delta went through a process from being quite strongly bifurcation-biased to utilizing external and nonfamily resources to be internationally more competitive and growth-oriented. Under the governance of the first-generation founder father, the company was under heavy SEW preservation pressure, with overly restricted, risk-averse and family-centered decision-making that torpedoed financial growth opportunities. The even toxic but strongly instilled family-centered culture made the second-generation son to continue as a family CEO without true motivation, and the transition process to open the company to external expertise took decades. However, he was able to do that and make the needed personnel decisions, in the process of which the realities of competitive global business environment outweighed family preferences in top management positions.

5. Unleashing the Perseverance of Family Managers in Critical Incidents

Although bringing nonfamily expertise have proved to be effective in professionalizing FFs and equipping them better to seize international opportunities, it should not be taken as granted that nonfamily management is superior to family management. There are several cases, including those mentioned earlier in the context of long-term-oriented and knowledge-based decision-making, in which the capabilities of family managers combined with strong motivation and perseverance have led to growth-oriented and profitable internationalization. Epsilon, a Finnish manufacturer of sawmill products, has been under family top management team since the establishment in 1952, with fourth-generation family CEO running the company nowadays. The long-term history of profitable business and an over 90% foreign sales to total sales themselves are manifestations of the capabilities of the family members, but one critical incident in the history shows very well the power of family members to steer the business to the right direction. In the early 1990s, when recession hit Finland hard, Epsilon’s domestic sales dropped dramatically. The third-generation family owners and managers worked late into the night after putting three sons to sleep, calculating and figuring out different ways to find ways out of the severe financial situation. They then decided to pack the car with the whole family and drive to Germany to find export markets. Eventually, a significant deal was closed and since then, Middle Europe has become the largest export market for Epsilon.

Accordingly, there is certain ‘survival tendency’ in FFs when the business and family’s survival and welfare go hand in hand. In critical incidents, family members converge and are determined to find solutions that engage everyone to the chosen path. Since the business markets have been increasingly global for the last three decades, internationalization paths have proven to be the most profitable ones. The ability to operate in unison and with perseverance create decisions that hold, leading to committed internationalization process. This also makes many FFs resilient when a crisis takes place. Resilience, i.e., “an ability to go on with life, or to continue living a purposeful life after hardship or adversity” (Tedeschi & Calhoun, 2004, p. 2) has been emphasized in some recent entrepreneurship studies (Bullough & Renko, 2013; Bullough et al., 2014), and the long-term perspective and perseverance clearly make many FFs resilient, even if the operating environment becomes volatile and uncertain. From the IB perspective this could be studied from the capability perspective but operating in an international market is also a risk management strategy and this should also be taken into consideration in FF research (cf. Gallo & Pont, 1996). Those firms which have an international outlook and orientation can find more customers residing in different geographical areas and eventually sell more even if the home market demand would not be there.

6. Summary: The International Business Decision-Making Process of FFs

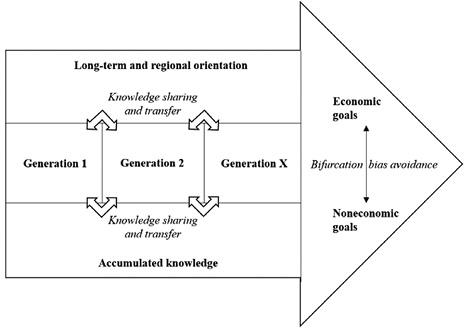

The cases from Alpha to Epsilon show how family managers are able to make IB decisions on rational grounds, acknowledge the realities of global business environment, and pursue international growth in such a way that family connection does not act as a restraining bifurcation or affective bias. The time these take to realize as well as the degree to which IB expands varies, which reminds us that FFs should be treated in a heterogeneous way. However, the long histories and multigenerational involvement of different family members show that family presence, and perhaps the underlying SEW, can serve as motivational triggers to rational and economically driven decision-making, so that the baton can be passed to future generations. When bifurcation bias is avoided, noneconomic goals do not necessarily outweigh economic goals; on the contrary, they complement each other, and IB decision-making becomes balanced, predictable, and profitable in the end. In Figure 1, the insights from the cases discussed are compiled together with an aim to create an integrative IB decision-making process model of FFs.

Figure 1. Key factors affecting international business decision-making process in family firms

The arrow-shape in Figure 1 indicates how both economic and noneconomic goals are there in the horizon when FFs make IB decisions, the former of which relating to the financial growth opportunities internationalization provides and the latter of which relating to family involvement and benefit. To integrate these two goal orientations in decision-making, bifurcation bias must be avoided. In this process, knowledge sharing and transfer from generation to generation is vital. This concerns both the accumulated knowledge from the past and the current long-term and regional orientation, including the business relationships FF and its family members have established. Family members should share knowledge on the foreign partnerships and clientele, their perceptions on how the resources and capabilities of the FF match IB needs, and other relevant factors for the decision-making to be balanced in terms of the economic-noneconomic goal division and family versus nonfamily asset division. The italicized bifurcation bias avoidance and knowledge sharing and transfer represent the key actions family members need to consider or execute, so that they can make effective decisions and be competitive in the international market. In these actions, their strengths as FFs also lie; non-FFs are not able to identify such a promising marriage of family and nonfamily assets combined with effective knowledge sharing and transfer within familial and communal organizational space. However, these actions, if considered in a family-centered way within a bounded rationality, can turn out to be detrimental to FFs.

7. Discussion and Conclusions

Since there are two sides of the coin, and that the academic literature on FF internationalization itself is mixed (Metsola et al., 2020), the most intriguing question to be unraveled is: Is there truly something FF-contextualized literature can provide to FF managers to make better IB decisions, or does general non-FF literature provide them with enough relevant knowledge? With this question we are in a dangerous area questioning the legitimacy of the whole FF academic research, but the question must be asked to push us think deeper and more in a managerially oriented way. Our answer, for now, based on the above discussion and examples, is as follows. In the current global, accessible, yet competitively fierce business environment, small details and nuances in the ways in which a company operates and conducts its business model matter and differentiate it from competitors. This said, FFs and especially family SMEs can derive these small yet powerful factors from family ownership and management and utilize them for better decision-making, e.g., when entering new markets with long-term orientation, transferring IB knowledge within different generations effectively, or enabling smooth balance between nonfamily and family management and ownership. The creation and development of internal knowledge structures can contribute to the identification of international opportunities in the FFs (Musso & Francioni, 2020). In the turbulent times we live, the “soft” and long-term-oriented values and preferences may prove to be competitive as long as the dark sides of dysfunctional family assets are recognized and tackled. The IB decision-making process of FFs presented in this paper and other academic FF IB literature can provide knowledge about these softer, even hidden factors for family managers to supplement their decision-making processes, but also general non-FF literature is worth recognizing. The possible markets are same for FFs and non-FFs, so the general, proven practices to enter them and expand in them apply for both. In this we agree with e.g., Arregle et al. (2021) that FF literature needs to incorporate IB theories better into future studies focusing on FF internationalization and IB decisions. More work would be needed at different levels (entrepreneur, top management team, board) over time, for example about how the decisions are actually done.

Having relevant value-added content academic FF and non-FF IB and decision-making literature can provide for FFs is not enough, as this content must also be effectively shared and transferred to FF managers – just like family members do the knowledge sharing and transfer within generations as depicted in our IB decision-making process model. FF managers, like all managers, constantly operate amidst profusion of alternative decisions, especially in the context of complex IB, with limited time to consider an academic journal article. Scholars must descend from theoretical clouds to the practical grassroots levels of managerial reality and communicate their findings directly to managers or through various effective channels, such as social media and industry events. In the best-case scenario, integrating oneself into the IB operations and decision-making processes of FFs through ethnographic or observational approaches could provide excellent connection between scholars and FF managers when planning and conducting various decisions. While owning and managing family members may have bifurcation bias related to family and nonfamily assets, scholars may have their own bifurcation bias related to academic and practical contribution. Let’s avoid our bias to make FF managers avoid their bias in IB decision-making.

References

Aharoni, Y., Tihanyi, L., & Connelly, B. L. (2011). Managerial decision-making in international business: a forty-five-year retrospective. Journal of World Business, 46(2), 135-142. https://doi.org/10.1016/j.jwb.2010.05.001

Ahi, A., Baronchelli, G., Kuivalainen, O., & Piantoni, M. (2017). International market entry: how do small and medium-sized enterprises make decisions? Journal of International Marketing, 25(1), 1-21. https://doi.org/10.1509/jim.15.0130

Arregle, J. L., Chirico, F., Kano, L., Kundu, S. K., Majocchi, A., & Schulze, W. S. (2021). Family firm internationalization: past research and an agenda for the future. Journal of International Business Studies, 52, 1159-1198. https://doi.org/10.1057/s41267-021-00425-2

Boellis, A., Mariotti, S., Minichilli, A., & Piscitello, L. (2016). Family involvement and firms’ establishment mode choice in foreign markets. Journal of International Business Studies, 47(8), 929-950. https://doi.org/10.1057/jibs.2016.23

Bullough, A., & Renko, M. (2013). Entrepreneurial resilience during challenging times. Business Horizons, 56(3), 343-350. https://doi.org/10.1016/j.bushor.2013.01.001

Bullough, A., Renko, M., & Myatt, T. (2014). Danger zone entrepreneurs: the importance of resilience and self–efficacy for entrepreneurial intentions. Entrepreneurship Theory and Practice, 38(3), 473-499. https://doi.org/10.1111/etap.12006

Casillas, J. C., Moreno, A. M., & Acedo, F. J. (2010). Internationalization of family businesses: a theoretical model based on international entrepreneurship perspective. Global Management Journal, 2(2), 18-35.

Chetty, S., Ojala, A., & Leppäaho, T. (2015). Effectuation and foreign market entry of entrepreneurial firms. European Journal of Marketing, 49(9/10), 1436-1459. https://doi.org/10.1108/EJM-11-2013-0630

Child, J., & Hsieh, L. H. (2014). Decision mode, information and network attachment in the internationalization of SMEs: a configurational and contingency analysis. Journal of World Business, 49(4), 598-610. https://doi.org/10.1016/j.jwb.2013.12.012

Coviello, N. (2006). The network dynamics of international new ventures. Journal of International Business Studies, 37(5), 713-731. https://doi.org/10.1057/palgrave.jibs.8400219

D’Angelo, A., Majocchi, A., & Buck, T. (2016). External managers, family ownership and the scope of SME internationalization. Journal of World Business, 51(4), 534-547. https://doi.org/10.1016/j.jwb.2016.01.004

Davis, J., Frankforter, S., Vollrath, D., & Hill, V. (2007). An empirical test of stewardship theory. Journal of Business and Leadership: Research, Practice and Teaching, 3(1), 40–50.

Debicki, B. J., Kellermanns, F. W., Chrisman, J. J., Pearson, A. W., & Spencer, B. A. (2016). Development of a socioemotional wealth importance (SEWi) scale for family firm research. Journal of Family Business Strategy, 7(1), 47-57. https://doi.org/10.1016/j.jfbs.2016.01.002

Fernández, Z., & Nieto, M. J. (2005). Internationalization strategy of small and medium-sized family businesses: some influential factors. Family Business Review, 18(1), 77-89. https://doi.org/10.1111/j.1741-6248.2005.00031.x

Gabrielsson, P., & Gabrielsson, M. (2013). A dynamic model of growth phases and survival in international business-to-business new ventures: the moderating effect of decision-making logic. Industrial Marketing Management, 42(8), 1357-1373. https://doi.org/10.1016/j.indmarman.2013.07.011

Gallo, M. A., & Pont, C. G. (1996). Important factors in family business internationalization. Family Business Review, 9(1), 45-59. https://doi.org/10.1111/j.1741-6248.1996.00045.x

Gomez‐Mejia, L. R., Campbell, J. T., Martin, G., Hoskisson, R. E., Makri, M., & Sirmon, D. G. (2014). Socioemotional wealth as a mixed gamble: revisiting family firm R&D investments with the behavioral agency model. Entrepreneurship Theory and Practice, 38(6), 1351-1374. https://doi.org/10.1111/etap.12083

Gómez-Mejía, L. R., Haynes, K. T., Núñez-Nickel, M., Jacobson, K. J., & Moyano-Fuentes, J. (2007). Socioemotional wealth and business risks in family-controlled firms: evidence from Spanish olive oil mills. Administrative Science Quarterly, 52(1), 106-137. https://doi.org/10.2189/asqu.52.1.106

Gómez-Mejía, L. R., Patel, P. C., & Zellweger, T. M. (2018). In the horns of the dilemma: socioemotional wealth, financial wealth, and acquisitions in family firms. Journal of Management, 44(4), 1369-1397. https://doi.org/10.1177/0149206315614375

Hambrick, D. C., Misangyi, V. F., & Park, C. A. (2015). The quad model for identifying a corporate director’s potential for effective monitoring: toward a new theory of board sufficiency. Academy of Management Review, 40(3), 323-344. https://doi.org/10.5465/amr.2014.0066

Ji, J., & Dimitratos, P. (2013). An empirical investigation into international entry mode decision-making effectiveness. International Business Review, 22(6), 994-1007. https://doi.org/10.1016/j.ibusrev.2013.02.008

Johanson J., & Vahlne J-E. (1977). The internationalization process of the firm: a model of knowledge development and increasing foreign market commitments. Journal of International Business Studies, 8(1), 23–32.

Jorge, M., Couto, M., Veloso, T., & Franco, M. (2017). When family businesses go international: management sets the path. Journal of Business Strategy, 38(1), 31-38. https://doi.org/10.1108/JBS-01-2016-0006

Kano, L., & Verbeke, A. (2018). Family firm internationalization: heritage assets and the impact of bifurcation bias. Global Strategy Journal, 8(1), 158-183. https://doi.org/10.1002/gsj.1186

Knight, G. A., & Cavusgil, S. T. (2004). Innovation, organizational capabilities, and the born-global firm. Journal of International Business Studies, 35(2), 124-141. https://doi.org/10.1057/palgrave.jibs.8400071

Kogut, B., & Zander, U. (1992). Knowledge of the firm, combinative capabilities, and the replication of technology. Organization Science, 3(3), 383-397.

Kogut, B., & Zander, U. (1993). Knowledge of the firm and the evolutionary theory of the multinational corporation. Journal of International Business Studies, 24(4), 625-645. https://doi.org/10.1057/palgrave.jibs.8490248

Kontinen, T., & Ojala, A. (2012). Internationalization pathways among family‐owned SMEs. International Marketing Review, 29(5), 496-518. https://doi.org/10.1108/02651331211260359

Mariotti, S., Marzano, R., & Piscitello, L. (2021). The role of family firms’ generational heterogeneity in the entry mode choice in foreign markets. Journal of Business Research, 132, 800-812. https://doi.org/10.1016/j.jbusres.2020.10.064

Metsola, J., Leppäaho, T., Paavilainen-Mäntymäki, E., & Plakoyiannaki, E. (2020). Process in family business internationalisation: the state of the art and ways forward. International Business Review, 29(2), 101665. https://doi.org/10.1016/j.ibusrev.2020.101665

Miller, D., Le Breton-Miller, I., & Scholnick, B. (2008). Stewardship vs. stagnation: an empirical comparison of small family and non-family businesses. Journal of Management Studies, 45(1), 51–78. https://doi.org/10.1111/j.1467-6486.2007.00718.x

Musso, F., & Francioni, B. (2020). The strategic decision-making process for the internationalization of family businesses. Sinergie Italian Journal of Management, 38(2), 21-43. https://doi.org/10.7433/s112.2020.02

Mustakallio, M., Autio, E., & Zahra, S. A. (2002). Relational and contractual governance in family firms: effects on strategic decision making. Family Business Review, 15(3), 205-222. https://doi.org/10.1111/j.1741-6248.2002.00205.x

Nummela, N., Saarenketo, S., Jokela, P., & Loane, S. (2014). Strategic decision-making of a born global: a comparative study from three small open economies. Management International Review, 54(4), 527-550. https://doi.org/10.1007/s11575-014-0211-x

Okoroafo, S. C. (1999). Internationalization of family businesses: evidence from Northwest Ohio, USA. Family Business Review, 12(2), 147-158. https://doi.org/10.1111/j.1741-6248.1999.00147.x

Petrou, A. P., Hadjielias, E., Thanos, I. C., & Dimitratos, P. (2020). Strategic decision-making processes, international environmental munificence and the accelerated internationalization of SMEs. International Business Review, 29(5), 101735. https://doi.org/10.1016/j.ibusrev.2020.101735

Sarasvathy, S. D. (2001). Causation and effectuation: toward a theoretical shift from economic inevitability to entrepreneurial contingency. Academy of Management Review, 26(2), 243-263. https://doi.org/10.5465/amr.2001.4378020

Tedeschi, R. G., & Calhoun, L. G. (2004). A clinical approach to posttraumatic growth. In P. A. Linley & S. Joseph (Eds.), Positive Psychology in Practice (pp. 405–419). Hoboken, NJ: Wiley. https://doi.org/10.1002/9780470939338.ch25

Zahra, S. A., Hayton, J. C., & Salvato, C. (2004). Entrepreneurship in family vs. non–family firms: a resource–based analysis of the effect of organizational culture. Entrepreneurship Theory and Practice, 28(4), 363-381. https://doi.org/10.1111/j.1540-6520.2004.00051.x

Zahra, S. A., Korri, J. S., & Yu, J. F. (2005). Cognition and international entrepreneurship: implications for research on international opportunity recognition and exploitation. International Business Review, 14(2), 129–146. https://doi.org/10.1016/j.ibusrev.2004.04.005